Higher tariff rate pause triggers relief rebound for high beta FX

USD: Trump tariff climb down brings broad-based relief but not for China

The high beta G10 currencies of the Australian and New Zealand dollars have outperformed overnight following President Trump’s decision to pause the “higher reciprocal tariff” rates applied to the 60 worst offenders for 90 days with the notable exception of China who had their tariff rate raised further to 125%. For all other trading partners they will now face the lower 10% tariff rate alongside other tariffs that have been implemented including the 25% tariffs on autos, steel & aluminium, and on non-USMCA compliant imports from Canada and Mexico (lower 10% rate applied to Canadian energy & potash). As a result, the weighted average tariff on all US imports is still around 25% but when excluding China drops for the rest of the world to around 13-14%. The 90-day pause will allow more time for President Trump to negotiate deals with trading partners before he decides whether to re-implement the higher “reciprocal tariff” rates or lower/reverse current tariffs further. US Treasury Secretary Scott Bessent expressed optimism yesterday that “we can probably reach a deal with our allies” at the end of the day, and “then we can approach China as a group”. In contrast he stated it was “unfortunate that the Chinese actually don’t want to come and negotiate, because they are the worst offenders in the international system”. It follows China’s decision to retaliate further against the US yesterday by raising their tariff rate on imports from the US up to 84%. The tit-for-tat tariff hikes between China and the US highlights that trade tensions remain on an escalatory path in the near-term.

The decision to temporarily pause the higher “reciprocal tariff” rates on all other trading partners has triggered relief amongst market participants that it will help prevent an even more disruptive impact for global trade and global economy. US equities surged higher resulting the S&P500 index closing up +9.5% and the Nasdaq composite index by +12.1% reversing the bulk of the losses recorded since the “reciprocal tariffs” were announced by President Trump on 2nd April. The sharp rebound in US equity markets also coincided with a drop in US yields. The 10-year and 30-year US Treasury yields both fell by around 20bps and 30bps. The sell-off in the US Treasury market in recent days and more disorderly price action with investor concerns building over the forced liquidation of basis trades appears to have played a role in putting pressure on President Trump to quickly pause his higher “reciprocal tariff” rate plan just after it had gone live.

The Trump administration has clearly indicated it wants lower US Treasury yields and has been calling on the Fed repeatedly to cut rates. The risk of more disorderly price action in the US Treasury market was also beginning to fuel speculation that the Fed would have to provide support potentially including temporary purchases of US Treasuries. Market pressure on the Fed to act imminently has eased in response to Trump’s tariff climb down. The US rate market has scaled back expectations for Fed rate cuts to around 75bps by the end of this year down from a recent peak of closer to 125bps. The release of minutes overnight from the last FOMC meeting in mid-March, which are more dated than normal given recent developments, reiterated that the Fed is not in a rush to resume cut rates. While stagflation risks for the US economy have now reduced, the higher tariff rates still in place and elevated level of policy uncertainty remain a headwind to US and global growth and will work against a more sustained rebound in high beta currencies at the current juncture. We still expect to see building evidence of weaker economic data released in the coming months in response to recent developments.

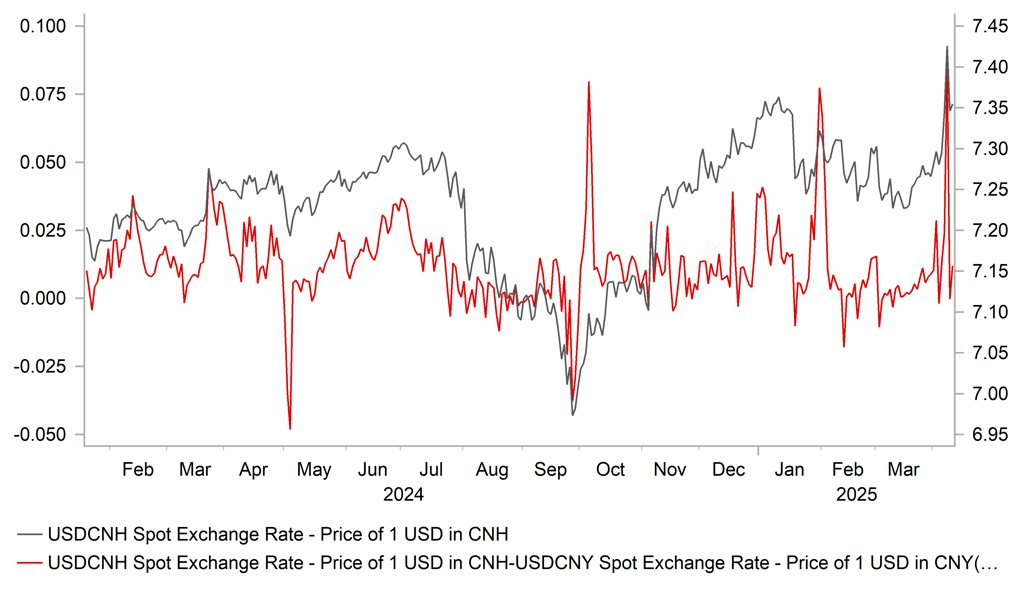

At the same time, market speculation over the risk of a bigger devaluation for the renminbi is likely to continue in response to the much higher tariffs imposed on China and the even bigger divergence between tariffs imposed on all other trading partners. Renminbi devaluation expectations resulted in USD/CNH hitting a high in recent days at 7.4290 while USD/CNY moved towards the top of the daily +/- 2% trading band. The spread between USD/CNH and USD/CNY widened out to the highest level since January 2020 although USD/CNH has since dropped back toward the 7.3500-level closer to where USD/CNY is trading. Reuters reported yesterday that the PBoC has asked major state banks to reduce US dollar purchases for their proprietary accounts this week as they seek to dampen downward pressure on the renminbi in the near-term. The Reuters report went on to add that the PBoC will not resort to renminbi devaluation to soften the blow from tariffs to their economy. Bloomberg has reported overnight as well that China’s top leaders are poised to meet today to discuss additional economic stimulus according to people familiar with the matter. The ad-hoc meeting is set to focus on support measures for housing, consumer spending and technological innovation. Other government bodies including financial regulators will convene to discuss steps to boost the economy and stabilize markets. More front-loaded and bigger stimulus will be needed to offset the hit from the escalating trade war with the US which continues to pose downside risks for other Asian and commodity-related currencies. A quick deal with the US to reverse/water down tariff hikes anytime soon appears even more unlikely now, although as we’ve seen one can’t rule out anything with President Trump.

RENMINBI TO REMAIN UNDER SELLING PRESSURE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

AU |

11:00 |

RBA Gov Bullock Speaks |

-- |

-- |

-- |

! |

|

GE |

13:00 |

German Buba Vice President Buch Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Core CPI (MoM) |

Mar |

0.3% |

0.2% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

223K |

219K |

!!! |

|

UK |

14:00 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

US |

14:30 |

Fed Logan Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

Fed Schmid Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

17:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

17:30 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

30-Year Bond Auction |

-- |

-- |

4.623% |

!! |

Source: Bloomberg