BoE inches toward a June rate cut with limited GBP impact

GBP: The MPC shift was modest and not enough to hit GBP

The pound weakened only very modestly versus the euro yesterday and while there was another important step taken toward a first rate cut, it wasn’t enough to shift the dial and lead to a greater sell-off of the pound. We covered the immediate outcome yesterday in an FX Focus piece (here). The 7-2 vote was a small but possibly important step to a turn in the policy cycle. Dave Ramsden is Deputy Governor, so a senior MPC member, and he has form in signalling a turn in the policy cycle. In November 2021 he joined Michael Saunders and for the first time voted to hike. The following month the MPC hiked for the first time. Our sense now with Bailey appearing sympathetic to a cut, is that Huw Pill, Ben Broadbent and Sarah Breeden will be the three key members in determining when a shift to cutting will take place.

Most of the key guidance comments from Bailey and Broadbent in the press conference and again from Bailey in a Bloomberg TV interview after the press conference were clear in signalling rate cuts are coming. Mostly notable was Bailey’s Comment that the monetary stance would “likely” need to be made less restrictive and “possibly more so than currently priced into market rates”. That comment really couldn’t be much clearer in signalling where the bias is shifting within the MPC and in our view strengthens the prospect of a June cut. The market pricing ahead of the meeting was for just over two rate cuts so this comment indicates a reasonable belief of at least three rate cuts by the MPC – given there are five meetings including the June meeting, cutting by more than twice is very plausible. The inflation forecast at the end of the forecast profile of 1.6% has essentially allowed the BoE to indicate that there is scope to cut if the economy evolves as the MPC expects.

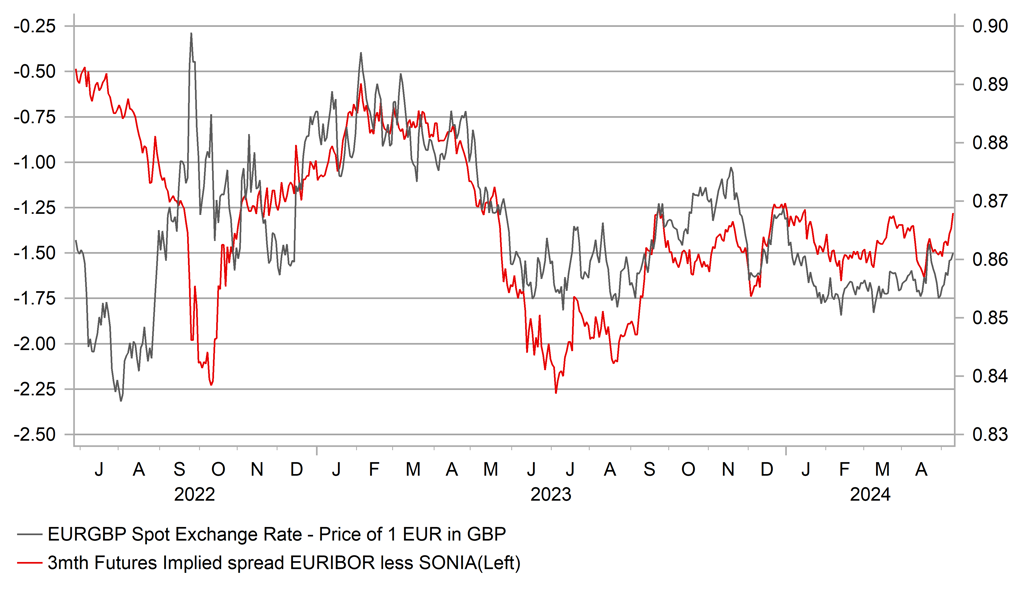

The rates and FX impact has been quite muted. The OIS has added about 5bps of cuts by year-end with about 60bps of cuts now priced, compared to 72bps from the ECB and 45bps by the Fed. The data will determine how these expectations evolve but we certainly maintain our view of the BoE cutting three times this year, the same as the ECB and the Fed, which implies the biggest potential for rates to drop from current levels being in the US then followed by the UK.

From a pure rates angle this argues for the potential of a move higher in EUR/GBP, a trade view we published in our FX Weekly last week (here). But there was a lack of conviction evident in market pricing given the MPC caution in moving toward a rate cut. That will be more the case now this morning after the UK GDP data came in a lot stronger than expected. The Q/Q gain of 0.6% was well above consensus with March alone gaining 0.4% m/m. The data underlines the benefit of declining inflation but from a BoE policy perspective we would still argue inflation and wage data will be more important in determining whether the BoE cuts in June or not. It’s worth noting a lot of the strength in Q/Q GDP growth is in the net trade component.

3MTH FUTURES IMPLIED SPREAD EURO OVER UK & EUR/GBP

Source: Macrobond, Bloomberg & MUFG Research

USD: Biden to impose tariffs on China

Bloomberg is reporting that the Biden administration is set to announce a plan for increases in tariffs on China following a review of Section-301 tariffs that were first imposed on China by President Trump. Section-301 allows for tariffs if the US Treasury concludes that there has been a “trade agreement violation or that an act, policy, or practice of a foreign government is unjustifiable and burdens or restricts US commerce.” Trump first implemented tariffs under Section-301 in 2018 before adding to them and President Biden has left those tariffs largely intact and are estimated to total approximately USD 300bn. Most of these tariffs were up for a review and it is this review that is expected to result in these previous tariffs remaining in place and then added to with additional products hit with tariffs.

The additional tariffs are reported by Bloomberg to include electric vehicles, batteries and solar cells. An announcement is scheduled for next Tuesday. Trade tensions are clearly set to escalate with the US and Europe concerned over China’s strategy of ramping up manufacturing activity in order to offset the weakness in domestic demand conditions due to the collapse of the real estate sector.

Trade data does back that up when viewed in terms of China’s trade balance. China’s trade surplus has surged in the post-covid period and last April reached a record USD 909bn on a 12mth basis. It has declined since and this week’s data saw the 12mth surplus decline to USD 813bn. Still, just five years ago, prior to covid, China’s 12mth surplus stood at just USD 367bn. However, some of this development is certainly down to weaker import demand and not just increased exports abroad.

Escalating trade tensions and further increases in tariffs are going to put upward pressure on USD/CNY. The higher for longer US theme is already doing this and these upside risks for USD/CNY will certainly intensify. For now given these large surpluses and renewed foreign investor buying of China debt, there is still reason to believe that China can manage CNY in an orderly way, avoiding any need for USD/CNY moving notably higher. Our view of a broader weakening of the dollar will also help limit a negative CNY fallout versus USD from additional tariffs.

FOREIGN INFLOWS TO CHINA’S BOND MARKETS HAVE RETURNED

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (YoY) |

Mar |

-- |

-3.1% |

! |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Mar |

0.3% |

0.1% |

! |

|

EC |

09:45 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

UK |

12:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!! |

|

EC |

12:30 |

ECB Account of Mon Policy Meeting |

-- |

-- |

-- |

!! |

|

UK |

12:45 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

!! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

-- |

-- |

0.4% |

! |

|

CA |

13:30 |

Avg hourly wages Permanent employee |

-- |

-- |

5.0% |

!! |

|

CA |

13:30 |

Employment Change |

Apr |

20.9K |

-2.2K |

!!! |

|

CA |

13:30 |

Participation Rate |

Apr |

-- |

65.3% |

! |

|

CA |

13:30 |

Unemployment Rate |

Apr |

6.2% |

6.1% |

!! |

|

US |

14:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

May |

-- |

3.2% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

May |

-- |

3.0% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

May |

-- |

76.0 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

May |

76.0 |

77.2 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

May |

-- |

79.0 |

! |

|

US |

17:45 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

18:30 |

Fed V Chair Supervision Barr Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg