Sharp USD rebound ahead of this week’s FOMC meeting

USD: Robust NFP report increases risk of hawkish Fed policy update

The US dollar has continued to rebound at the start of this week as it builds onto gains following the release of the robust US employment report on Friday. It has helped to lift the dollar index back above the 105.00-level overnight after it failed to break below the 104.00-level last week. The US dollar rebound was initially driven by a further hawkish repricing of Fed rate cut expectations after the NFP report for May has ruled out a rate cut over the summer, and has cast more doubt on whether the Fed will even have room to cut rates later this year. The US rate market is now pricing in only 2bps of cuts by July and 37bps of cuts by the end of this year. Our call for the first Fed rate cut in September has fallen to around a 50:50 probability. The hawkish repricing of the US rate curve follows the NFP report revealing that the US economy added a robust 272k jobs in May which was a clear step back up after the slowdown to job gains of 165k in the prior month. For this year as a whole the US economy has added 248k jobs/month which is roughly in line with the average for last year of 251k/month. There is little evidence of a slowdown in employment growth so far this year in the establishment survey. At the same time, the NFP report revealed that average hourly earnings growth picked up as well by 0.4%M/M in May after slowing to 0.2%M/M in April. While the upside surprise in May was disappointing it does not alter the gradual softening trend that has been in place. Over the last twelve months to May average hourly earnings have increased on average by 0.3%M/M compared to an average of 0.4%M/M in the prior twelve months.

The strong employment report increases the risk of the Fed providing a more hawkish policy update at this week’s FOMC meeting. We already expect the Fed to signal a delay to plans to begin cutting rates given the lack of progress so far this year for inflation to fall back to their 2.0% target. Ahead of the next FOMC meeting on Wednesday, the latest US CPI report for May will be released creating additional uncertainty over the Fed’s updated policy signal on Wednesday. Another upside inflation surprise could prompt the Fed to scale back plans for rate cuts this year from 3 projected back in March to just one this week. Whereas a second consecutive softer CPI print in May could provide more reassurance that the pick-up in Q1 was just temporary and favour the Fed scaling back rate cut plans to 2 rather than 1. In light of current US rate market pricing, the Fed would have to signal it now plans to deliver just one rate cut this year/or go further and question whether it needs to cut rates at all to trigger a bigger US dollar rally. We are still sticking to our view that the Fed can cut rates more later this year but it will require further evidence of slowing inflation and/or a more marked slowdown in employment growth. We acknowledge though that recent developments have increased the risk that the US dollar will remain stronger for longer, and cut our long EUR/USD trade idea (click here) on Friday.

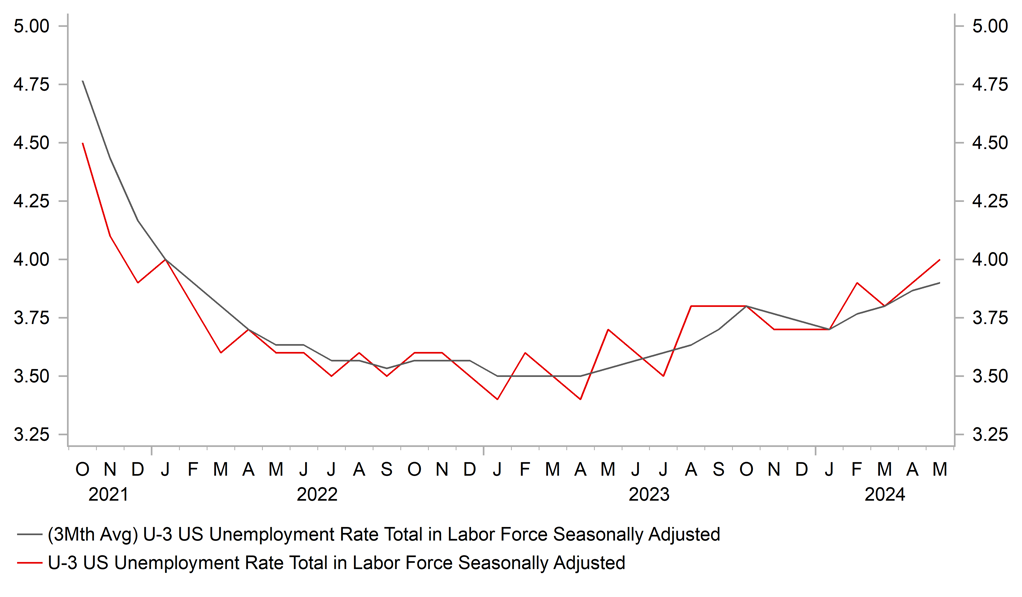

GRADUAL RISE IN UNEMPLOYMENT RATE PROVIDES SOME COMFORT

Source: Macrobond & MUFG GMR

EUR: Heightened political risk in France & EU-China trade dispute in focus

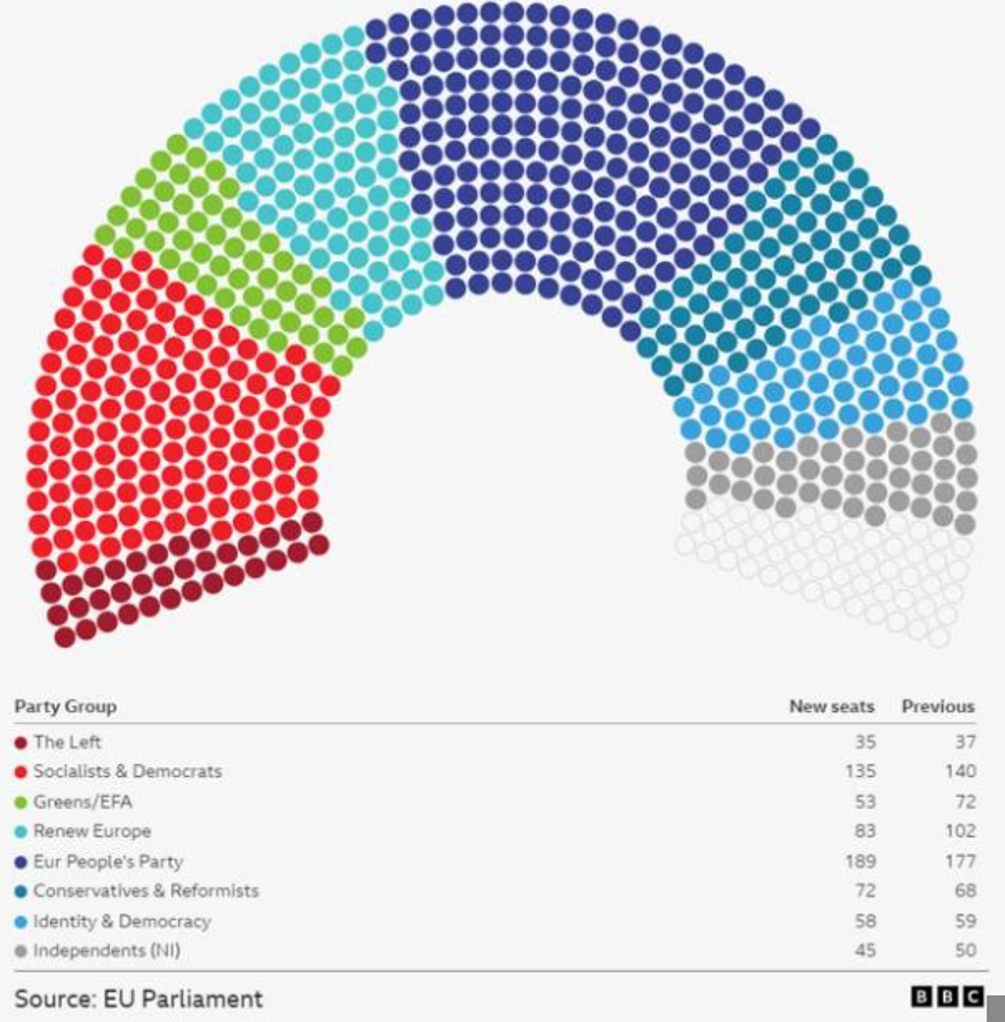

The US dollar’s rebound has also been reinforced at the start of this week by a pick-up in political risk in Europe following the EU elections over the weekend. It has resulted in the euro weakening by around -0.5% against both the US dollar and pound overnight. It follows the surprise announcement from French President Macron to dissolve parliament and call snap elections for later this summer after this weekend’s disappointing EU election results. The snap general election will take place in two rounds on 30th June and 7th July. It could result in President Macron having to work alongside a new far-right prime minister and is viewed as a big gamble. As Bloomberg highlighted while Macron’s position as head of state won’t be directly affected by the upcoming vote, his ability to push through legislation, the power to choose a like-minded prime minister and the credibility of his political project will all be on the line.

The EU election results revealed that the far-right Rassemblement National party won 31.5% of the vote in France compared to only 14.5% for the Besoin d’Europe alliance including President Macron’s Renaissance party. It would appear that President Macron is hoping that support for the far-right parties will not be as strong in the national election and/or is hoping that their popularity would be undermined ahead of the Presidential elections which are expected by April 2027 should they win the general election. According to people familiar with the thinking of Macron’s inner circle, they aren’t worried about Le Pen managing to take control of the legislature because the far-right parties are still expected to fall short of winning a majority with support around 40%. An inability to pass legislation could hurt far-right support ahead of the Presidential elections.

The other potential downside risk for the euro today is the expected announcement from the European Commission over whether to will impose tariffs on EV imports from China. As we highlighted in our latest FX Weekly (click here) the risk of a tit-for-tat trade spat between Europe and China could further hurt investor sentiment towards the euro in the near-term but both developments are unlikely to trigger a break below the bottom of the 1.0500-1.1000 range for EUR/USD.

CENTRE-RIGHT PARTIES WON THE MOST SEATS

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Apr |

0.3% |

-0.5% |

! |

|

EC |

09:30 |

Sentix Investor Confidence |

Jun |

-1.5 |

-3.6 |

! |

|

GE |

10:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

CB Employment Trends Index |

May |

-- |

111.25 |

! |

Source: Bloomberg