US jobs in focus with USD at highs

USD: NFP should confirm FOMC inaction

The final payrolls report for 2024 will be released today and judging from the level of the US dollar and US yields, market participants are expecting the data to confirm a still solid labour market with jobs growth consistent with sustained economic growth. The JOLTS data this week saw job openings accelerate while the ISM Services Employment Index remained stable above the 51-level. The ADP jobs data was a little on the weaker side which is consistent with perhaps a gradual weakening trend in the labour market which is what is evident by the 6mth and 12mth moving averages that have been trending gradually lower since around the start of 2023. The 3mth moving average has stabilised since the middle of the year.

The consensus for today’s nonfarm payrolls is 165k, close the mid-point between the 6mth and 12mth moving averages (143k and 190k respectively) and would certainly be consistent with the FOMC at least skipping from cutting at the meeting this month. There is close to nothing priced for January and only 11bps of cuts priced for March so a much weaker payroll figure would be the bigger surprise that could prompt a bigger initial reaction in the rates and FX markets as markets price a March cut with more conviction. But certainly other economic data do not point to a deteriorating labour market at this juncture. Indeed, we should perhaps be more mindful of the potential of a post-election bounce in hiring. We already know there was a huge increase in the NFIB Small Business Optimism Index following the election result and given Trump’s pro-business, tax cutting policies, small businesses who possibly held back on hiring into the election could now be more active in hiring. NFP did bounce notably in December 2016 although that was not the case in the initially reported NFP in January 2017 and only became evident in the revised data.

But given the clear rhetoric from Fed officials of late and given Trump’s inauguration is approaching it would likely require a notable miss versus consensus to see the rates and FX markets move significantly. A print within a range of say 130k-190k will likely result in relatively contained moves in markets given what is coming and given the Fed is clear on its stance over the short-term. Governor Bowman stated yesterday that she saw the December cut as “the final step” in a recalibration of monetary policy while Fed Presidents Collins and Harker both signalled increased caution on additional rate cuts.

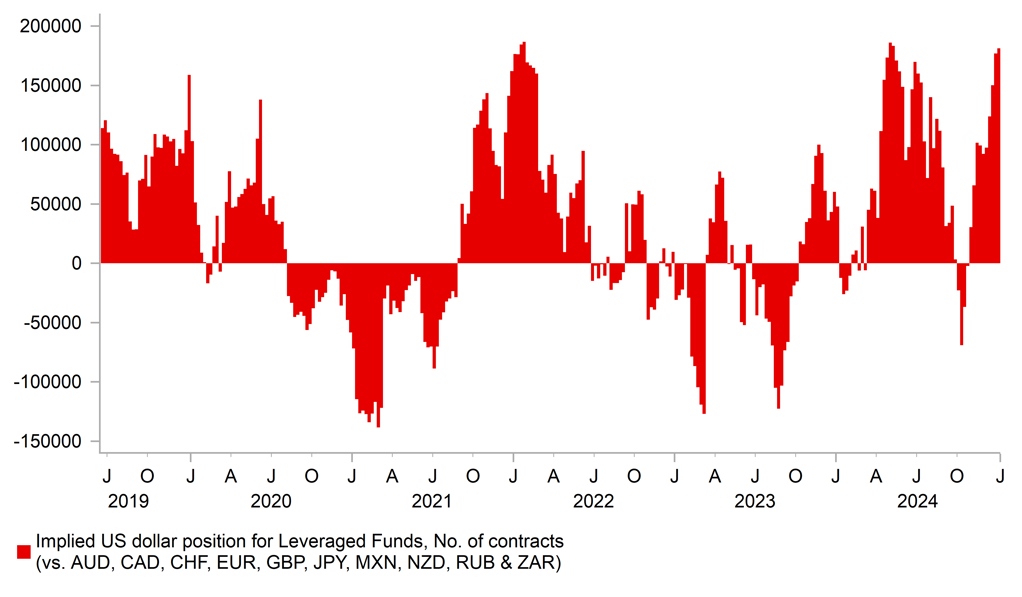

It may also be difficult for the US dollar to advance much further from here ahead of inauguration. Positioning data highlights the scale of speculative long dollar positions that point to the long dollar trade becoming increasingly crowded. We remain dollar bullish but moves could be more contained until we get confirmation of trade tariff announcements on or soon after inauguration day.

LONG USD POSITIONING AMONGST LEVERAGED FUNDS HAS QUICKLY REACHED RECENT EXTREMES

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Data / BoJ views still point to rate hike

The yen rebounded modestly yesterday but remains close to the lows around 160.00 hit last year after market participants lost conviction in December over the BoJ’s appetite to raise rates. But the decision to hike in January by 25bps is still seen as a possible and is only a little less than a 50% probability now. The big issue for the markets increasing conviction at this juncture is that the uncertainty in the markets is high ahead of Trump’s inauguration on 20th January.

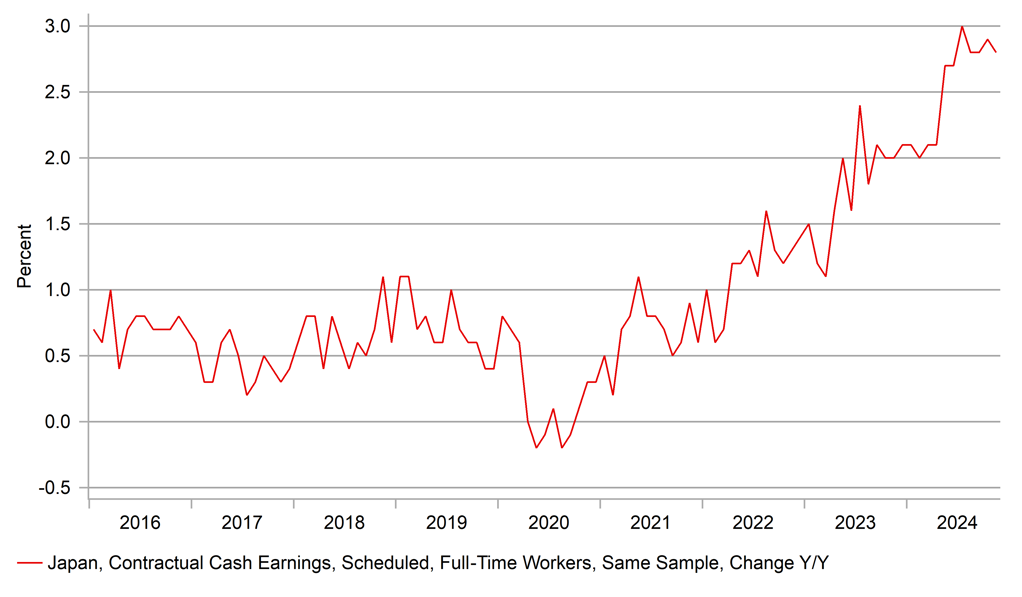

But the wage data released yesterday was certainly consistent with what the BoJ states is required in order to justify another rate hike. Total cash earnings jumped from a downwardly revised 2.2% (vs 2.6%) to 3.0% while under a same sample basis to remove distortions the growth rate picked from 2.8% to 3.5% while scheduled full-time pay under the same sample basis dropped marginally from 2.9% to 2.8%. This is further evidence of the continued stability of wage growth at levels consistent with achieving the price stability goal and hence could be used to justify another rate hike by the BoJ. But the market reaction yesterday, and indeed into to today, has been relatively muted given the simple fact that there has been no rhetoric from BoJ officials to suggests that they wish to guide the market toward a hike on 24th January.

We did also get the release of the quarterly Summary of the Regional Branch Managers’ views which perhaps was more significant than the data as it provides from a more forward looking picture of wage growth. The BoJ report highlighted “the view that continuous wage increases are necessary is spreading across companies in a wide range of sectors and of various sizes”. This will be something that would give the Monetary Policy Committee more confidence on the outlook for wage growth.

So a rate hike on 24th January is still certainly a possibility but our sense is that some form of more direct explicit guidance would likely be forthcoming and without that expectations are unlikely to shift much. It’s feasible that after inauguration but before the meeting some guidance via the media could be the catalyst but that window is small and will be highly uncertain. In that sense March look more plausible given by then there will certainly be more available information on ‘shunto’ wage negotiations than at the meeting this month. USD/JPY is therefore likely to remain well supported in anticipation of yields in the US remaining elevated on higher inflation risks. Of course today’s jobs report could also play into BoJ deliberations given a stronger than expected report could see USD/JPY threaten the 160-level again.

JAPAN CONTRACTUAL CASH EARNINGS; SCHEDULED FULL-TIME WORKERS – SAME SAMPLE YOY RATE

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Retail Sales (MoM) |

Nov |

0.2% |

-0.5% |

! |

|

CH |

09:40 |

M2 Money Stock (YoY) |

Dec |

7.3% |

7.1% |

! |

|

CH |

09:40 |

New Loans |

Dec |

890.0B |

580.0B |

!! |

|

CH |

09:40 |

Outstanding Loan Growth (YoY) |

Dec |

7.6% |

7.7% |

! |

|

CH |

09:40 |

Chinese Total Social Financing |

Dec |

2,000.0B |

2,340.0B |

! |

|

US |

13:30 |

Nonfarm Payrolls |

Dec |

164K |

227K |

!!!!! |

|

US |

13:30 |

Unemployment Rate |

Dec |

4.2% |

4.2% |

!!!!! |

|

US |

13:30 |

Average Hourly Earnings (YoY) |

Dec |

4.0% |

4.0% |

!! |

|

US |

13:30 |

Average Hourly Earnings (MoM) |

Dec |

0.3% |

0.4% |

!!! |

|

US |

13:30 |

Average Weekly Hours |

Dec |

34.3 |

34.3 |

! |

|

US |

13:30 |

Manufacturing Payrolls |

Dec |

5K |

22K |

! |

|

US |

13:30 |

Participation Rate |

Dec |

-- |

62.5% |

!! |

|

US |

13:30 |

Private Nonfarm Payrolls |

Dec |

135K |

194K |

!! |

|

CA |

13:30 |

Employment Change |

Dec |

24.9K |

50.5K |

!!!! |

|

CA |

13:30 |

Avg hrly wages Perm employee |

Dec |

-- |

3.9% |

! |

|

CA |

13:30 |

Building Permits (MoM) |

Nov |

1.3% |

-3.1% |

!! |

|

CA |

13:30 |

Unemployment Rate |

Dec |

6.9% |

6.8% |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Jan |

-- |

2.8% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Jan |

-- |

3.0% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jan |

74.0 |

74.0 |

!! |

Source: Bloomberg