US yields could quickly start to bite

USD: Supply concerns could ultimately hurt the dollar

Solid data yesterday was enough to see UST bond yields take another lurch higher as the US economy continues to show resilience ahead of Trump’s inauguration on 20th January. The 10-year yield is close to breaking above the 4.74% intra-day high set in April of last year which would then take us back to the period of peak inflation fears in Q4 2023 when the 10-year yield hit a high just above the 5.00% level. Our sense is that the economy is certainly not as strong as back then with the post-covid stimulus support no longer as supportive a factor for growth. That could mean the fundamental backdrop could deteriorate more notably on this occasion as financial market conditions continue to tighten.

But for now there is limited sign of weakening economic activity and yesterday’s data was certainly ‘green light’ for further bond selling. The JOLTS job opening total jumped back above the 8mn level for the first time since May although the Quits rate did fall back to 1.9% suggesting less optimism amongst potential jobseekers than the headline job openings increase would suggest. Still, the ISM services data also pointed to an economy that remains reasonably robust. The standout for bond investors was the big jump in Prices Paid from 58.2 in November to 64.4 in December, the highest level since February 2023. The index series in ISM is of course more volatile than actual services inflation so this one month jump is not yet cause for believing inflation is back on the rise and when you consider the wage disinflation it’s hard to argue that services inflation in the US is suddenly about to spike back up again. Still, if you’re a bond investor that logic doesn’t count for much when sentiment is bad, and fixed income sentiment is not particularly positive at the moment when you consider that in a 3-month period the UST bond yield is now 100bps higher.

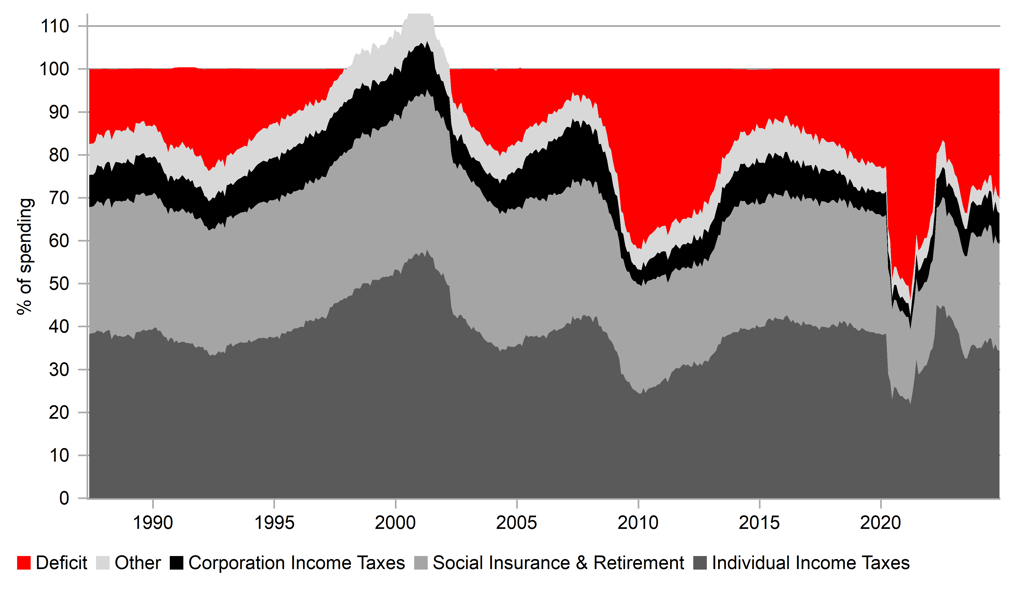

Two other near-term factors could fuel further bond selling. Firstly, this week is auction week in the US. A 3-year auction on Monday was followed by a 10-year auction yesterday and a 30-year auction this evening. We see increased risks that supply concerns become a bigger issue for the markets this year given the near-term fiscal outlook is dire. The 10-year UST bond auction yesterday drew a bid-to-cover of 2.53 times versus 2.7 in December but close to the 2.55 of the last six auctions. The debt-servicing cost for the US government has now breached the USD 1trn level, which is more than the entire pre-covid federal budget deficit and in the first two months of the new fiscal year, the deficit is running 20% higher than in the same two months as last year (stripping out some timing distortions).

Secondly, this evening the FOMC will release the minutes from the final meeting of last year. If you recall this was the meeting when after the FOMC cut, Chair Powell gave a press conference that left you wondering why they cut at all. Comments this week from Fed officials certainly focused more on upside inflation risks and that could well be evident in the minutes tonight. The first full cut from the Fed is now not fully priced until July. We see the Fed cutting before then and we see increasing risks that rising UST bond yields could turn into a bigger negative feature for the markets that will mean good news becomes bad news which helps curtail dollar buying at these stronger levels. The robust correlation between 10-year yields and the dollar would then start to weaken.

OUTSIDE OF CRISIS PERIODS, THE CURRENT SIZE OF THE BUDGET DEFICIT HAS NEVER BEEN A LARGER PORTION OF TOTAL FINANCING

Source: Bloomberg, Macrobond & MUFG GMR

CNY: Countering CNY depreciation

The press conference from President-elect Trump at Mar-a-Lago yesterday certainly highlighted the fact that China will not be the sole focus of Trump’s trade policies with Denmark now in the firing line along with Canada and Mexico. But equally you certainly got the sense that Trump is not going to hold back in his early days and there has been no toning down of promises and commitments as inauguration date approaches.

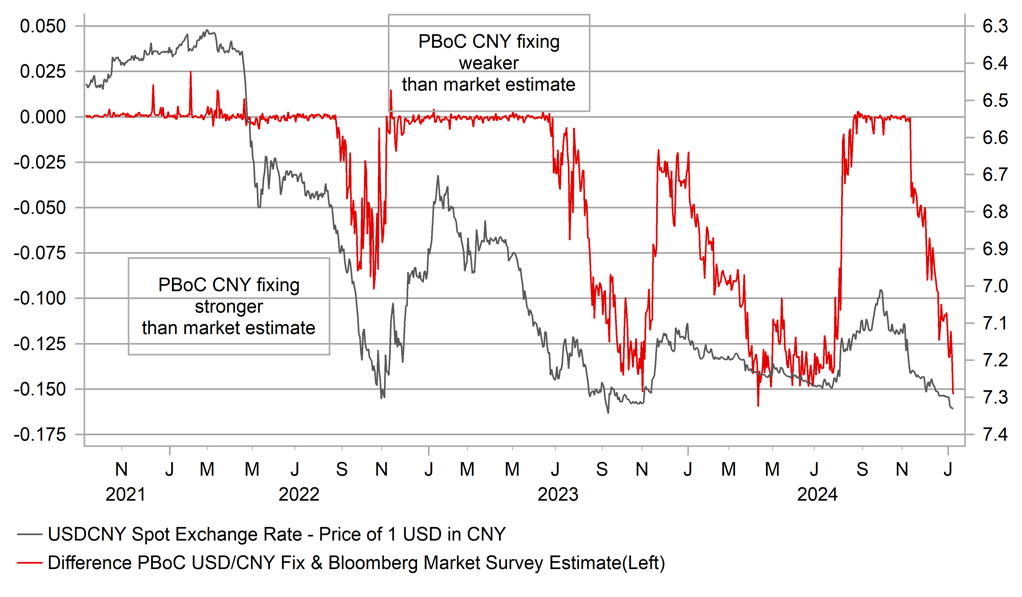

CNY continues to grind weaker as investors position for a sharp escalation in tariffs very quickly after inauguration on 20th January. In line with that the Chinese authorities are increasing the resistance to further depreciation with the PBoC USD/CNY fixing today that was stronger than the Bloomberg daily estimate by the widest margin since April. As can be seen in the chart above, when we get to this extent of divergence in the past it has coincided with USD/JPY topping out. This time will probably be different depending on the extent of the tariffs announced but we should certainly not assume a sharp move given the authorities desire for orderly contained moves. This was made clear at the end of last week following the latest quarterly monetary policy meeting when the PBoC emphasised continued FX stability as a key goal. State banks have also pared back offshore CNH liquidity with the overnight rate still elevated at 7.82% today, but down from 8.1% yesterday, providing support for CNH.

But with onshore rates set to remain under downward pressure, the likelihood is that CNY will continue to gradually weaken toward our target of 7.5000. How aggressive policies are to boost domestic demand will be important. The authorities today published details on increased subsidies on certain consumer products to help lift domestic demand. A 15% subsidy for smart device purchases will help boost demand while subsidies for an expanded list of household goods and the renewal of a trade-in subsidy for EVs will help as well. Nonetheless, action to help discourage China’s high savings rate is what’s really required over the medium term through increased social safety net benefits.

THE DIFFERENCE IN ACTUAL PBOC CNY FIXING AND THE MARKET ESTIMATE THE STRONGEST SINCE APRIL LAST YEAR

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Business and Consumer Survey |

Dec |

95.6 |

95.8 |

! |

|

EC |

10:00 |

Consumer Confidence |

Dec |

-14.5 |

-13.7 |

! |

|

EC |

10:00 |

Services Sentiment |

Dec |

5.9 |

5.3 |

! |

|

EC |

10:00 |

Industrial Sentiment |

Dec |

-11.7 |

-11.1 |

! |

|

EC |

10:00 |

PPI (MoM) |

Nov |

1.5% |

0.4% |

! |

|

EC |

10:00 |

PPI (YoY) |

Nov |

-1.2% |

-3.2% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-12.6% |

! |

|

US |

13:15 |

ADP Nonfarm Employment Change |

Dec |

136K |

146K |

!!!! |

|

US |

13:30 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

214K |

211K |

!! |

|

US |

13:30 |

Jobless Claims 4-Week Avg. |

-- |

-- |

223.25K |

!! |

|

US |

15:00 |

Wholesale Inventories (MoM) |

Nov |

-- |

-0.2% |

! |

|

US |

15:00 |

Wholesale Trade Sales (MoM) |

Nov |

-- |

-0.1% |

! |

|

US |

16:00 |

Thomson Reuters IPSOS PCSI |

Jan |

-- |

57.59 |

! |

|

CA |

16:00 |

Thomson Reuters IPSOS PCSI (MoM) |

Jan |

-- |

48.24 |

! |

|

US |

18:00 |

30-Year Bond Auction |

-- |

-- |

4.535% |

!! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!!! |

|

US |

20:00 |

Consumer Credit |

Nov |

10.60B |

19.24B |

! |

Source: Bloomberg