Downside risks for the pound from today’s MPC meeting

JPY: BoJ signals more concern over yen weakness

The yen has re-weakened this week resulting in USD/JPY rising back towards the 156.00-level overnight after hitting an intra-day low of 151.86 on Friday. The price action highlights that it will be difficult for Japan to reverse the yen weakening trend unless intervention is backed up by a change in economic fundamentals as well. The release overnight of the summary from the BoJ’s latest policy meeting in April revealed that board members are closely watching the performance of the yen which could have implications for their outlook for monetary policy. According to the summery, one of the BoJ board members stated “if underlying inflation continues to deviate upward from the baseline scenario against the backdrop of a weaker yen, it is quite possible that the pace of monetary policy normalization will increase”. Another BoJ board member held the view that “attention is warranted on the risk that prices will deviate upward from the baseline scenario” due to the yen’s depreciation and high oil prices. It follows the comments yesterday from BoJ Governor Ueda that indicated more concern over yen weakness than displayed in the press conference following the last policy meeting. He stated that “abrupt and one-sided weak yen moves raise uncertainties and are negative for Japan’s economy and are undesirable as, for example, they make it hard for companies to formulate their business plans”. It’s natural for the central bank to consider taking action if foreign exchange moves hit the nation's price trend. He said that “depending on those moves [in the yen], a monetary policy response might be needed”.

Overall, the comments support our forecast for the BoJ to deliver another rate hike earlier than expected at the July policy meeting which would help to provide more support for the yen in the near-term alongside the ongoing risk of further intervention. Additionally, the summary from the BoJ’s last policy meeting revealed that one board member thought “it is important for the bank to proceed with reducing its purchase amount of JGBs in a timely manner” from the current monthly pace of around JPY6 trillion. A more hawkish tone from the BoJ should keep upward pressure on Japanese yields even if the follow through to a stronger yen is more muted. The more hawkish tone from the BoJ will have been encouraged as well overnight by the release of much stronger wage data from Japan. Scheduled full-time pay using the same sample base picked up to 2.3% in March. We continue to expect further evidence of stronger wage negotiations for workers at small and medium-sized firms to encourage the BoJ to hike rates sooner.

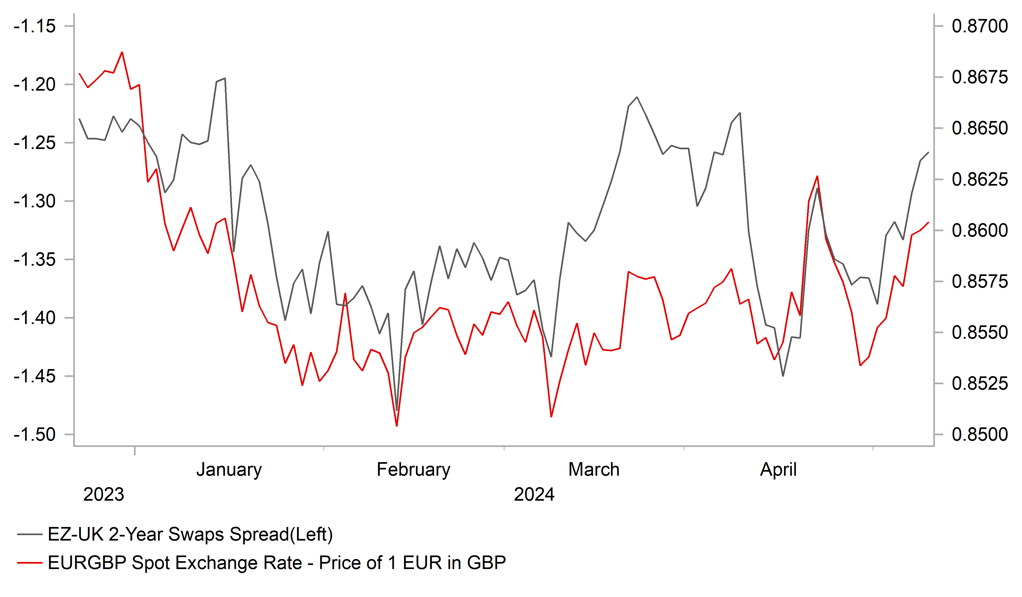

EUR/GBP VS. SHORT-TERM YIELD SPREAD

Source: Macrobond, Bloomberg & MUFG Research

GBP: How close is the BoE to cutting rates?

Market attention will shift today to the BoE’s latest policy meeting to assess how close they are cutting rates. It follows the Riksbank’s decision yesterday to become the second G10 central bank to start lowering rates when they cut their policy rate by 0.25 point to 3.75%. The decision to begin cutting rates ahead of the ECB rather than wait until June signalled that they are not overly concerned over the risk that the krona weakens further in the near-term. The updated policy guidance did though emphasize the that pace of further rate cuts will be gradual. A weaker krona was cited as an upside risk to the inflation outlook that could derail their rate cut plans. The Riksbank is planning to cut rates two more times this year. The update leaves the krona vulnerable to further weakness in the near-term and could see EUR/SEK extending its’ recent advance back closer to last year’s highs between 11.800 and 12.000.

As highlighted in our latest FX Weekly report (click here), we are expecting the BoE to deliver a more dovish policy update today posing downside risks for the pound. We recommended a long EUR/GBP trade idea in advance of today’s MPC meeting. While the BoE is expected to leave the policy rate on hold at 5.25% in the week ahead, recent comments from MPC officials have indicated that more MPC members may join arch dove Swati Dinghra in voting for a rate cut. Deputy Governor Dave Ramsden is the most likely candidate given he recently judged that risks to the BoE’s inflation forecasts are now “titled to the downside”. He expressed a similar view to Governor Bailey in having more confidence that the UK appears less of an outlier in terms of higher inflation than in other major economies, and now appears more of a laggard with inflation set to slow further this year. The shift in the balance of risks should be captured in the updated inflation projections in today’s Quarterly Inflation Report. We expect the updated forecasts to indicate a lower probability of inflation overshooting the BoE’s inflation target over the forecast period. In light of these developments, we have held on to our forecast for the BoE to begin cutting rates sooner in June (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

12:00 |

BoE Interest Rate Decision |

Apr |

5.25% |

5.25% |

!!! |

|

UK |

12:00 |

BoE MPC Meeting Minutes |

-- |

-- |

-- |

!!! |

|

UK |

12:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

GE |

12:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

212K |

208K |

!!! |

|

UK |

14:15 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

CA |

16:00 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

UK |

17:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg