JPY weakens as Ueda strengthens message on possible rate hike

JPY: Limited FX moves but intervention scepticism persists

The US dollar has continued to consolidate at weaker levels although has recouped some of the losses recorded after the weaker than expected jobs report last Friday. US yields remain 20bps below the recent high but have moved higher off the lows. Minneapolis Fed President Neel Kashkari was quoted yesterday through a letter published on the Fed’ website questioning whether the monetary stance was restrictive enough given the resilience of the economy. There was limited reaction to the comments but there will be plenty more speakers this week with Governors Jefferson and Cook speaking today along with Fed President Collins. Fed Presidents Daly, Logan and Goolsbee and Governors Bowman and Barr all speak Thursday and Friday.

Certainly their comments are probably more likely to impact the direction of USD/JPY than comments from officials in Japan. Market participants remain sceptical over the potential for USD/JPY turning lower after the probable intervention last week and comments from Governor Ueda yesterday had little impact. Governor Ueda met with PM Kishida with the recent changes in monetary policy discussed. Governor Ueda also stated that he would “closely monitor” the impact of yen moves on the outlook for inflation in Japan. However crucially, Ueda has gone much further in comments today stating earlier that “Foreign exchange rates make a significant impact on the economy and inflation”, adding that “Depending on those moves, a monetary policy response might be needed”. This is a clear upgrade in signalling to the markets that an FX move can and probably will prompt a BoJ policy response.

In the FX Weekly (here) on Friday we highlighted the fact that the history of intervention points to turning points on most occasions which suggests that the level of scepticism in the market may be unfounded. There are always caveats and elements of uniqueness but turning points do often take place. Fundamentals play a role and hence at least it can be argued that good timing of intervention may help. We believe the timing now will ultimately prove to have been good and Friday’s signs of weaker employment could be important.

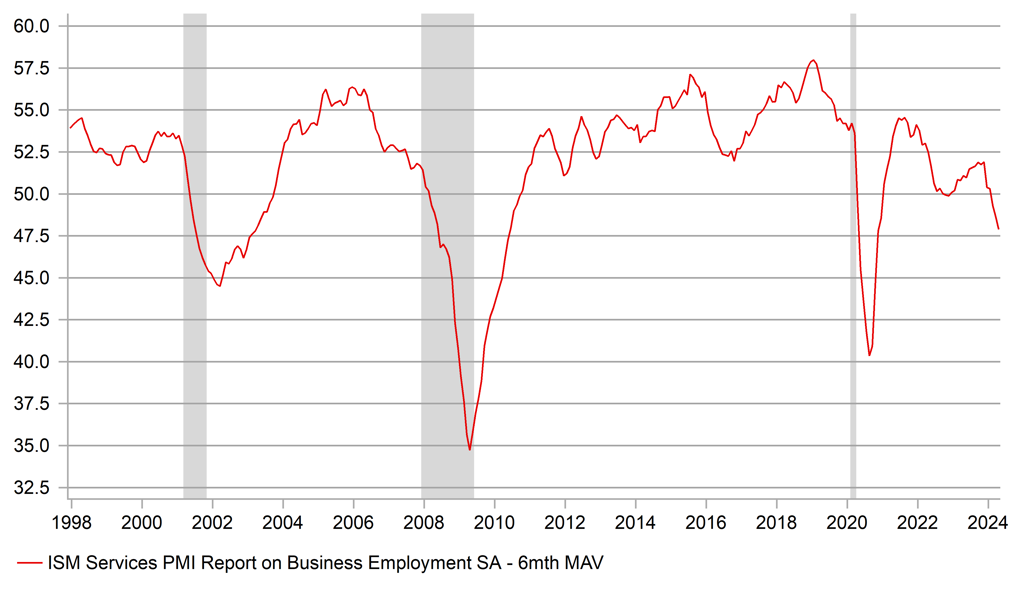

Of course, it is not just the jobs data. GDP data revealed weaker real personal disposable income growth that points to weaker consumption growth ahead. Other employment data points back up the weakening jobs growth on show on Friday. The ISM Service Employment index weakened notably on Friday and the 6mth average is at 47.88 and consistent with much weaker services employment ahead.

The jobs report may well be more impactful than the estimated approx. JPY 9trn spent by the MoF last week to drive USD/JPY lower. The 2-year UST note yield is over 20bps lower from the high last week – a swing in yields that’s just not feasible in Japan. We do have monthly cash earnings data tomorrow from Japan which along with the CPI data will be most important in determining the timing of another BoJ rate hike. We maintain our view of a 15bp hike at the end of July and tomorrow’s data will be one important determinant of an earlier than expected BoJ hike. JPY moves and international demand conditions will be other key determinants.

6MTH MAV OF ISM SERVICES EMPLOYMENT INDEX POINTS TO DOWNSIDE US EMPLOYMENT RISKS AHEAD

Source: Macrobond, Bloomberg & MUFG Research

SEK: Riksbank in focus this morning with decision finely balanced

The market views today’s decision from the Riksbank (08:30 BST) as a close call and the OIS market implies around a 70% probability of a 25bp rate cut today. The guidance from the Riksbank at its last meeting in March and what has unfolded since then certainly argue in favour of a rate cut today. The Riksbank indicated in March that there would be scope for a rate cut at either the May or June meetings and since the March meeting inflation data has come in weaker than expected with the GDP indicator (a predictor of actual GDP) for Q1 contracting, suggesting that the Swedish economy has contracted for four consecutive quarters. Underlying inflation (CPIF) excluding energy slowed from 3.5% to just 2.9% in March, much weaker than expected.

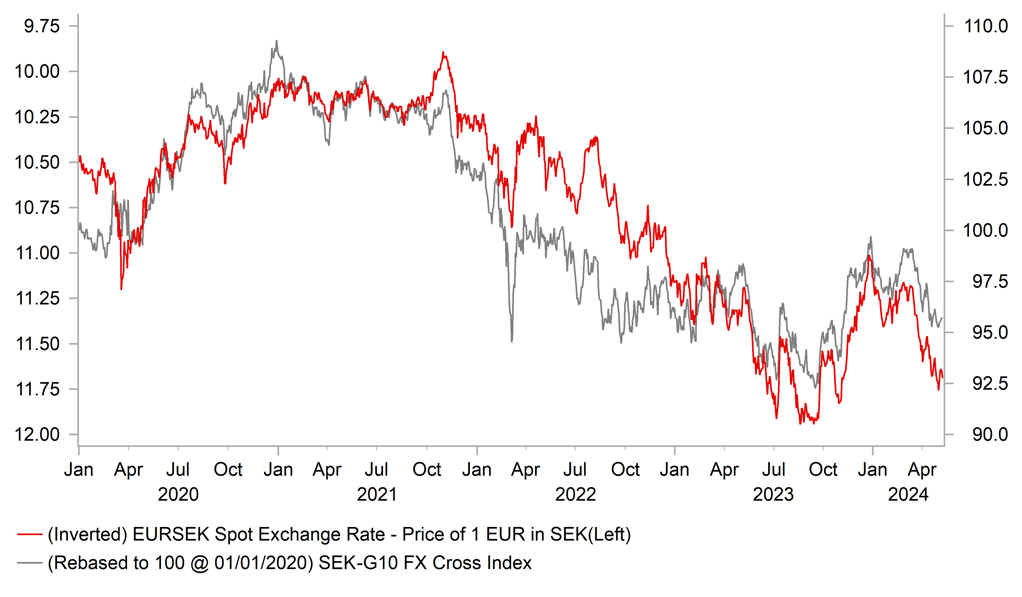

If the incoming data on growth and inflation were the only determinants of today’s decision, a rate cut would be agreed quickly. However, the performance of SEK is the variable that creates some uncertainty over today’s decision. The Riksbank have indicated it is a key inflation risk and with the Fed delaying, Norges bank proving more hawkish and the ECB on hold until next month, there is a case for waiting.

However, while SEK is underperforming NOK, the difference is not large and in any case, a delay in cutting and for the data to then continue weakening with inflation declining would likely still see SEK weaken in circumstances of the Fed on hold and yields remaining more elevated. While SEK may suffer initially, a pre-emptive move can help reduce any scale of FX underperformance and weak domestic demand conditions are more important in determining inflation than the difference in SEK value from cutting today and cutting in June. So we expect on balance that the Riksbank will cut today given the faster decline in inflation and the continued weak economic conditions. SEK underperformance is unlikely to be significant given the expectations and the prospects of other central banks commencing cutting cycles over the coming months.

SEK UNDERPERFORMANCE IS BROADBASED

Source: Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Retail Sales (MoM) |

Mar |

0.2% |

0.1% |

! |

|

IT |

09:00 |

Italian Retail Sales (YoY) |

Mar |

-- |

2.4% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-2.3% |

! |

|

US |

15:00 |

IBD/TIPP Economic Optimism |

May |

44.1 |

43.2 |

! |

|

US |

15:00 |

Wholesale Inventories (MoM) |

Mar |

-0.4% |

0.5% |

! |

|

US |

15:00 |

Wholesale Trade Sales (MoM) |

Mar |

-- |

2.3% |

! |

|

US |

16:00 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

!!! |

|

US |

16:00 |

Thomson Reuters IPSOS PCSI |

May |

-- |

53.44 |

! |

|

CA |

16:00 |

Thomson Reuters IPSOS PCSI (MoM) |

May |

-- |

48.02 |

! |

|

US |

16:45 |

Fed Collins Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

10-Year Note Auction |

-- |

-- |

4.560% |

!! |

|

US |

18:30 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg