Focus on France shifts to the US and Powell and CPI

EUR: Uncertainty will linger but risk of volatility has receded

Following the initial modest reaction to the French parliamentary election result yesterday, the markets have remained calm with little reason to de-risk again given we may now be in a vacuum while negotiations take place over a possible government being formed. We have been here before in many other countries in the euro-zone and coalition negotiations can take a very long time – Belgium holds the record at 592 days before a new government was formed in 2020, surpassing its own previous record of 541 days in 2010. The Netherlands took nearly nine months to reach a deal in December 2021. So a long negotiation period is not uncommon. Still, this is France and is bigger and more powerful and markets would not remain calm for that period – but key here is that the government continues to function as these negotiations unfold.

No surprise then that President Macron refused the resignation of Prime Minister Attal, asking him to stay on for “the moment” for the stability of the country. EUR/USD was close to unchanged and the OAT/Bund spread narrowed by 2bps. A key take-away from the election result that could help ensure relative stability over the near-term is that President Macron’s Ensemble did better than expected considering his unpopularity. If we consider the fact that the New Popular Front is a recently cobbled together amalgamation of left-leaning political parties with no history of working together, we do in fact have a parliament in which Ensemble is the single largest established political party. That leaves Macron in a much stronger position.

Indeed, the negotiations to govern could well open up fractures in NPF and it could well be a testing time for its unity, especially for Melenchon’s Unbowed. He is the most divisive figure but Unbowed did win the largest number within NPF – 71 seats. But Raphael Glucksman’s Socialists were second with 64 seats. If NPF was to fracture due to the obvious internal differences, a road to a left/centrist coalition could open up. Time will tell how this evolves and time of course means greater fiscal slippage is a risk but these are better issues for France to have than a party that historically at least is anti-Europe and wants to look inwards.

EUR/USD does now look to be more aligning with moves in rate spreads and the narrowing of the 2-year EZ-US swap spread is consistent with the move higher in EUR/USD. Fears are receding in the market over any big surge in volatility over a significant sell-off in OATs and the drop in yields in the US is therefore having greater influence. Indeed, the relative macro status currently measured by the difference in Economic Surprise indices in the euro-zone and the US shows the most favourable relative macro backdrop for the euro-zone since 2021. There is probably still a small amount of risk premium in the euro price but events in the US tomorrow and on Thursday will be key to whether this move higher in EUR/USD can extend back closer to the 1.1000-level.

EURO-ZONE/US RELATIVE MACRO MOST POSITIVE SINCE 2021

Source: Macrobond & Bloomberg

USD: Powell in focus ahead of CPI on Thursday

There seems a higher level of anticipation ahead of today’s semi-annual testimony from Fed Chair Powell with the recent run of weaker economic data pointing to the prospect of Powell being more willing to signal the potential for rate cuts. The OIS implied probability of a 25bp rate cut in September stands at 70% with today’s testimony and the CPI data on Thursday key in whether that probability rises further. With two more payroll reports and three CPI reports still to be released before we get to the September FOMC meeting, the level of conviction on a rate cut by then is unlikely to increase dramatically. It also points to a level of caution from Powell today – but he will certainly acknowledge the direction of travel in inflation is turning favourable again and if continued will open up the prospect of monetary easing.

There was more positive data yesterday with the New York Fed’s 12mth inflation expectations survey showing an easing of inflation from 3.2% in May to 3.0%. The 3-year level increased modestly from 2.8% to 2.9%. Still, at these levels the readings remain consistent with the levels back in late 2021 early 2022 prior to the inflation surge and will be another factor reassuring the Fed.

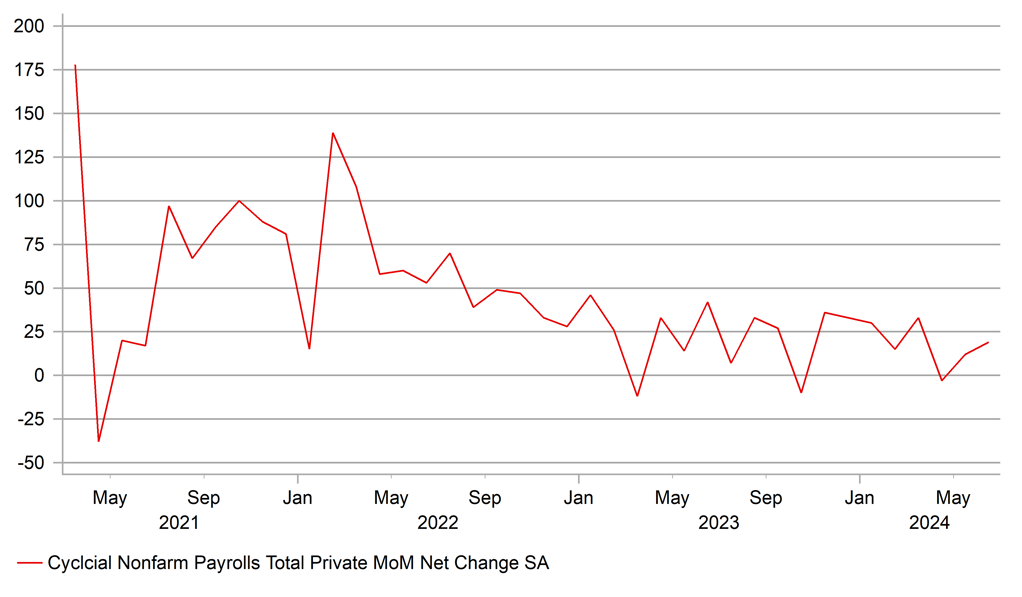

But it will be comments on the labour market this afternoon that might show the biggest potential change. The data last week makes a further shift in thinking more likely. The pace of cyclical NFP growth in the private sector (ex-education & health) was very weak again at 54k, the unemployment rate is drifting higher and wage growth on a 3mth annualised basis hit 3.5% - the magic number that is deemed to be consistent with price stability. If the unemployment rate remains at 4.1% next month, the Sahm Rule (3mth moving average being 0.5ppt higher than the low-point over the last 12mths) will be hit and will send a strong signal of potential imminent downturn.

So we would expect some stronger rhetoric this afternoon on the weakening labour market, which will be read by the markets as indirectly opening up the way for a September rate cut if the gradual weakening momentum continues. Powell will also for sure emphasise that politics will not influence any decision-making, which again will be read as leaving open a September rate cut. We see the dollar as vulnerable to further selling today given the macro backdrop and the signals from FOMC members over concerns that the labour market data could be over-stating strength – something included in the minutes of the last meeting. That could show up in comments suggesting a willingness of the FOMC to respond quickly to changing conditions in the labour market.

PRIVATE SECTOR SERVICES EMPLOYMENT GROWTH EXCLUDING HEALTH & EDUCATION – REMAINING WEAK

Source: Macrobond, Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

11:00 |

NFIB Small Business Optimism |

Jun |

89.9 |

90.5 |

!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

! |

|

UK |

12:00 |

BoE Quarterly Bulletin |

-- |

-- |

-- |

! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.8% |

! |

|

US |

14:15 |

Fed V Chair Supervision Barr Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Fed Chair Powell Testifies |

-- |

-- |

-- |

!!!!! |

|

US |

15:00 |

Total Vehicle Sales |

-- |

15.80M |

15.90M |

! |

|

US |

15:00 |

Treasury Secretary Yellen Speaks |

-- |

-- |

-- |

!!! |

|

US |

18:30 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg