USD remains in holding pattern ahead of US CPI report

NZD: RBNZ signals more confidence in meeting inflation target

The biggest mover in the FX market overnight has been the New Zealand dollar. It has weakened by around -0.6% against both the US dollar and Australian dollars. It has resulted in NZD/USD falling closer to support at the 0.6000-level while AUD/NZD has risen towards the 1.1100-level. The main trigger was the RBNZ’s latest policy update overnight which revealed a softening in their policy guidance. The RBNZ’s updated policy statement noted that their “restrictive monetary policy stance has significantly reduced consumer price inflation, with the Committee now expecting headline inflation to return to within the 1 to 3 percent target range in the second half of this year”. The faster than expected fall in inflation reflects receding domestic price pressures as well as lower inflation for goods and services imported into New Zealand. The easing of domestic inflation pressures has been supported by a softening of labour market conditions. The RBNZ noted that firms have become cautious over hiring while at the same time labour supply has been boosted by strong immigration resulting in looser labour market conditions. The developments are making the RBNZ more confident that that inflation will continue to slow. The RBNZ noted that there are signs inflation persistence will ease in line with the fall in capacity pressures and business pricing intentions. The RBNZ’s tight policy stance is judged to be dampening economic activity including business and consumer investment spending and investment intentions as expected. In light of those developments, the RBNZ has more confidence that their restrictive policy stance is proving effective at slowing growth and inflation. The RBNZ’s forward guidance was adjusted to signal that “the extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures”.

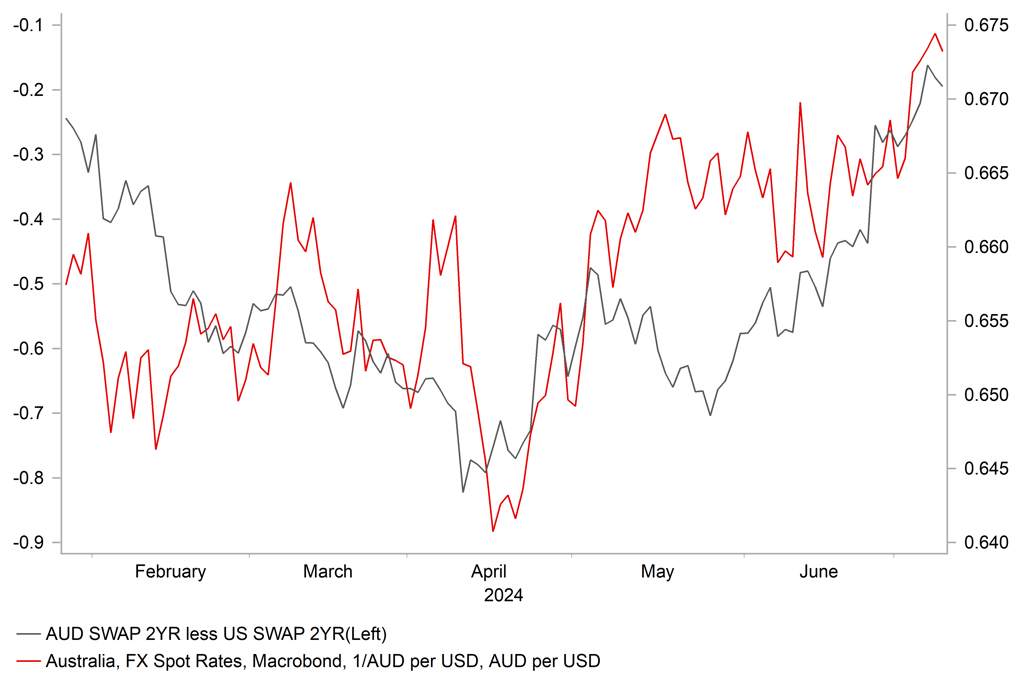

Overall, the updated policy guidance has given market participants more confidence that the RBNZ will begin to lower rates later this year. It stands in contrast to the guidance provided by the RBNZ at their previous policy meeting in May when they pushed out forecasts for the their policy rate to be lowered into the 2H of next year. It suggests that the New Zealand rate market maybe getting a bit ahead of itself in pricing in even earlier and deeper cuts from the RBNZ this year. Nevertheless, today’s dovish policy update is contributing to a further widening of monetary policy expectations between the RBNZ and RBA who are considering whether to hike rates further over the summer. As we highlighted in our latest FX Weekly it continues to pose upside risks for AUD/NZD (click here)

BUILDLING EXPECTATIONS FOR POLICY DIVERGENCE BEWEEN RBA & RBNZ

Source: Macrobond & Bloomberg

USD: All eyes on US CPI report after Chair Powell’s testimony

The main event yesterday was Fed Chair Powell’s semi-annual testimony on monetary policy to the Senate Banking Committee. The testimony has had limited impact on the US dollar and US yields which have risen only modestly. The dollar index has bounced off support at the 105.00-level. Fed Chair Powell delivered a similar policy message to that at the last FOMC meeting in June. It was at the June FOMC meeting when the updated DOT plot revealed that FOMC participants now favour delivering only one rate cut this year.

In yesterday’s testimony, Fed Chair Powell acknowledged that US growth has moderated in the 1H of this year following impressive strength in the 2H of last year. Consumer spending was described as still-solid even though it has slowed recently. The labour market was described as strong but not overheated. On inflation, Chair Powell acknowledged that recently monthly inflation readings have shown modest further progress after a lack of progress in Q1 of this year. However, the Fed is not yet confident enough to begin lowering rates and wants to see “more good data”. He did emphasise though that risks to their inflation outlook have become more balanced. The Fed is more wary now of the risk that keeping rates too high for too long could unduly weaken economic activity and employment. In the Q&A session, Chair Powell stated that the Fed is keeping a close eye on the labour market and they could respond by lowering rates if they see unexpected weakness. Market attention will now turn to the release tomorrow of the US CPI report for June. Another softer print would support our outlook for the Fed to begin cutting rates in September and for a weaker US dollar.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

UK |

14:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Fed Chair Powell Testifies |

-- |

-- |

-- |

!!! |

|

GE |

15:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

UK |

16:30 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

Source: Bloomberg