GBP weakness triggered by concerns over Gilt market sell-off

USD: Fed still waiting for more clarity on Trump’s policies

The US dollar has continued to trade close to recent highs overnight after the dollar index rose back above the 109.00-level yesterday and back to within touching of the year to date high at 109.53 recorded on 2nd January. The stronger US dollar in recent days has been encouraged by renewed upward momentum for US yields. The 10-year US Treasury yield finally broke above resistance provided by recent highs at around 4.64%. In contrast yields at the short end of the US curve have remained more stable highlighting that the sell-off at the long-end of the curve is not currently being driven by the hawkish repricing of Fed rate cut expectations. Investors are demanding more compensation for taking on risk further out the curve. The New York’s Fed measure of the term premia produced by economists Tobias Adrian, Richard Crump and Emanuel Moench (ACM) has risen up to 54bps and has reached the highest level since July 2015. With the Fed expected to be much more cautious over cutting rates further, it is making investors more wary of holding long-term bonds given the incoming Trump administration plans to maintain loose fiscal policy which alongside tariff hikes and tougher immigration rules could prove inflationary. The US budget deficit totalled around 6.5% of GDP last year for the second consecutive calendar year. Fed officials already started to take into consideration the potential impact of Trump’s policy agenda on the outlook for the US economy which was one reason why they adopted a more cautious stance over further rate cuts at the last policy meeting in December. The Fed’s updated dot plot revealed that the Fed is now planning only two further rate cuts this year. A view which is roughly shared by the US rate market that is pricing in around 42bps of cuts by December.

The release overnight of the minutes form the December FOMC meeting shed more light on the rationale behind the Fed’s hawkish policy shift. The minutes revealed that a majority of FOMC judged that the decision to cut rates last month “had been finely balanced” with “some” seeing merit in keeping the Fed funds rate unchanged. The decision to cut rates last month appears to have been more finely balanced that we had assumed. At the same time, “almost all participants” judged that upside risks to the inflation outlook had increased increased due to “recent stronger than expected readings on inflation and the likely effects of potential changes in trade and immigration policy”. The subsequent release of the softer US inflation data for November has since provided some comfort for the Fed. As a result, a “substantial majority of FOMC participants observed that, at the current juncture, with its policy stance still meaningfully restrictive, the Committee was well positioned to take its time to assess the evolving outlook”. The Fed is expected to take more time before cutting rates further and is likely to skip the January FOMC meeting. The US rate market has recently become less confident that the Fed will cut rates at all in Q1 that has helped to encourage stronger US dollar with other major central banks such as the BoE, ECB and PBoC expected to keep cutting rates at the start of this year. Prior to the release of the FOMC minutes, Fed Governor Waller sent a dovish policy signal to market participants that they should not go too far in pricing out further rate cuts. He stated that he believes “more cuts will be appropriate”. He went on to say that ”if, as I expect, tariffs do not have a significant or persistent effect on inflation, they are unlikely to my view of appropriate monetary policy”.

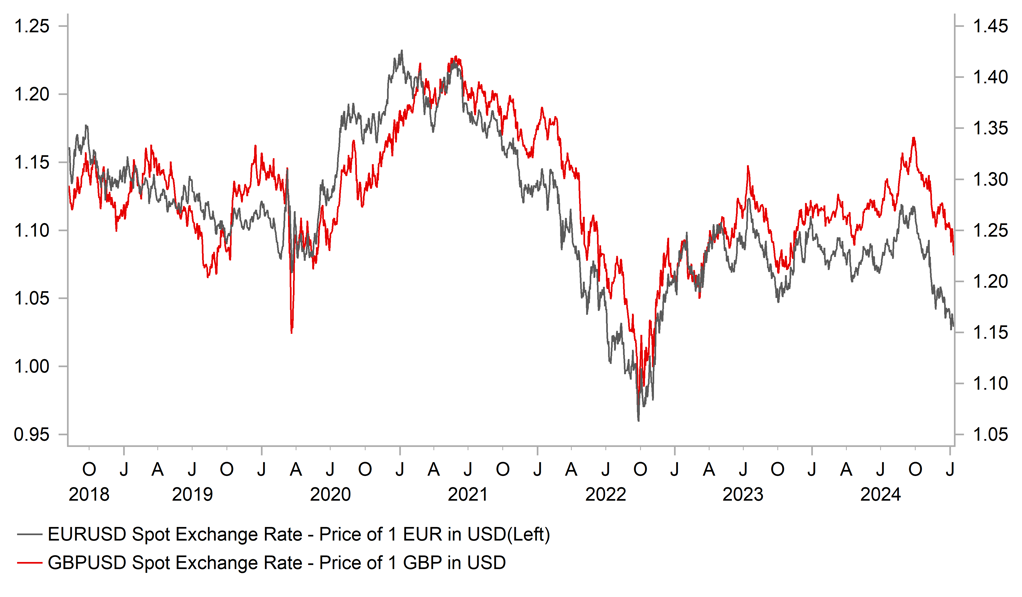

GBP HAS PROVEN MORE RESILIENT THEN EUR IN FACE OF STRONGER USD

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Gilt sell-off spills over into pound weakness

The pound has come under more selling pressure over the last 24 hours resulting in cable falling sharply below the April low at 1.2300 and EUR/GBP rising to its highest levels since early November at closer to the 0.8400-level. Pound weakness reflects more investor unease over the ongoing sell-off in the Gilt market which has captured more attention this week after the 10-year and 30-year Gilt yields rose to their highest levels since October 2008 and August 1998 respectively. It has drawn some comparisons to the sell-off following former PM Liz Truss’ ill-fated mini-Budget in autumn 2022. The scale of the of the sell-off is currently significantly smaller. The 30-year Gilt yield increased by around 300bps between the lows from August 2022 and from highs September 2022. The recent move higher in Gilt yields also appears broadly in line with the similar moves higher in other bond markets. The 10-year and 30-year Gilt yields have increased by around 55 and 60bps respectively since the end of November. In comparison, the 10-year and 30-year US Treasury yields have increased by around 50bps and 55bps respectively. Similarly, 10-year and 30-year German government bond yields have increased by around 45bps. It would suggest that the Gilt market sell-off is mainly driven by the broader repricing of long end bonds as investors seek more compensation for taking on duration risk rather than UK specific factors at the current juncture.

Having said that the rising cost of UK government borrowing if sustained will put pressure on the government to tighten fiscal policy. The UK press have reported today that Chancellor Reeves is already drawing up contingency plans for emergency spending cuts or tax rises. Treasury sources have reportedly acknowledged that the government could be forced to act as soon as March in response to higher borrowing costs. The OBR will present updated economic and fiscal forecasts in March and if they show that the government risks breaking the self-imposed fiscal rules then the Chancellor would be more inclined to take corrective action rather than wait until the Autumn Budget. She is reportedly against further tax rises or borrowing and will cut spending if unfavourable market conditions continue. In last Autumn’s Budget the government highlighted that it only had fiscal headroom of GBP9.9 billion which could be wiped out by higher borrowing costs. The Autumn budget included front-loaded fiscal spending which is expected to be supportive for growth this year which is adding to unease amongst Gilt investors alongside the persistence of more elevated core and services inflation in the UK.

Higher yields in the UK and the BoE’s caution over cutting rates was one of the key reasons why the pound outperformed last year when it was the second best performing G10 currency after the US dollar. Recent price action highlights though that higher yields are not always positive for a currency if they are driven by unease over the public finances and inflation in the UK. The BoE could also find it comes under pressure to scale back its QT programme if Gilt yields continue to rise. The BoE is currently committed to shrinking its Gilt holdings by a further GBP100 in the year from October of which around GBP12 billion will be through active Gilt sales and the rest by allowing Gilts to mature. Overall, the unfavourable market developments have increased downside risks for the pound at the start of this year and increase the likelihood of cable falling back below 1.2000

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Economic Bulletin |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Retail Sales (MoM) |

Nov |

0.3% |

-0.5% |

! |

|

US |

12:30 |

Challenger Job Cuts |

Dec |

-- |

57.727K |

! |

|

US |

14:00 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

UK |

16:00 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

US |

17:40 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

18:35 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,852B |

!! |

Source: Bloomberg