China steps help stabilise sentiment for now

CNY: Limited FX reaction to latest measures

There has been limited impact so far from the announcement from the PBoC that it was cutting the foreign exchange minimum reserve requirement from 6% to 4% effective 15th September. The action will help add to US dollar supply and discourage the hoarding of dollars that has helped support USD/CNY. The resistance to CNY weakness remains evident in the daily PBoC fixings – today the fixing was set at 7.1788, down from 7.1811 and well below the market estimate of 7.2880. The divergence of over 10 big figures remains extreme and the fixings and the US dollar reserve requirement cut reinforces the impression that the Chinese authorities see 7.3000 as the line in the sand in terms of tolerance of CNY weakness.

The action today followed the measures announced yesterday to try and boost property sector activity. The nationwide minimum down payment for first time buyers will be uniformly set at 30% for first-time buyers and 30% for second-time buyers. Often the minimum down payment on second properties can be as high as 80%. Mortgage rates will also be cut with negotiations between lenders and homeowners following instructions to banks to lower rates. We are not that surprised that there has been limited reaction so far to these announcements. It is more piecemeal / ad hoc reactive policy steps and is unlikely to revive notably a sector weighed down by excessive levels of debt and excessive supply of properties putting downward pressure on prices.

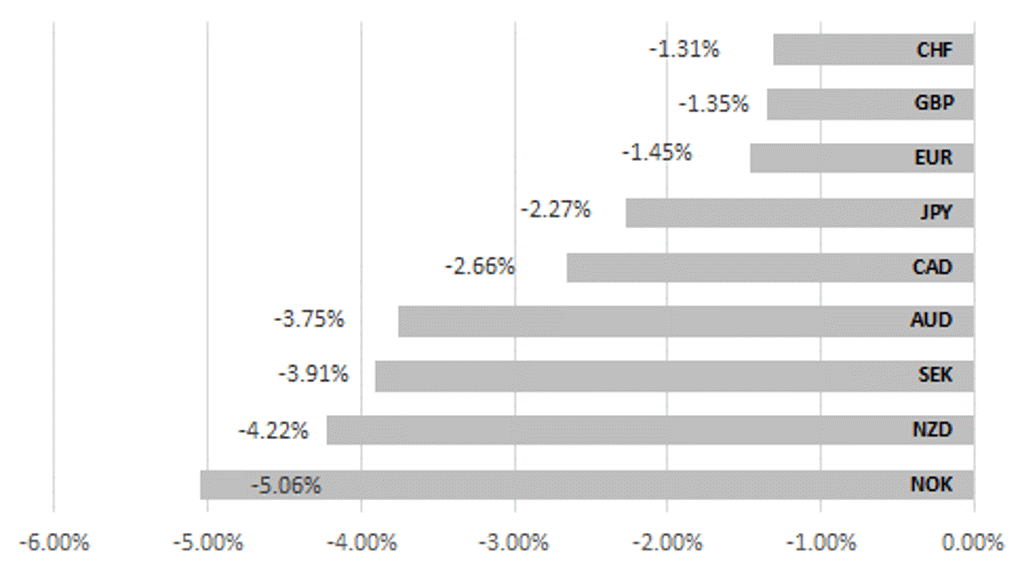

The chart above shows the G10 FX performance versus the US dollar in August. It was a month of broad-based dollar strength and the global backdrop of weakening growth in China and high levels of uncertainty over the property sector plus euro-zone growth teetering again at recession levels mean the scope for sustained dollar weakness will be limited over the short-term. More pronounced evidence of US economic weakness and some improvement in China sentiment will be needed for renewed dollar weakness to take hold.

USD STRENGTH VERSUS ALL G10 IN AUGUST

Source: Bloomberg; 17:30 BST 31st August – August % change vs USD

USD: Government shutdown risks

The US dollar remains firm and the higher than expected PCE inflation data yesterday was the latest supportive factor although based on yield moves yesterday it was the EUR side that fuelled the drop in EUR/USD with the 2-year government bond yield in Germany down 10bps.

The debt ceiling fiasco is gladly now behind us with a suspension in place until January 2025 after the deal reached between Republicans and Democrats in early June. That deal sets limits on non-defence discretionary spending which will effectively mean fiscal consolidation ahead. But what that deal didn’t do was map out the precise government funding details for the new fiscal year starting on 1st October. That has prompted President Biden yesterday to seek a short-term government funding package to finance the government while Congress hammers out a deal.

Senate leaders have signalled a willingness to do a deal but the issue will be with Republican hardliners in the House. A stopgap funding package would cover a period through to mid-December and the White House outlined finance for disaster assistance following Hurricane Idalia in Florida – that shouldn’t be a problem. However, a request for USD 1.85bn for handling a surge in immigrants will be more contentious. The package totalling USD 40bn would also include USD 12bn for international aid including support for Ukraine, again another issue for the Republicans. With House speaker Kevin McCarthy weak there is certainly a high risk that Republicans seeking spending cuts to do a deal will have greater influence which could take us into a period of government shutdown in October.

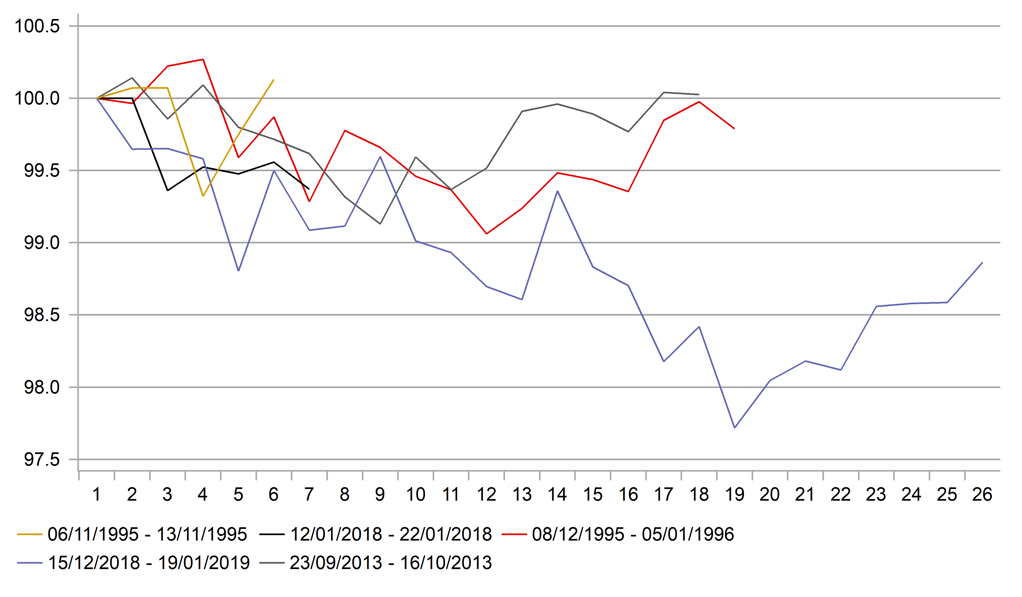

There will be no surprise to see this drag on and through close to the end of this month at the very least which will see increased speculation on a government shutdown. We have been here before. The longest government shutdown in history began in December 2018 and last 35 days and three of the four longest shutdowns have taken place since 1995.

While the longer a shutdown becomes the greater the potential economic impact is, in general the impact in the markets has been minimal. The last shutdown being the longest did have the biggest negative impact on the dollar although that shutdown did coincide with a substantial sell-off in the S&P 500 which were down to numerous other factors – Fed rate hikes, weak China, trade conflicts with China (sound familiar?). So in of itself, it might not have much impact but it may not be helpful if at that juncture we see weaker growth emerge in the US and China remains in the doldrums.

USD PERFORMANCE THROUGH GOVERNMENT SHUTDOWNS SINCE 1995

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:50 |

French Manufacturing PMI |

Aug |

46.4 |

45.1 |

!! |

|

GE |

08:55 |

German Manufacturing PMI |

Aug |

39.1 |

38.8 |

!!! |

|

IT |

09:00 |

Italian GDP (YoY) |

Q2 |

0.6% |

1.9% |

! |

|

IT |

09:00 |

Italian GDP (QoQ) |

Q2 |

-0.3% |

0.6% |

! |

|

IT |

09:00 |

Italian PPI (MoM) |

Jul |

-- |

-0.3% |

! |

|

IT |

09:00 |

Italian PPI (YoY) |

Jul |

-- |

-5.5% |

! |

|

NO |

09:00 |

Manufacturing PMI |

Aug |

56.0 |

56.7 |

! |

|

NO |

09:00 |

Unemployment Change |

Aug |

64.16K |

64.24K |

! |

|

EC |

09:00 |

Manufacturing PMI |

Aug |

43.7 |

42.7 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Aug |

42.5 |

45.3 |

!!! |

|

US |

13:30 |

Nonfarm Payrolls |

Aug |

170K |

187K |

!!!!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Aug |

0.3% |

0.4% |

!!!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) (YoY) |

Aug |

4.4% |

4.4% |

!! |

|

US |

13:30 |

Average Weekly Hours |

Aug |

34.3 |

34.3 |

!! |

|

US |

13:30 |

Participation Rate |

Aug |

62.6% |

62.6% |

!! |

|

US |

13:30 |

U6 Unemployment Rate |

Aug |

6.8% |

6.7% |

! |

|

US |

13:30 |

Unemployment Rate |

Aug |

3.5% |

3.5% |

!!!! |

|

CA |

13:30 |

GDP Implicit Price (QoQ) |

Q2 |

1.50% |

0.20% |

! |

|

CA |

13:30 |

GDP (QoQ) |

Q2 |

0.3% |

0.8% |

!!! |

|

CA |

13:30 |

GDP (YoY) |

Q2 |

-- |

2.21% |

!! |

|

CA |

13:30 |

GDP (MoM) |

Jun |

-0.2% |

0.3% |

!!! |

|

CA |

13:30 |

GDP Annualized (QoQ) |

Q2 |

1.2% |

3.1% |

!! |

|

CA |

14:30 |

Manufacturing PMI |

Aug |

49.2 |

49.6 |

! |

|

US |

14:45 |

Manufacturing PMI |

Aug |

47.0 |

49.0 |

!! |

|

US |

15:00 |

Construction Spending (MoM) |

Jul |

0.5% |

0.5% |

! |

|

US |

15:00 |

ISM Manufacturing Employment |

Aug |

44.2 |

44.4 |

!! |

|

US |

15:00 |

ISM Manufacturing PMI |

Aug |

47.0 |

46.4 |

!!!! |

|

US |

15:00 |

ISM Manufacturing Prices |

Aug |

43.9 |

42.6 |

!!! |

Source: Bloomberg