China fiscal plans dampen investor optimism over stronger growth

AUD: China fiscal stimulus plans disappoint weighing on the Aussie

The worst performing G10 currency overnight has been the Australian dollar reflecting investor disappointment following the briefing by the National Development and Reform Commission in China. According to Bloomberg, officials from China’s economic planning agency stated that they would speed up spending while largely reiterating plans to boost investment and increase direct support for low-income groups and new graduates. The key takeaways from the NDRC briefing were: i) plans to bring forward CNY100 billion in government investment originally budgeted for 2025, ii) plans to expand sectors allowed to use funds raised from special local bond sales, iii) plans to push provinces to issue about CNY290 billion in new special local bonds allocated for this year by the end of October, and iv) plans to accelerate the use of special local bond funds and construction of related projects. In addition, China will continue to issue ultra-long sovereign bonds next year to support major projects.

The measures support the NDRC’s commitment to meeting this year’s GDP growth target of around 5%. However, the policy announcement has fallen short of market expectations for larger fiscal stimulus. Prior to the policy announcement, some banks had been speculating that the fiscal package could total around CNY2-3 trillion. The NDRC emphasized that the government would make the best use of existing resources indicating that it is not planning to increase its budget. According to Bloomberg around CNY18.4 trillion of budgeted expenditure remained unspent at the end of August. Investors were also left disappointed by the lack of details for spending plans.

Overall, the NDRC’s update overnight has put a dampener on building investor optimism over a pick-up in growth heading into early next year. It follows the package of easing measures announced last month including rate cuts and direct support for the housing and equity markets. With monetary policy viewed as less effective at stimulating growth in China, market participants have been placing more weight on the need for bigger fiscal stimulus. It is not surprising therefore to see the renminbi, other Asian and commodity related currencies weaken overnight as market participants’ optimism over stronger growth in China has been dampened.

At the same time, the Australian dollar has been undermined in part by the release overnight of the minutes from the RBA’s last policy meeting on 24th September. The minutes have been viewed as another small step closer for the RBA to cutting rates. The minutes dropped the reference that “it was unlikely that the cash rate target would be reduced in the short-term”. It has encouraged market speculation that the RBA could begin to cut rates before the end of this year. The Australian rate market is currently pricing in just over a 50:50 probability of a 25bps rate cut by the December policy meeting. However, Deputy Governor Hauser stated in the press conference that the RBA was only trying to zoom in on potential risks that could affect policy making. The minutes revealed that members affirmed that monetary policy would need to be sufficiently restrictive until they were confident that inflation was moving sustainably towards the target range.

ASIA FX GIVING BACK STRONG GAINS FROM OVER SUMMER

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Weaker USD trend challenged ahead of US election

Emerging market currencies have suffered a setback over the past week as the USD has staged a powerful rebound from year to date lows. The worst performing emerging market currencies so far this month have been the THB (-4.2% vs. USD), MYR (-3.8%), IDR (-3.4%) and RUB (-3.3%). It marks a sharp reversal of their recent performance although the MYR and THB are still the two best performing emerging market currencies since Q2. Asian currency weakness has extended overnight after the disappointment over a lack of China fiscal stimulus. In contrast, the MXN (2.0% vs. USD) has been the best performing emerging market currency over the past week. After hitting a peak of 20.218 on 5th August, USD/MXN has dropped back closer to support at the 19.000-level.

The USD has staged its strongest rebound since the current bearish trend started in July. There have been number of number of supportive fundamental developments. Firstly, the USD has been supported by the significant step-up in Middle East geopolitical risks over the past week. Market participants are waiting to see how Israel retaliates in the week ahead to the missile strikes carried out last week by Iran. The price of Brent crude oil has risen up closer to USD80/barrel as a larger risk premium has been priced into reflect unease over a potential disruption to global supplies. At the same time, the proximity of the flare up in Middle East tensions to the upcoming US elections could play into the hands of Donald Trump as he seeks a second term as president. The threat of another trade war continues to pose downside risks for emerging market currencies especially those from Asia and Latam. Secondly, the USD is deriving support from the hawkish repricing of Fed policy expectations. The release of the much stronger nonfarm payrolls report for September has moved market expectations into line with the Fed’s plans to slowdown the pace of easing by delivering a smaller 25bps cut in November just after the US election.

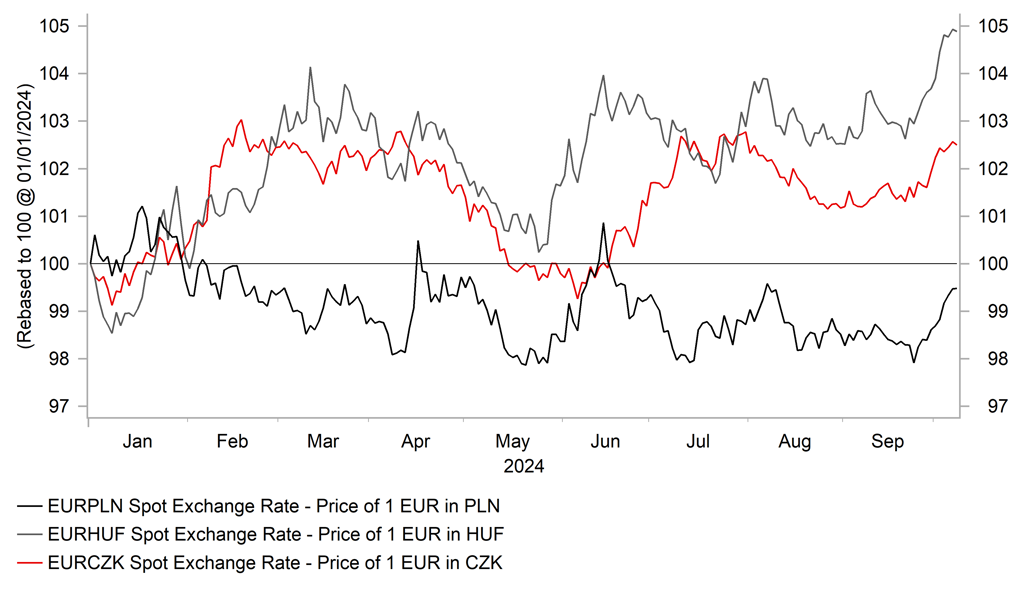

At the same time, the USD has benefitted from recent dovish signals from central banks outside of the US. The economic recovery in Europe has lost upward momentum in the 2H of this year and inflation has continued to slow encouraging regional central banks to signal more willingness to cut rates including the ECB and BoE. The negative regional developments and higher energy prices have weighed on Central European currencies helping to lift EUR/CZK further above the 25.000-level, EUR/HUF back above the 400.00-level and EUR/PLN back above the 4.3000-level. The release of the latest CPI reports for September from the Czech Republic and Hungary will be in focus in the week ahead. The PLN sell-off has been encouraged by more dovish comments by NBP Governor Glapinski who opened up the door to rate cuts as soon as March or earlier. The NBP has been reluctant to cut rates again since last year’s election. Please see our latest EM EMEA Weekly for more details (click here).

CEE-3 FX TRADING ON SOFTER FOOTING ESPECIALLY HUF

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

11:00 |

NFIB Small Business Optimism |

Sep |

92.0 |

91.2 |

! |

|

EC |

11:00 |

ECOFIN Meetings |

-- |

-- |

-- |

! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Trade Balance |

Aug |

-70.10B |

-78.80B |

!! |

|

CA |

13:30 |

Trade Balance |

Aug |

-0.40B |

0.68B |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.3% |

! |

|

US |

15:10 |

IBD/TIPP Economic Optimism |

Oct |

47.2 |

46.1 |

! |

|

US |

15:30 |

Atlanta Fed GDPNow |

Q3 |

2.5% |

2.5% |

!! |

|

US |

17:45 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

GE |

18:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

21:00 |

Fed Collins Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg