USD is ending the week on a softer footing ahead of FOMC meeting

EUR/USD: Weaker data ahead of next week’s ECB & Fed policy meetings

The US dollar has continued to trade at weaker levels during the Asian trading session that has helped to lift EUR/USD back closer towards the 1.0800-level as it moves further above the low from the end of last month at 1.0635. The US dollar sell-off yesterday was reinforced by the release of the latest weekly claims report which jumped to a new high of 261k for the week ending the 3rd of June. Initial claims have been volatile over the past month and have subsequently been revised lower so we would caution against placing too much emphasis on one weekly print. The initial claims data is expected to be noisy in the month ahead as the seasonals struggle to cope with the annual automakers’ retooling shutdowns. It could mean that a clear picture of the underlying trend for claims may not emerge until later next month/early August. The price action does highlight though that the US rate market and the US dollar are sensitive to any evidence of weakening in the US labour market. So far the labour market has remained resilient which leaves the door open to further Fed rate hikes. The US rate market is still expecting one more rate hike from the Fed by the July meeting and there are currently 19bps priced in. The probability of another hike as soon as next week has though been scaled to back with around 7bps priced in. The hawkish policy surprises from the RBA and more importantly the BoC who both signalled more concern over the risk of inflation proving more persistent than expected have not encouraged US rate market participants to price in a higher risk of hawkish surprise from the Fed next week.

The euro has strengthened against the US dollar even as it was revealed yesterday that the euro-zone economy fell into technical recession after a bigger than expected downward revision to GDP growth in Q1. The euro-zone economy has now contracted marginally for two consecutive quarters by -0.1% in both Q4 2022 and Q1 2023. The downward revisions were mainly due to Germany and Ireland, which offset an upward revision to Italy. The details revealed that weaker consumer and government spending were the main hits to growth in Q1. Household consumption fell by 0.3% following on from a -1.0% slide in Q4, while government spending dropped sharply by 1.6% Covid expenditures in Germany ended. Inventories were also a sizeable drag on growth shaving off -0.4ppt. Weaker than expected domestic demand should make the ECB more cautious over continuing to tighten monetary policy although we still expect the ECB to stick to current plans to deliver two more 25bps rate hikes in June and July that lift the deposit rate to a peak of 3.75%. It is a view shared by the euro-zone rate market that is currently pricing in around 25bps of hikes for next week’s policy meeting and 43bps of hikes by the July policy meeting. The recent run of weaker activity and inflation data from the euro-zone could encourage the ECB staff to lower their GDP and inflation forecasts for this year at next week’s policy meeting. Overall, the developments have seen EUR/USD move back towards the middle of this year’s trading range between 1.0500 and 1.1000 as the pair struggles for direction.

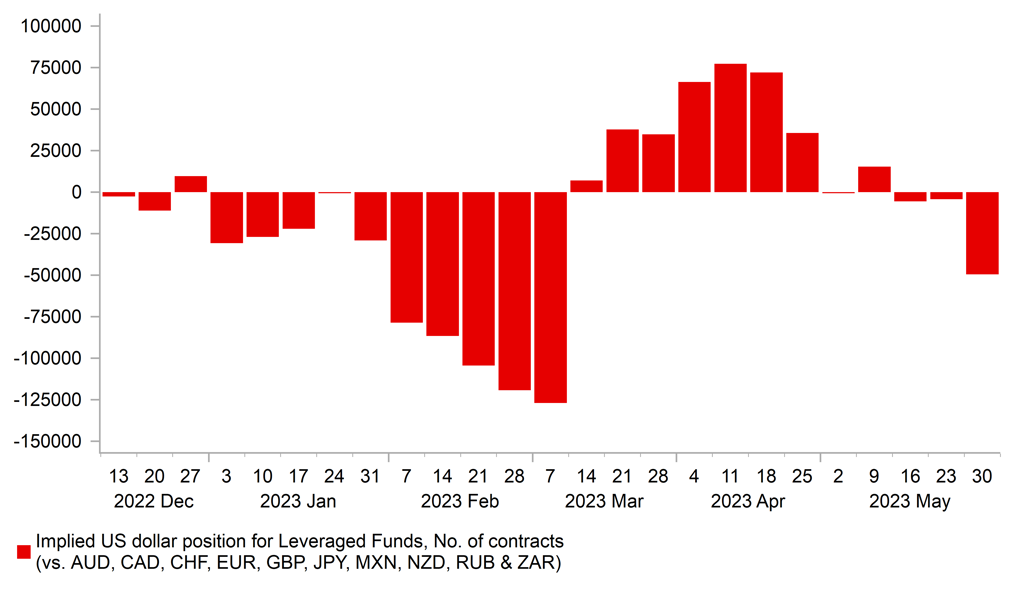

LEVERAGED FUNDS HAVE INCREASED USD SHORTS RECENTLY

Source: Bloomberg & Macrobond

TRY: New CBRT Governor reinforces expectations for higher rates

The lira has resumed its sharp sell-off today resulting in USD/TRY rising up to the 23.500-level. It follows the official announcement that President Erdogan has appointed a new Governor for the Central Bank of Turkey. Sahap Kavcioglu has been replaced by Hafize Gaye Erkan in line with speculation in recent days. Hafize Gaye Erkan is a former banking executive in the US having worked at First Republic Bank and Goldman Sachs. She becomes the first female Governor of the Central Bank of Turkey. Her appointment will reinforce expectations that an important policy shift is now underway in Turkey. It follows hot on the heels of the recent appointment of Mehmet Simsek as the new treasury and finance minister

A shift away from the unconventional policies that have been in place in Turkey in recent years already appears to be underway with policymakers allowing the lira to adjust lower to help rebalance the economy and boost external competitiveness. Market participants will now be watching closely to see whether the appointment of a new CBRT Governor will be backed up by a significant tightening of monetary policy. The next policy meeting is scheduled to take place on 22nd June, although a decision could be made to deliver an inter-meeting emergency rate hike. In order to make monetary policy more credible and mark a clear shift from unconventional policy settings, the policy rate will need to rise much closer to the current rate of inflation. While headline inflation has slowed sharply this year, it was still elevated at 39.6% in May and the core rate remained even higher at 46.6%. With the one-week deposit rate at just 8.50%, it clearly needs to be set much higher. The Turkey OIS curve is already pricing in expectations that yields will move closer towards 30% through the rest of this year. Much higher rates if sustained should help to provide more support for the lira after it has adjusted lower to more competitive levels. Market participants will remain wary though over the risk that tighter policy may not be sustained for long given President’s Erdogan’s well-known opposition to higher rates.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Apr |

0.1% |

-0.6% |

! |

|

EC |

09:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Employment Change |

May |

23.2K |

41.4K |

!! |

|

CA |

13:30 |

Unemployment Rate |

May |

5.1% |

5.0% |

!! |

Source: Bloomberg