FOMC cuts as Powell stands firm on Fed independence

USD: FOMC cuts with little FX impact

The retracement of US dollar strength yesterday (see below) was not notably altered by the FOMC decision last night and the dollar has stabilised at only modestly stronger levels than yesterday’s close. The decision from the FOMC was as expected with a unanimous decision to cut the fed funds rate by 25bps to 4.50%-4.75%. The outcome of the meeting has left the market priced at 18bps for another cut in December and that leaves a decision on another cut this year perhaps a little more finely balanced than many would have assumed prior to Trump’s election victory. Fed Chair Powell was asked about the impact on the economy and inflation from the policies of President-elect Trump and Powell was very clear that “the election will have no effects on our policy decisions”, adding that the Fed didn’t know “the timing and substance of any policy changes” and hence “we don’t guess, we don’t speculate, and we don’t assume”. On that basis, we shouldn’t rule out a rate cut in December which will be more shaped by the data between now and the meeting rather than making assumptions of the policy steps to be announced after inauguration on 20th January.

There was certainly nothing in the communications from the FOMC statement or from Fed Chair Powell to suggest the Fed’s bias is to pause. Indeed, an argument could be made for getting a further modest cut in early and then being in a position to pause for a period to assess the implications of Trump’s policies that should become clearer in Q1 2025. Another 25bp cut in December would still leave the stance restrictive with a real policy rate around 150bps above the estimated neutral level.

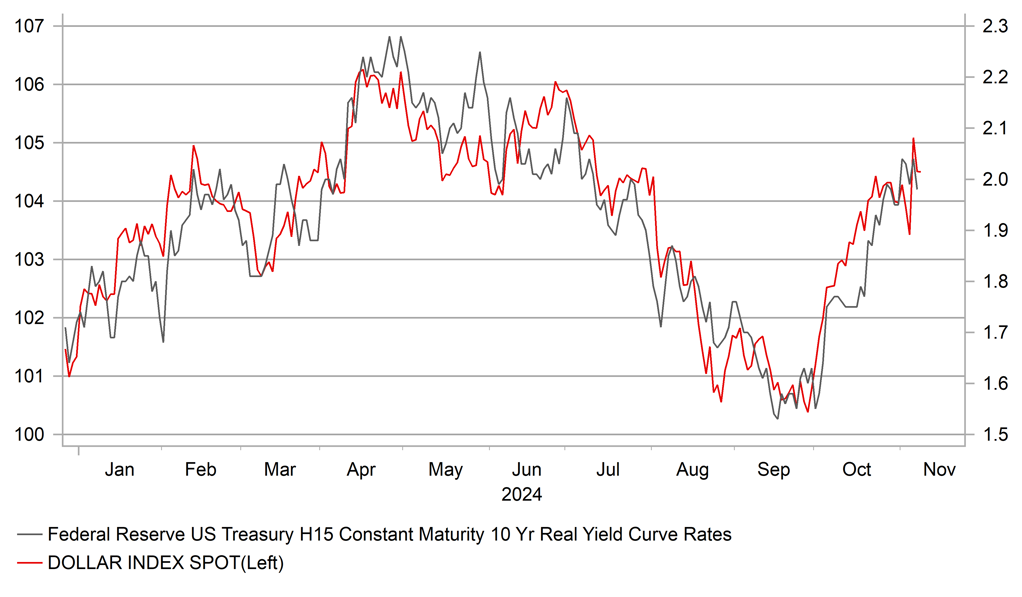

Powell also played down the run-up on long-term yields being about inflation expectations and the Trump trade and believed it was more a reflection of the run of stronger economic data that is lifting growth expectations, stating the increase in yields was “not principally about higher inflation expectations”. Certainly looking at real yield moves in October Powell is correct although some of that likely reflected the Trump trade impact as well. And certainly since Trump won we have seen inflation expectations (10yr breakeven) rising as much as nominal yields, leaving real yields unchanged, which may be one factor behind the dollar’s reversal (see below).

Powell was very clear when it came to Fed independence stating there was no legal route to firing him and he would not go if Trump asked him to go. In theory Trump could test that view of Powell’s and certainly Trump will have an influence in replacing the Chair when Powell’s term ends in May 2026. White House interference in Fed deliberations is likely to become a bigger issue next year and could be a catalyst for a turnaround in dollar appreciation which looks likely to unfold over the coming 3-6mths.

US 10-YEAR REAL YIELD RISE IN OCTOBER MATCHED BY USD STRENGTH BUT REAL YIELD HAS FAILED TO RISE FURTHER SINCE TRUMP’S WIN

Source: Bloomberg & Macrobond

G10 : Trump trade reverses across G10

If we had been asked to pick the top three performing G10 currencies following a Trump election victory, NOK, AUD and NZD probably wouldn’t have been the currencies we would have picked. Ahead of the election we had estimated a rough 2-3% gain for the US dollar if Trump won and while the high-to-low yesterday was a 2% gain for the dollar, those levels were not sustained and now yesterday we have had a notable retracement. What can explain this more mixed performance for the US dollar than we expected?

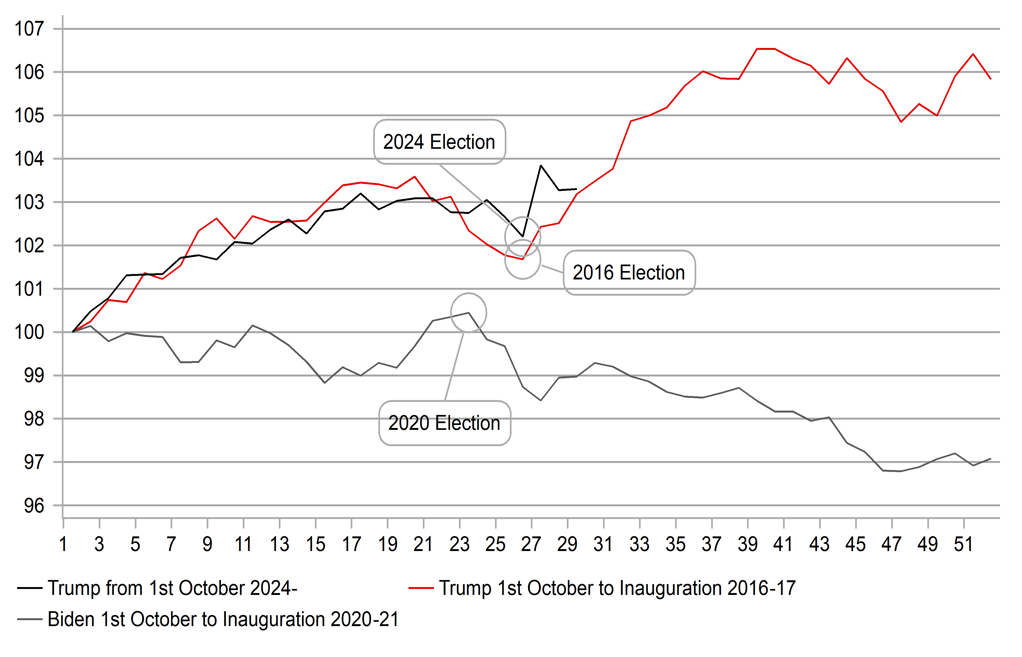

Starting with the obvious, we simply may have under-estimated the degree to which a Trump victory was priced. The US dollar did advance 3.5% in October and while there was strong US data to explain this move as well, more of that move could have been election speculation related. Secondly, we have had ongoing increased optimism that the Chinese authorities are set to announce a large fiscal stimulus plan that in the wake of the election could be larger and targeted at offsetting the looming weaker export outlook via a stronger boost to domestic demand. The jury is still out on this though and there is scope for disappointment on that we feel.

Thirdly, Trump’s victory speech was reasonably magnanimous and absent of divisive rhetoric and there was no specific focus on tariffs. Again though, we’d be sceptical of that reflecting what’s to come. After such a resounding election victory President-elect Trump will be emboldened to deliver on what he promised while campaigning.

Fourth, if inflation is on its way back under a Trump presidency, real yield moves will be important in shaping US dollar performance. A look at the move in 10-year UST bond yields and the 10-year breakeven shows that the 10-year real yield is roughly unchanged since Trump’s win. This is in contrast to the 12bps jump in real yields in the first 48hrs following Trump’s win back in 2016. This tallies with the make-up of Trump’s fiscal plans. The most expensive component of Trump’s fiscal plans (according to the Committee for a Responsible Federal Budget) is extending his Tax Cuts & Jobs Act from 2017, at USD 5.3trn over ten years, some 70% of the total estimated cost of his tax cutting / fiscal spending plans. That step does not boost growth very much, it merely confirms the status quo. A growth-boosting plan would have a greater impact in lifting real yields.

Some of these factors that possibly explain this dollar retracement are unlikely to last but we will be monitoring closely real yield moves and it could be a more sustainable factor in curtailing dollar appreciation. Still, the trade tariffs if delivered as outlined by Trump would still see the dollar strengthen going forward and it may be just that market participants do not have a consensus on how/when/how much Trump will increase tariffs and hence will only be priced when more clarity is available.

USD PERFORMANCE 1ST OCT TO INAUGURATION 2016-17; 2020-21; 2024-

Source: Bloomberg & Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Sep |

-0.4% |

0.1% |

! |

|

IT |

09:00 |

Italian Industrial Production (YoY) |

Sep |

-- |

-3.2% |

! |

|

EC |

09:30 |

ECB McCaul Speaks |

-- |

-- |

-- |

!! |

|

IT |

11:00 |

Italian Retail Sales (YoY) |

Sep |

-- |

0.8% |

! |

|

IT |

11:00 |

Italian Retail Sales (MoM) |

Sep |

0.2% |

-0.5% |

! |

|

CA |

11:10 |

BoC Deputy Governor Gravelle Speaks |

-- |

-- |

-- |

! |

|

UK |

12:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!! |

|

CA |

13:30 |

Avg hourly wages Permanent employee |

Oct |

-- |

4.5% |

! |

|

CA |

13:30 |

Employment Change |

Oct |

27.9K |

46.7K |

!!! |

|

CA |

13:30 |

Participation Rate |

Oct |

-- |

64.9% |

! |

|

CA |

13:30 |

Unemployment Rate |

Oct |

6.6% |

6.5% |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Nov |

-- |

2.7% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Nov |

-- |

3.0% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Nov |

-- |

74.1 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Nov |

71.0 |

70.5 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Nov |

-- |

64.9 |

! |

|

US |

15:00 |

Retail Inventories Ex Auto |

Sep |

0.1% |

0.5% |

!! |

|

US |

16:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg