China stimulus optimism provides boost for commodity currencies

CNY: Stronger policy stimulus to provide offset to bigger headwind from trade disruption

The top performing currencies at the start of this week have been commodity-related currencies with the Australian dollar and South African rand both strengthening yesterday by over 1% against the US dollar. The main trigger was announcement from China’s Politburo who signalled more strongly that they are planning to significantly step up policy support for economic growth next year. It has helped to provide an offset by concerns that economic growth will face an additional headwind from trade disruption when Donald Trump returns for a second term as president in January. He has already threatened to raise tariffs on all goods imported from China by further 10% early in his second term which could prove to be only an opening step in an escalating trade war between the US and China given he pledged on the campaign to trail to raise tariffs up to 60% from the current average rate of around 20%. In order to provide more reassurance that Chinese policymakers will be more active in supporting domestic demand at a time when external demand will be challenged, the Politburo indicated that they will implement “more proactive and impactful macro policies” with the aim to strengthen the “extraordinary counter-cyclical adjustment”. The changes to domestic policies will include: i) a shift to “moderately loose” monetary policy from the current “prudent” approach, ii) “more proactive fiscal policy” and iii) further steps to stabilize the domestic stock market and housing market.

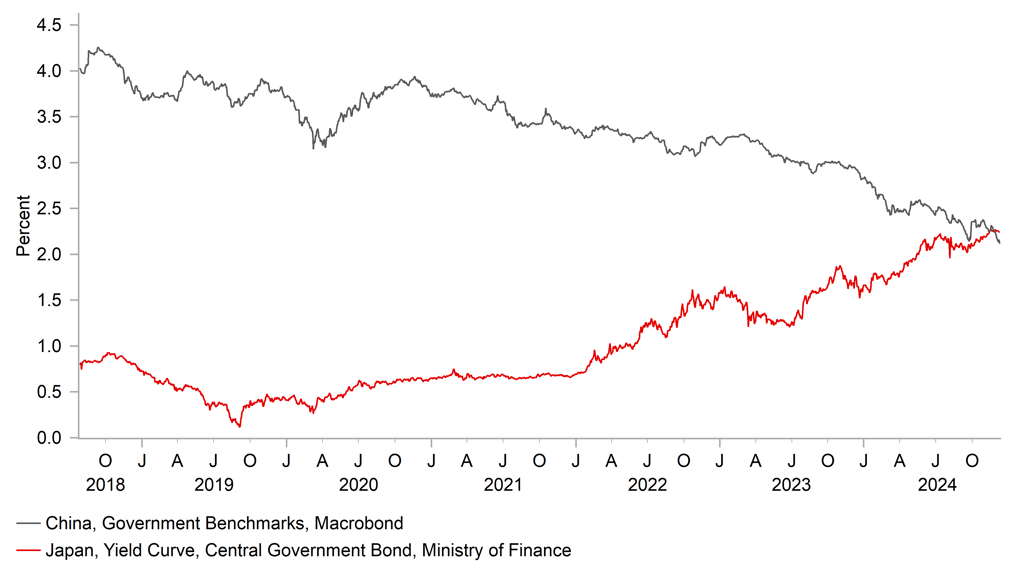

The coming big annual economic conference (CEWC) will be watched even more closely in the coming days for any further insight over the likely scale of policy stimulus next year. According to recent reports, China’s government is expected to target a wider budget deficit for next year of between 3.0% to 4.0% of GDP up from 3.0% for this year. Any further stimulus would be viewed more positively if it also includes fiscal measures to help rebalance demand in China by providing more support for personal consumption rather than adding to the overinvestment problem. With yields in China haven already fallen to records lows, there will be question marks over how effective a further loosening of monetary policy will be at supporting growth. China’s 30-year government bond yield recently fell below the equivalent in Japan for the first time attracting market attention as a signal China is following the slowing growth and inflation path of Japan, and requires a more powerful policy response to address structural problems. The shift in stance in favour of looser monetary policy may also indicate a greater tolerance for allowing the renminbi to weaken further to provide an offset to the negative impact on external demand from higher US trade tariffs. For commodity currencies a more powerful policy stimulus in China would help to dampen downside risks going forward from trade disruption but is unlikely on its own to reverse our outlook for further weakness in the year ahead (click here).

LONG-TERM YIELDS IN CHINA FALL BELOW THOSE IN JAPAN

Source: Bloomberg, Macrobond & MUFG GMR

AUD: RBA signals it is moving closer to cutting rates next year

The Australian dollar has already given back most of its strong gains recorded yesterday after falling sharply overnight following the RBA’s latest policy meeting. It has resulted in AUD/USD moving back below the 0.6400-level after hitting a high yesterday of 0.6471. While the RBA left policy unchanged again at 4.35% where it has remained throughout this calendar year, the updated policy statement indicated that the Board are “gaining some confidence that inflationary pressures are declining” in line with their latest forecasts from the November Statement on Monetary Policy. The RBA acknowledged that economic activity has been on balance softer than expected in November. A further favourable development on the inflation front has been weaker than expected wage growth with the wage price index stepping down to an annual rate of 3.5% in Q3. Taking the recent data into account, the RBA judged that some of the upside risks to inflation have eased.

In the press conference Governor Bullock chose to emphasize that the battle against inflation has not yet been won although building evidence of slowing inflation was moving in the right direction. She added that the Board don’t necessarily need two or three quarterly CPI prints to provide justification to begin cutting interest rates. In response to the RBA’s more dovish communication overnight the Australian rate market has moved to price in a higher probability of the RBA beginning to cut rates at their next policy meeting in February (around 15bps) although a 25bps cut is not fully priced in yet until the following meeting in April. When asked about the dovish market reaction, RBA Governor Bullock stated that she was not surprised by the reaction to the latest weaker than expected Australian GDP report for Q3 and the RBA’s updated policy statement but would not go as far as endorsing the updated rate path. When asked directly about a rate cut in February, she stated that “honestly I don’t know” and was reluctant to give explicit guidance on the timing of the first rate cut. The RBA’s reluctance to cut rates this year has helped the Australian dollar to outperform other G10 commodity currencies. Lower rates next year poses a downside risk for the Australian dollar alongside trade disruption from Trump tariffs. AUD/USD is currently testing key support from recent lows between 0.6300 and 0.6400.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Oct |

-0.1% |

-0.4% |

! |

|

US |

10:00 |

OPEC Meeting |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

ECOFIN Meetings |

-- |

-- |

-- |

! |

|

EC |

10:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Nov |

94.6 |

93.7 |

! |

|

US |

13:30 |

Nonfarm Productivity (QoQ) |

Q3 |

2.2% |

2.5% |

!! |

|

US |

13:30 |

Unit Labor Costs (QoQ) |

Q3 |

1.9% |

0.4% |

!! |

|

US |

17:00 |

EIA Short-Term Energy Outlook |

-- |

-- |

-- |

!! |

|

JP |

23:00 |

Reuters Tankan Index |

Dec |

-- |

5 |

! |

|

JP |

23:50 |

PPI (YoY) |

Nov |

3.4% |

3.4% |

! |

Source: Bloomberg