US dollar and UST bond selling adds to investor uncertainties

USD: Triple selling highlights damage done

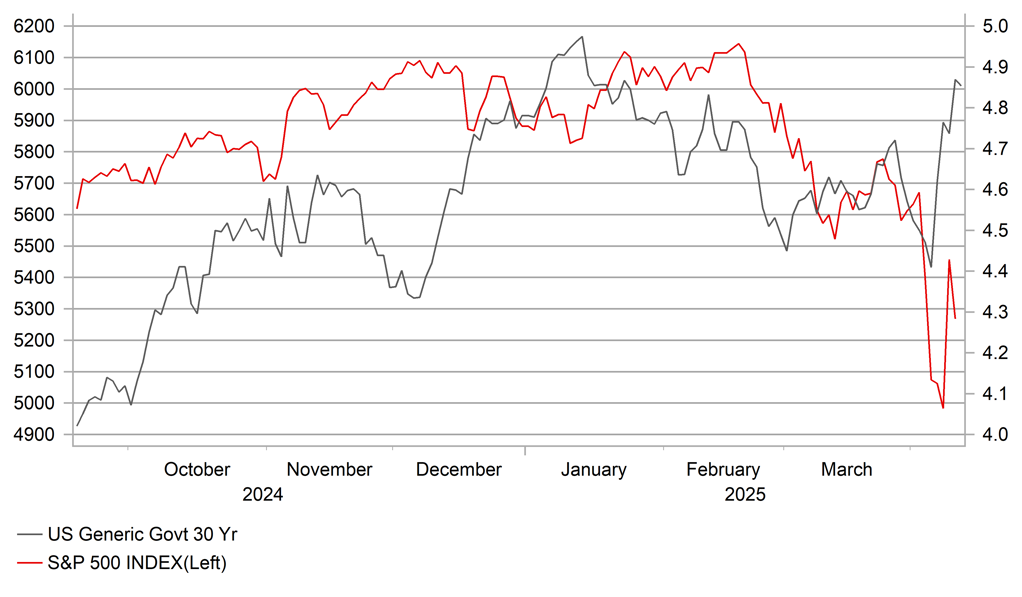

Investor sentiment remains very fragile but after further selling of US equities yesterday, sentiment appears to have partially stabilised with Asian equity market performance mixed – Japan equities are lower but China stocks and the Hang Seng higher. This could be simply a reflection of the Chinese authorities buying rather than private investors. Still, the S&P 500 and Euro Stoxx equity futures are also up. But of greatest alarm for investors is the continued evidence of a more serious deterioration in investor confidence in holding US Treasury bonds. The 30-year UST bond yield jumped 13bps yesterday as the S&P 500 recorded a 3.5% decline. The 30-year yield has now jumped 46bps this week and the yield at 4.87% is back at a level that last traded on 23rd January when the S&P 500 closed at a then record high, some 16% higher than where the S&P 500 closed last night. The long-end of the bond market is clearly suffering and if investors increasingly question the reliability of the usually most reliable safe-haven asset it will further reinforce investor uncertainty and increased financial market volatility. This seems more likely than not over the near-term.

A lack of faith in UST bonds will certainly be to the benefit of currencies that offers some degree of alternative. Japan and the euro-zone offers the next best prospect in terms of fixed income markets, in terms of size. Since Trump’s reciprocal tariff announcement it is only the Swiss franc, the yen and the euro that have outperformed the US dollar. The 10-year UST bond spread over German Bunds has widened 43bps this week while the spread over JGBs has widened by 40bps highlighting the outperformance of these key bond markets relative to the UST bond market. The fact that the US equity markets and the dollar are weaker indicates this is an investor confidence issue rather than a positive growth divergence development.

There are a host of factors to threaten confidence in UST bonds. Inflation expectations are proving stickier with front-end breakevens remaining elevated. The 2-year breakeven is trading at 3.11%, down from 3.37% earlier in April. Since mid-Feb, the 2-year UST bond yield is 53bps lower while the 2-year breakeven rate is just 7bps lower. This plunge in real yields is a big negative for the dollar. The long basis trade could also be undermining UST bond performance while the fiscal outlook remains dire. Yesterday, the House passed a budget (216-214) that adds over USD 5trn to the US debt pile and while the details differ from the Senate version and hence further negotiations will be required, we are heading for further tests of investor confidence in the UST bond market given apparent congressional indifference to the fiscal outlook.

In this environment it is hard to see any near-term revival in US dollar confidence. Fears that China and other countries could lighten up on their UST bond holdings could reinforce the type of price action we saw yesterday given Trump’s economic policy will remain unpredictable. It points to the prospects of core G10 FX continuing to outperform versus the dollar for investors. EUR/USD today has broken above the closing highs from 2024 and 2023 and back to levels last seen when Russia launched its invasion of Ukraine in February 2022.

UST 30-YEAR YIELD HAS SURGED WHILE US EQUITIES UNDERPERFORM HIGHLIGHTING DIMINISHING INVESTOR CONFIDENCE IN US ASSETS

Source: Bloomberg, Macrobond & MUFG GMR

USD: Lower inflation but Fed cut in June still unclear

The sell-off of the US dollar may have been helped by the weaker than expected US inflation data for March that will help ease concerns somewhat as the economy enters the phase of a notable pick-up in inflation due to the tariff increases about to kick in. The headline m/m drop (-0.1%) was the largest since the onset of covid in 2020. Core CPI was also weaker (0.1%) with transportation, medical care and recreation goods all reporting m/m declines. Services inflation was also weaker with shelter inflation slowing to 0.2%, although much of that was due to hotel prices falling while OER actually saw a slight pick-up from 0.3% to 0.4%.

Going forward we will have two further CPI reports before the FOMC meets for the key meeting on 18th June. There is little priced for a cut at the meeting on 7th May but by the June meeting the market is fully priced for a 25bp cut.

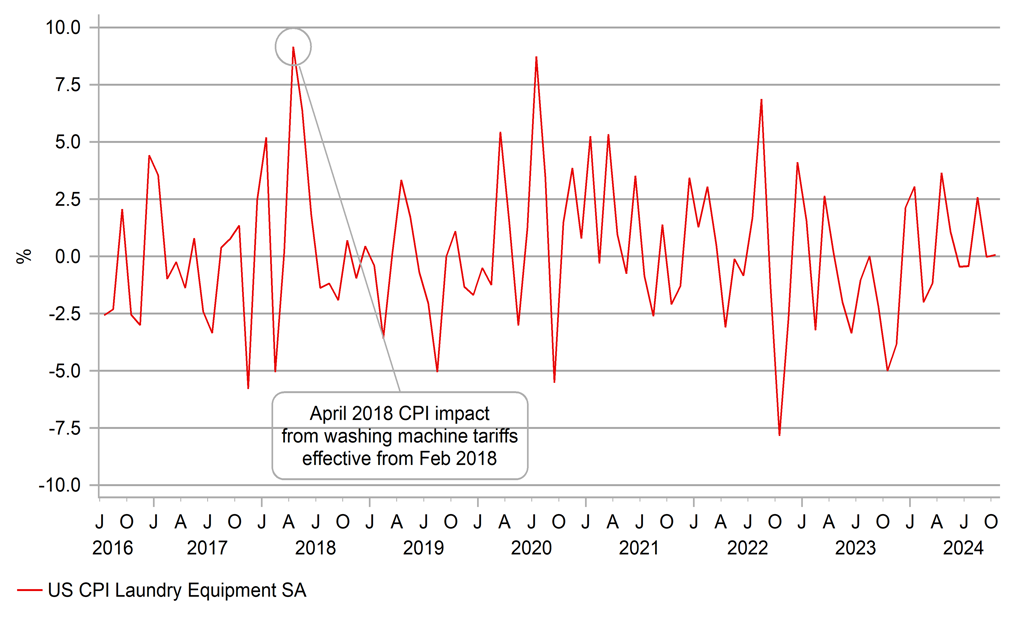

Does that make sense? Of course following the 90-day suspension of the reciprocal tariff rates above 10% the prospect of a cut in June is better. But the inflation impact is still set to be considerable. Bloomberg calculated only a modest lowering of the average tariff rate from 27% to 24% after the suspension. The key question to determine the near-term inflation impact is how quickly will the new tariff rates be seen in the data? Previously we have highlighted the impact of the 2018 tariff on washing machines on CPI which may give us some indication of how quickly the tariffs now will be seen in the CPI data. On 23rd January 2018, the Trump administration announced a tariff of 20% but up to 50% on washing machines, effective from February. In the February 2018 CPI report, CPI laundry equipment fell 5.1% m/m; gained 0.2% in March and then surged 9.2% in April and 6.4% in May and 1.8% in June before then falling in the three months that followed. This could imply an impact visual in the data as late as June, not released until July.

However, that was just one product and on this occasion the scale is far broader and domestic producers will likely be more confident about raising prices themselves so there is certainly a risk of a faster feed-through. We’d expect the Fed to have some indications in the hard data and no doubt will have anecdotal information as well. We certainly see a greater risk of the Fed not cutting in June the market implied pricing but of course the damage done in the last week could hit the hard data to a scale that keeps rate cut pricing more elevated than it should be for longer. That degree of uncertainty over pricing at the front-end of the US yield curve likely helps explain CHF outperforming JPY as the safe-haven G10 currency of choice. A jump in US front-end yields could see JPY gains retrace somewhat.

WASHING MACHINE TARIFF IN 2018 IMPACTED DATA 2MTHS LATER

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:45 |

Lagarde Eurogroup press conf |

!! |

|||

|

US |

13:00 |

Fed' Kashkari speaks on CNBC |

!! |

|||

|

US |

13:30 |

PPI Final Demand MoM |

Mar |

0.2% |

0.0% |

!! |

|

US |

13:30 |

PPI Ex Food and Energy MoM |

Mar |

0.3% |

-0.1% |

!!! |

|

US |

13:30 |

PPI Ex Food, Energy, Trade MoM |

Mar |

0.3% |

0.2% |

!!! |

|

US |

13:30 |

PPI Final Demand YoY |

Mar |

3.3% |

3.2% |

!! |

|

US |

13:30 |

PPI Ex Food and Energy YoY |

Mar |

3.6% |

3.4% |

!! |

|

US |

13:30 |

PPI Ex Food, Energy, Trade YoY |

Mar |

3.3% |

3.3% |

!! |

|

US |

15:00 |

U. of Mich. Sentiment |

Apr P |

53.5 |

57 |

!!! |

|

US |

15:00 |

U. of Mich. Current Conditions |

Apr P |

60.8 |

63.8 |

!! |

|

US |

15:00 |

U. of Mich. Expectations |

Apr P |

50.7 |

52.6 |

!! |

|

US |

15:00 |

U. of Mich. 1 Yr Inflation |

Apr P |

5.20% |

5.00% |

!!! |

|

US |

15:00 |

U. of Mich. 5-10 Yr Inflation |

Apr P |

4.30% |

4.10% |

!!!! |

|

US |

15:00 |

Fed's Musalem speaks |

!! |

|||

|

US |

16:00 |

Fed's Williams speaks |

!!!! |

Source: Bloomberg