Trump’s tariff plans to boost USD in week ahead

USD: Trump’s tariff plans & NFP report trigger USD rebound

The US dollar has continued to rebound at the start of this week with the dollar index rising back up towards 108.50 overnight after hitting a low last week at 107.30. The US dollar has been supported both by the release of the nonfarm payrolls report for January and President Trump’s decision to announce further tariff hikes at the start of this week on top of the 10% hike put in place against China last week. President Trump told reporters yesterday that he plans to impose 25% tariffs on all imports of steel and aluminium into the US including Canada and Mexico although did not specify when they would become effective. Data from the US Census Bureau revealed that the US imported the most steel and aluminium from Canada last year totalling USD11.2 billion and USD9.5 billion respectively. The next biggest countries from which the US imported steel were Mexico (USD6.5 billion), Brazil (USD5.2 billion) and China (USD5.2 billion). The tariff hikes if implemented as currently planned would be setback for Canada and Mexico after last week’s relief when President Trump decided to delay the implementation of 25% tariff hikes on all imports. The Canadian dollar has weakened modestly overnight in response lifting USD/CAD to an intra-day high of 1.4380 although it remains well below last week’s high of 1.4793 set prior to the 25% tariff hike delay on all imports. Tariff hikes on steel and aluminium were also one of the first measures President Trump implemented during his first presidency in 2018 when put in place a 25% tariff on steel and 10% tariff on aluminium on the grounds of national security. Furthermore, President Trump told Japanese Prime Minister Ishiba at last week’s meeting that “I don’t want US steel being owned by a foreign company. All they can have is an investment”. He added that Nippon Steel is now considering investing in US Steel rather than purchasing the company outright.

At the same time, it has been reported that President Trump is planning to announce a broader set of tariff measures at the start of this week. At the end of last week he stated that “I’ll be announcing next week, reciprocal trade, so that we’re treated evenly with other countries. We don’t want any more, any less”. He said he would be announcing tariffs that match the duties imposed by other countries perhaps in place in pace of his previous threat to put in place a universal tariff of say 10% or 20% on imports from all countries. He has previously stated that he would work with Congress to pass the Reciprocal Trade Act to give him the authority to raise tariffs on any particular foreign good to the level imposed by that country. Other countries would have the choice to get rid of/lower their tariffs on the US or face higher tariffs on their exports into the US. It remains be seen whether the reciprocal tariffs will cover all goods and countries which would be highly complex to implement on a line by line basis, or are more likely to focus on particular goods and countries to begin with. President Trump did indicate that tariffs on auto imports are “always on the table, it’s a very big deal. We have to equalize it”. He has previously complained that the EU currently imposes a higher import tariff on US autos of 10% compared to the US import tariff of 2.5%. The FT reported at the end of last week that the EU is already willing to offer cutting tariffs on US car imports as part of a deal to avoid a trade war with President Trump. Overall, the heightened risk of wider disruption to global trade from further tariff hikes is a supportive development for the US dollar.

The US dollar’s upward momentum has been supported as well by further evidence that the US labour market remains strong. It will encourage the Fed to leave rates on hold for longer at the start of this year and makes another rate cut as soon as the next FOMC meeting in March even less likely. The US rate market is currently pricing in only around 2bps of cuts for March and does not expect the next rate cut until the middle of this year. In contrast other major central banks of the BoE, ECB and PBoC are expected to continue lowering rates further at the start of this year opening up a wider policy divergence with the Fed, and encouraging a stronger US dollar. The nonfarm payrolls report revealed that the US economy added 143k jobs in January following upwardly revised jobs gains of 307k in December and 261k in November. As a result the average number of job gains since the US election has picked up to 237k in January from 118k in the three months to October. The Fed will also be reassured that the unemployment rate ticked lower by 0.1 point tot 4.0%, and has been consolidating since the middle of last year. Overall, the report does not provide justification for the Fed to consider cutting rates sooner. A view we expect to be expressed by Fed Chair Powell at this week’s semi-annual testimony on monetary policy. Inflation would have to slow further at the start of this year to encourage the Fed to continue cutting rates two more times as planned.

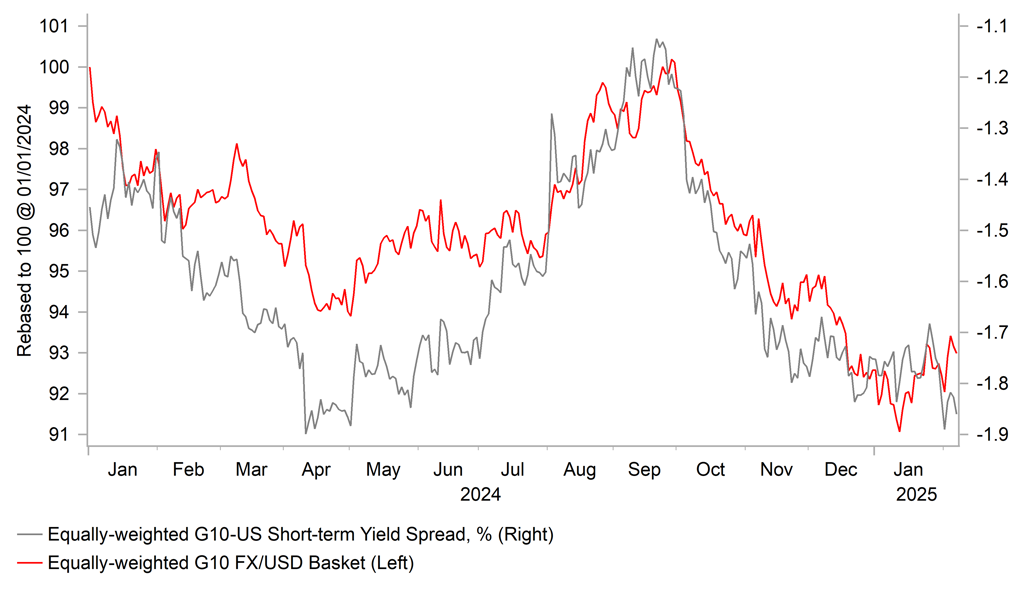

YIELD SPREADS REMAIN SUPPORTIVE FOR STRONGER USD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Feb |

-16.4 |

-17.7 |

! |

|

EC |

14:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg