Stronger NFP report provides support for USD ahead of FOMC meeting

USD: All eyes on FOMC meeting after stronger NFP report

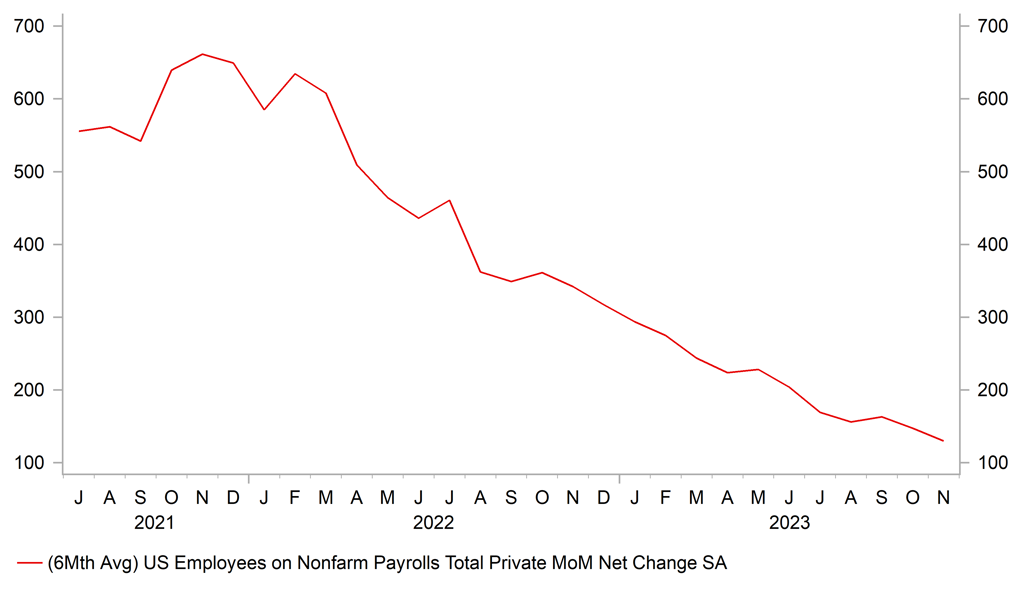

The US dollar has continued to trade at stronger levels overnight as it has extended its advance following the release of the stronger than expected US payrolls report on Friday. It has resulted in USD/JPY rising back above the 146.00-level overnight as it moves further above the low from last week of 141.70 recorded on 7th December. The rebound for USD/JPY in particular has been supported by the pick-up in US yields. The 2-year US Treasury bond yield has increased by 16bps from the intra-day low on Friday and the 10-year US Treasury bond yield by around 10bps. The stronger than expected US payrolls report has encouraged market participants to scale back expectations for Fed rate cuts in 2024. The implied yield on the December 2024 Fed fund futures contract has similarly increased by 17bps since the closing price on Thursday, and is currently pricing in around 108bps of rate cuts by the end of next year. However, the report has not significantly altered expectations over the timing of the first Fed rate cut which is still fully priced in (26bps) by the 1st May FOMC meeting.

The main upside surprise was provided by the household survey which revealed that employment bounced back strongly by 747k in November following a decline of -348k in October. The increase in household employment was bigger than the increase in the labour force which also increased strongly by 532k resulting in the number of unemployed falling by -215k and the unemployment rate by 0.2ppt to 3.7%. The unemployment rate has been moving gradually higher this year on the back of stronger labour supply growth which has helped to ease upward pressure on wages, and given the Fed more confidence that demand and supply in the labour market are becoming better balanced. In that context the November NFP report was a small setback for the Fed and will make it even more unlikely that the they will fully endorse the current scale of rate cut expectations priced into the US rate market when they meet this week.

For comparison at the September FOMC meeting, the median projection amongst FOMC participants was for 50bps of rate cuts next year with the policy rate expected to peak at a higher rate of 5.6% at the end of this year before falling to 5.1% in 2024. The breakdown did reveal though that nine out of nineteen FOMC members expected the policy rate to end next year at 4.875% or lower. In light of the recent improvement in US inflation there is still a good chance that the median projection for the end of next year could be lowered to signal 50bps of cuts next year or even 75bps. The release tomorrow of the latest US CPI report for November could prove important in determining whether the Fed will signal there is room for more rate cuts next year. Further evidence of slowing core and services inflation will be required. Overall, the developments are expected to continue providing more support for the US dollar in the near-term and have made it harder for the US rate market to price in even more aggressive rate cut expectations for now.

The yen has also given back more of last week’s gains in the early European trading session following the release of a report from Bloomberg stating that the BoJ sees little need to end negative rates in December as they have yet to see enough evidence of wage growth that would support sustainable inflation according to people familiar with the matter. The report is clearly intended to dampen speculation over an imminent end to negative rates in Japan that intensified last week following comments from Governor Ueda and Deputy Governor Himino. The report is consistent with the view of our analysts in Tokyo that the first rate hike is more likely to be delivered in January.

EMPLOYMENT GROWTH IN ESTABLISHMENT SURVEY IS STILL SLOWING

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB’s justification for maintaining restrictive rates is quickly diminishing

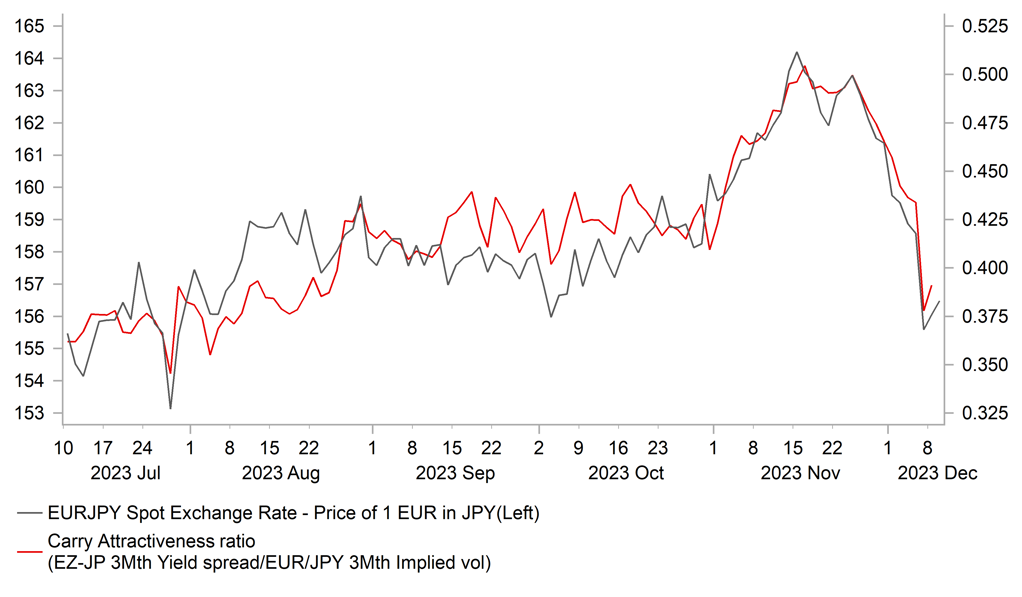

The EUR has weakened sharply since the end of last month driven primarily by the recent dovish repricing of ECB policy expectations. After EUR/USD peaked at 1.1017 on 29th November, the EUR has since been one of the three worst performing G10 currencies as it has declined by around -1.9% against the USD, -0.7% against the GBP, and -3.1% against the JPY. It has resulted in EUR/USD falling back into the middle of this year’s trading range between 1.05000 and 1.1000. While EUR/JPY has fallen back sharply towards support from the 200-day moving average at the 154.00-level. EUR/GBP has also fallen back below the 0.8600-level and moved closer to year to date lows at around the 0.8500-level.

The main catalyst for the recent sharp weakening of the EUR was the release of the latest euro-zone CPI report that revealed headline inflation falling back closer to the ECB’s target in November (at 2.4% down from 10.0% a year ago). It was even more encouraging that the annual rates of core and services inflation both fell sharply by 0.6 percentage points as well helping to ease concerns over the risk of more persistent inflation in the euro-zone. The faster than expected slowdown in inflation has caught ECB policymakers by surprise. It even prompted the normally hawkish ECB Executive Board member Isabel Schnabel to describe developments as “quite remarkable”. The stage is now set for the ECB to revise down their forecasts for inflation at this week’s policy meeting. Headline and core inflation forecasts for 2024 are both expected to be lowered by around 0.3ppts to 2.9% and 2.6% respectively. More importantly for market participants, the forecasts for 2025 and beyond could now show inflation returning to the ECB’s target at around 2.0%. It would provide justification for the ECB to officially end their hiking cycle, and provide further encouragement to market participants that the ECB will begin to reverse course next year.

The euro-zone rate market has already moved along way recently to price in both earlier and deeper ECB rate cuts for next year. Market participants are currently attaching around a 2-in-3 probability to the first rate cut being delivered as early as the March policy meeting, and for a total of around 134bps of cuts by the end of next year. If delivered it would help to bring the ECB’s policy rate closer to estimates of the neutral rate between 1.50% and 2.00%. It will become harder for the ECB to justify maintaining restrictive policy if inflation falls back to target and the euro-zone economy continues to stagnate next year. So while the ECB may attempt to push back this week against current market pricing it will be difficult to discourage expectations for earlier and deeper cuts if the economic data flow is moving in that direction.

In these circumstances, we expect the EUR to continue trading on a softer footing in the near-term. We expect EUR weakness to be more pronounced against the JPY (click here) resulting in EUR/JPY falling back below 150.00-level by early next year. We have recommended a new short EUR/JPY trade idea in our latest FX Weekly report (click here).

BOJ-ECB POLICY DIVERGENCE IS EXPECTED TO NARROW IN 2024

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

11:00 |

Leading Index (MoM) |

Nov |

-- |

-0.01% |

! |

|

US |

15:00 |

CB Employment Trends Index |

Nov |

-- |

114.16 |

! |

|

US |

16:00 |

Consumer Inflation Expectations |

-- |

-- |

3.60% |

! |

|

AU |

22:20 |

RBA Gov Bullock Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg