CPI print could be a game-changer for the dollar over the coming months

USD: Gains ahead with a June cut unlikely

We stated here yesterday that the US dollar could see some catch-up buying on a CPI print north of 0.3%, especially if there was some evidence of broad-based gains beyond rents. The MoM core CPI increase of 0.4% did certainly contain some evidence of broader price pressures beyond rents and that was the key catalyst for the jump in US yields and the dollar. The dollar was already lagging behind the rates move of late and a further 23bps jump yesterday understandably led to a bigger FX move – the 1.1% gain in DXY yesterday was the largest one-day jump since March last year.

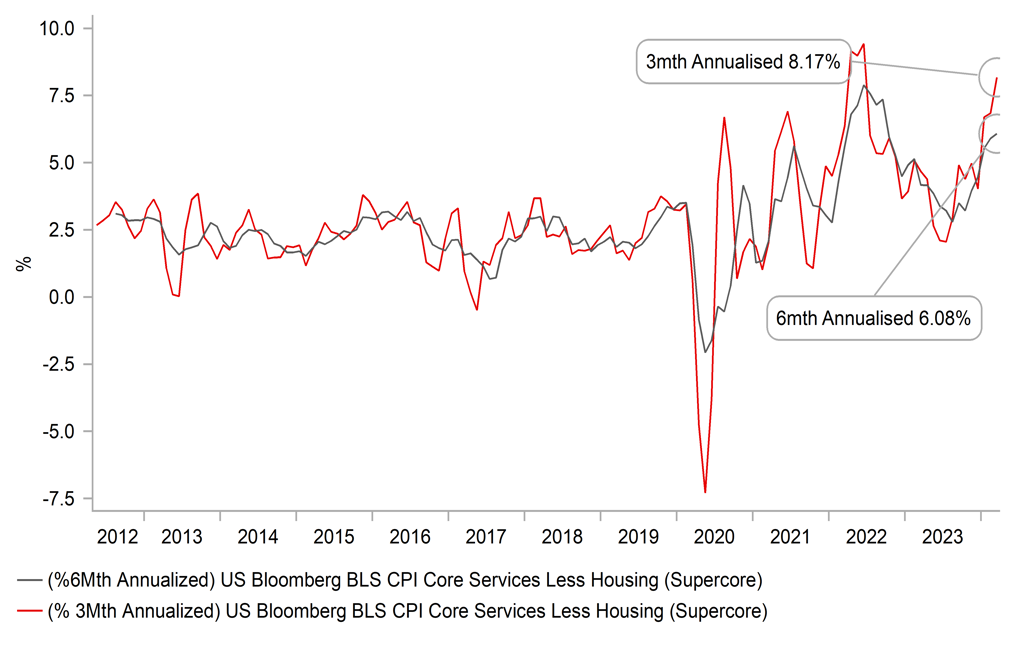

Of the 0.378% increase in headline CPI yesterday, 0.32ppt of that increase came from core services. Within core services, shelter accounted for nearly half (47%) of the MoM increase in core services underlining the fact that the stickiness of underlying inflation in the US is still predominantly a rents issue. A vast bulk of what explained the rest of the increase in core services came from transportation and medical care services. As a result of this core services inflation increase, the supercore measure of CPI increased by 0.65% and leaves the Fed in a bind given the emphasis put on this measure as a gauge for measuring progress in dampening underlying inflation pressures. That progress has certainly come to a halt and while there was evidence of broader inflation pressures yesterday, the primary culprit remains rents. The puzzle of this unusually long lag between CPI rents and actual rents continues but while this lag is unusually long there is no reason to believe CPI rents will not decline to align with actual rents.

But now is certainly not the time to bang that drum! The broader increases in other areas like transportation services (insurance and repairs); and medical services (hospital charges) mean the evidence of increased inflationary pressures will likely force some rethink at the Fed. The 3mth annualised supercore inflation rate is now at 8.17% while the 6mth measure is at 6.08% - way too high for an underlying measure the Fed has been highlighting as key.

It seems reasonable to us now after three upside inflation surprises that the Fed probably won’t have the confidence required after one good inflation print and if two are required now after yesterday’s data, then that means the May and June data would be required. The June data (for May) is released on the same day as the FOMC meeting (12th) so we shouldn’t rule out completely the prospect of a June cut, especially if two weaker CPI reports were accompanied by a clearer slowdown in jobs growth. But a June rate cut by the FOMC now seems very unlikely.

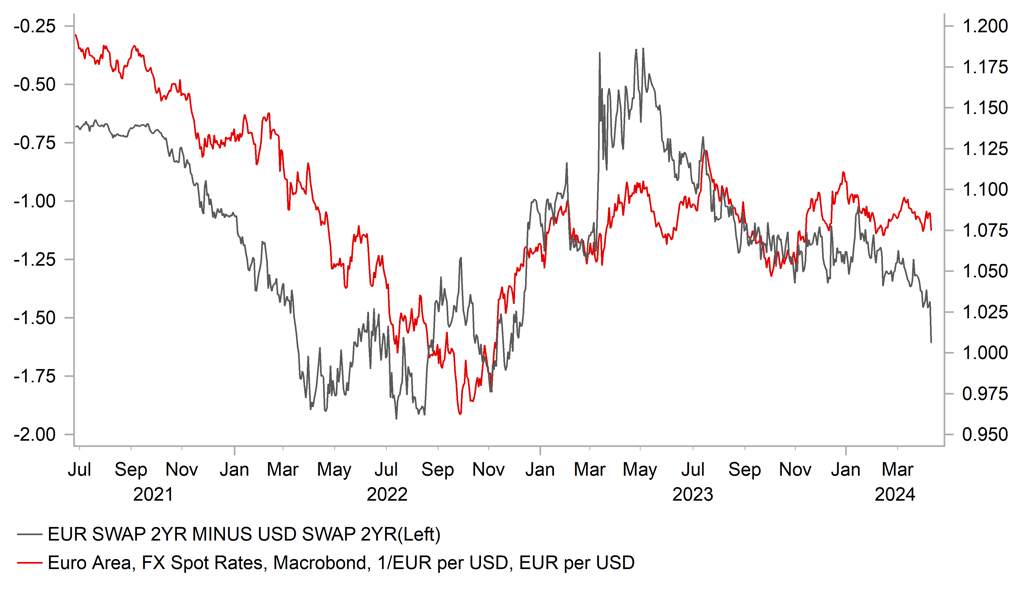

Our end-Q2 EUR/USD indicated some very moderate USD depreciation (1.0900) with a view of USD depreciation more likely in H2. If the Fed is now not going to cut in June and we get a cut from the ECB (let’s see what Lagarde says today; see below) then 1.0900 looks too high. Certainly over the very short-term (next few weeks into NFP in May), a window looks to have opened for further US dollar strength. The short-term yield jump in the US now implies EUR/USD at levels below 1.0500.

US SUPERCORE CPI – 3MTH & 6MTH ANNUALISED CHANGE

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Lagarde to signal June cut

We have covered today’s ECB meeting in earlier publications but to repeat we see good grounds for the ECB today communicating a clearer message on the increasing prospects of a rate cut at the meeting in June. One obvious way to signal that would be top drop the reference in the guidance in the statement today of the policy rate being maintained for “a sufficiently long duration” in order to achieve the price stability goal. Some changes in that regard would be a signal of a shift in thinking on the length of time keeping the policy rate at 4.00%. If the statement released today maintains that reference it will disappoint expectations of a clearer shift in rhetoric to signal a rate cut in June.

The drop in EUR/USD following the US CPI data yesterday likely means FX and the potential inflation risks from that could get more attention in the deliberations on the guidance to give on a possible rate cut in June and it certainly makes it much more likely that if the ECB does signal a June rate cut is coming that it will be accompanied by a message that decisions will be meeting-by-meeting and that the ECB will not be on auto-pilot in cutting rates going forward. Still, assuming a statement tweak and a clearer guidance on a possible June rate cut, we see scope for EUR/USD to extend further lower today toward the 1.0500 level.

EUR/USD DOWNSIDE RISKS COULD BE REINFORCED BY ECB IF JUNE CUT IS SIGNALLED

Source: Macrobond & Bloomberg

JPY: Intervention-watch

One obvious implication of the strong CPI is the jump in USD/JPY through the 152.00-level. That has triggered the usual comments from Tokyo with both Vice Finance Minister Kanda and Finance Minister Suzuki both warning against excessive FX moves and that recent moves “have been rapid”. Kanda stated that FX moves “since the beginning of the year are significant” – this could be the period used to justify excessive moves rather than recent moves given until yesterday, USD/JPY had been consolidating since around 20th March. The comment shows that in reality the authorities can move the goalposts to suit their objective. Ultimately if they want to act they can orchestrate the justification under G20 given the extreme level. These warnings from Tokyo will quickly start to sound hollow and hence for credibility purposes alone we maintain that intervention looks imminent. It may require one further sharp jump toward 155.00 to justify it more clearly given the fact that the moves to date certainly are more modest than in 2022 when intervention took place.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

BOE Credit Conditions Survey |

-- |

-- |

-- |

!! |

|

US |

12:00 |

OPEC Monthly Report |

-- |

-- |

-- |

! |

|

EC |

13:15 |

Deposit Facility Rate |

Apr |

4.00% |

4.00% |

!!!! |

|

EC |

13:15 |

ECB Interest Rate Decision |

Apr |

4.50% |

4.50% |

!!! |

|

US |

13:30 |

PPI ex. Food/Energy/Transport (MoM) |

Mar |

-- |

0.4% |

!! |

|

US |

13:30 |

PPI ex. Food/Energy/Transport (YoY) |

Mar |

-- |

2.8% |

!! |

|

US |

13:30 |

Core PPI (MoM) |

Mar |

0.2% |

0.3% |

!! |

|

US |

13:30 |

Core PPI (YoY) |

Mar |

2.3% |

2.0% |

! |

|

US |

13:30 |

PPI (MoM) |

Mar |

0.3% |

0.6% |

!!! |

|

US |

13:30 |

PPI (YoY) |

Mar |

2.2% |

1.6% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

216K |

221K |

!! |

|

US |

13:45 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!!!! |

|

US |

15:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!!! |

|

US |

17:00 |

Fed Collins Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

30-Year Bond Auction |

-- |

-- |

4.331% |

!! |

|

US |

18:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg