US CPI in focus with US dollar elevated near highs

USD: An upside surprise would have a bigger impact

The Trump impact on incoming economic data was clear to see yesterday with the NFIB Small Business Optimism index surging from 93.7 in October to 101.7 in November, the highest level since June 2021 with the MoM increase the largest since July 1980, and easily surpassing the increase in November 2016 in response to Donald Trump’s first election victory. Of course it is much too soon to expect any impact from Trump’s win on the inflation data today for November although the US Treasury bond market response does indicate where the risks lie in terms of the inflation impact going forward. For today though, the CPI data is set to show continued stickiness in getting underlying inflation moving back toward the 2.0% goal. Another 0.3% MoM gain is expected in core CPI which would leave the YoY rate unchanged at 3.3%. Last month saw the OER come in on the strong side at 0.4% MoM although that level of increase still confirms a slowing pace relative to the 12mth average in 2023 of 0.51% and the 2022 average of 0.61%. The current 12mth average is 0.42%. So disinflation is evident but the pace of slowdown remains very slow. A consensus print today will help reinforce the prospect of a rate cut by the FOMC next week and even a modest upside surprise due to volatile components like airfares will likely not be enough to derail a cut. However, a more broad-based and larger upside surprise across a number of categories would have the potential to fuel a bigger rates and FX move. The OIS and fed funds futures markets are priced at about 21bps of cuts so a weaker than expected print will have far less an impact than a much stronger gain that would put greater doubt on a move next week.

A cut still seems very likely in our view but a CPI report with elements of strength could certainly influence the guidance for 2025 from the FOMC next week. The dots profile from September indicates 100bps of cuts in 2025 which with a 25bp cut delivered next week is more cuts than what is currently priced. Another 75bps of cuts is what today’s futures market is implying. The FOMC looks likely to drop one of the cuts signalled for next year and a strong report today would probably encourage more FOMC members to signal just two cuts next year.

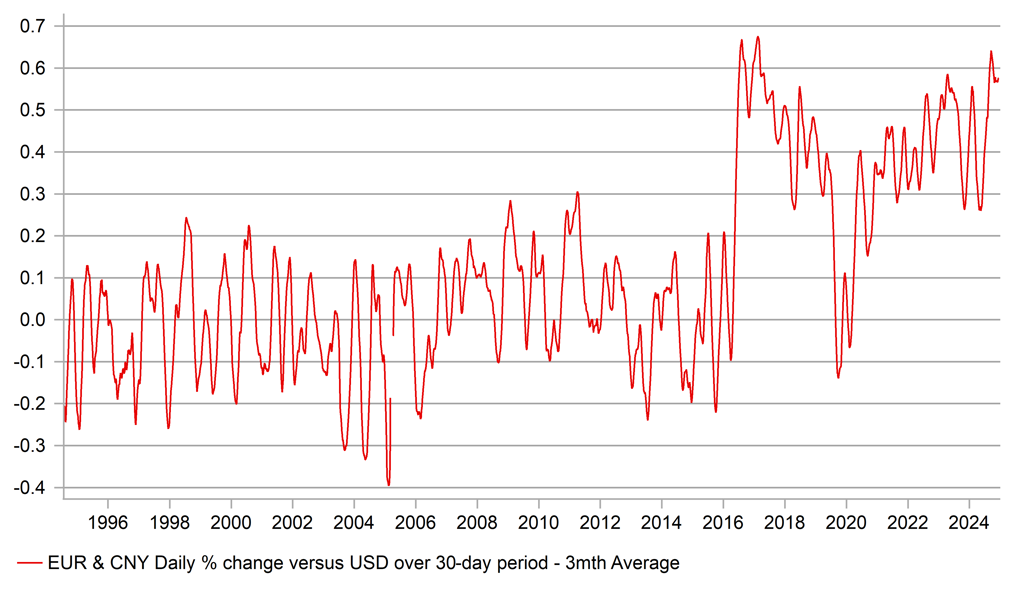

The bias for the US dollar remains to the upside. This bias has been helped further today by a Reuters report out of China that the authorities are considering allowing USD/CNY to move higher next year in order to counter the impact of the tariffs expected by President-elect Trump. Of course this isn’t hugely surprising and would merely be a reflection of the fundamentals, even beyond the assumption of tariff increases. Monetary policy is set to be loosened further and the economy needs as much support as possible and a weaker currency would also help to fight the build-up of mild deflationary pressures. USD/CNY correlates more notably with other G10 currencies following the change in FX regime in 2015 and a move higher in USD/CNY is certainly consistent with further US dollar gains in the G10 space as well.

EUR & CNY CORRELATION VS USD NOT FAR FROM RECORD STRENGTH

Source: Bloomberg, Macrobond & MUFG GMR

CAD: BoC set to go big again and cut 50bps

USD/CAD has been broadly stable so far this week following the spike higher on Friday in response to the Canada jobs data. The data had positive aspects with employment up a solid 50.5k in November, double the consensus. However, expectations of another large 50bp cut from the BoC today reflects the notable jump in the unemployment rate from 6.5% to a new cyclical high of 6.8%. If you exclude the covid-period, the unemployment rate is now at the highest level since January 2017. The jump in the unemployment rate underlined the increased labour supply that is helping to dampen upside wage inflation risks. The post-covid jump in net immigration is unlikely to last but will ensure risks over the coming 12-24mths to inflation via wage growth remain more modest. The hourly wage rate for permanent employees on an annual basis slowed from 4.9% to 3.9% in November – well below the market consensus of 4.7%.

This gives the BoC the opportunity to counter some emerging risks of the economy underperforming expectations. Wage inflation risks are lower and GDP growth slowed to just 1.0% on a Q/Q SAAR basis. Business investment fell nearly 30% on an annualised basis in Q3 and private sector hiring is weakening relative to the public sector.

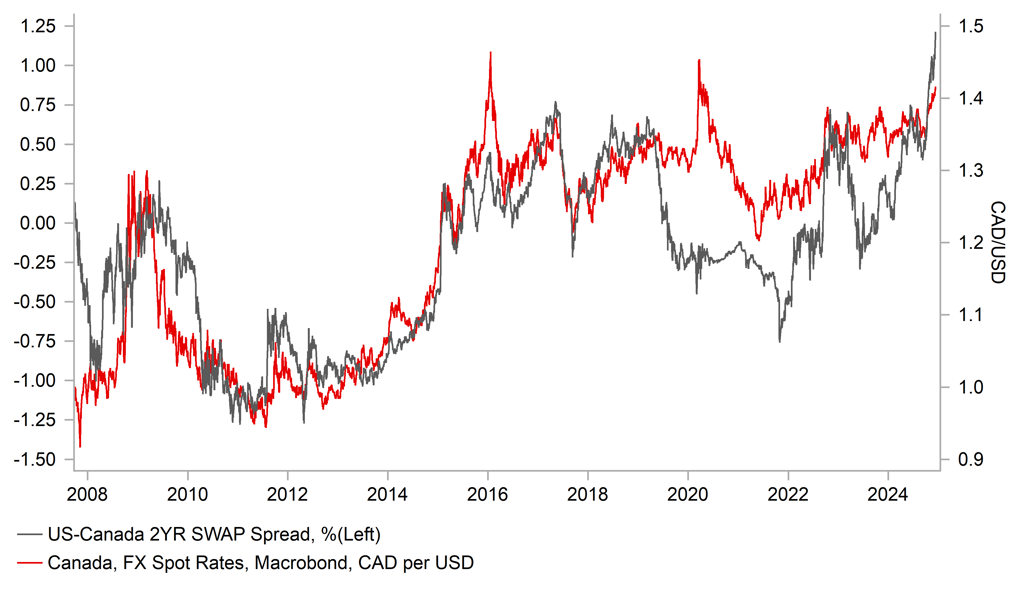

There therefore seems limited risk in getting the monetary stance back to neutral and hence cutting by a larger 50bps. The OIS market indicates 45bps of cuts is priced for today so the BoC would be merely meeting close to what the market expects. This would take the BoC policy rate to 3.25% with the markets then still expecting the policy rate to drop to 2.75%. That has been largely incorporated into the 2-year swap spread which has widened out to just over 120bps, the widest in the data series on Bloomberg back to the Global Financial Crisis. Covering five years of data the spread still suggests upside risks for USD/CAD from here.

However, the market appears quite well positioned for a 50bp cut and if that is what is delivered today, the decision may well be accompanied by a degree of caution over the policy outlook ahead. 50bps today means 175bps of cuts will have been delivered by the BoC since the start of June which is a much more pre-emptive easing cycle than all other G10 central banks to date. Upside risks from here therefore may stem more from Trump and his policy announcements in January rather than the BoC’s actions. Still, even with a cautious message today from the BoC, we see limited scope for CAD recovery and we see scope for USD/CAD extending further to around the 1.4500-level before any sustained recovery beyond Q1 can materialise.

RELATIVE YIELD SPREAD & USD/CAD SINCE GFC POINTS TO UPSIDE RISKS

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

2.8% |

! |

|

US |

12:00 |

OPEC Monthly Report |

-- |

-- |

-- |

! |

|

US |

13:30 |

Core CPI (MoM) |

Nov |

0.3% |

0.3% |

!!!!! |

|

US |

13:30 |

Core CPI (YoY) |

Nov |

3.3% |

3.3% |

!!! |

|

US |

13:30 |

CPI (MoM) |

Nov |

0.3% |

0.2% |

!!!! |

|

US |

13:30 |

CPI (YoY) |

Nov |

2.7% |

2.6% |

!!! |

|

US |

13:30 |

Real Earnings (MoM) |

Nov |

-- |

0.1% |

! |

|

CA |

14:45 |

BoC Rate Statement |

-- |

-- |

-- |

!!!! |

|

CA |

14:45 |

BoC Interest Rate Decision |

-- |

3.25% |

3.75% |

!!!! |

|

CA |

15:30 |

BOC Press Conference |

-- |

-- |

-- |

!!!! |

|

US |

16:00 |

Cleveland CPI (MoM) |

Nov |

-- |

0.3% |

!! |

|

US |

16:00 |

Thomson Reuters IPSOS PCSI |

Dec |

-- |

55.71 |

! |

|

CA |

16:00 |

Thomson Reuters IPSOS PCSI (MoM) |

Dec |

-- |

49.72 |

! |

|

US |

19:00 |

Federal Budget Balance |

Nov |

-325.0B |

-257.0B |

! |

Source: Bloomberg