GBP continues to outperform supported by BoE rhetoric & UK GDP report

USD: Will US CPI report provide further reassurance for Fed?

The US dollar has continued to consolidate at weaker levels ahead of the release later today of the latest US CPI report for June. The dollar index has been trading in a narrow range close to the 105.00-level so far this week. Similarly, US yields have continued to trade close to recent lows with the 2-year US Treasury yield haven fallen back to 4.60% which is the lowest level since late March/early April. Comments from Fed Governor Lisa Cook have attracted some market attention overnight. She was speaking to the Australian Conference of Economists in Adelaide and expressed optimism that recent data is consistent with a soft landing for the US economy. However, she did emphasize that the Fed is “very attentive” to the unemployment rate currently, and would be “responsive” if it worsened. She is wary that that there can be “non-linearities in these data”. The unemployment rate has been drifting higher since the second half of last year and hit a fresh high of 4.1% in June. The three-month moving average of the unemployment rate has now increased by 0.4 percentage points from the low over the last twelve moths which is close to triggering the Sahm rule. A further increase in the unemployment rate in the second half of this year would create more room for the Fed to lower rates and potentially create more unease over the risk of a harder landing for the US economy if Fed keeps the policy rate too tight for too long. The updated economic projections from the June FOMC meeting revealed that participants were optimistic that the unemployment rate would not rise much further above 4.0%. The tops of the central tendency range of forecasts for this year and next were set at 4.1% and 4.2% respectively.

The focus will shift today to the release of the latest monthly inflation update from the US economy. According to Bloomberg the consensus expectation is for today’s report to reveal that core CPI increased more softly by 0.2%M/M for the third consecutive month in Q2 following the stronger monthly readings in Q1 when core CPI increased on average by 0.4%M/M. The dollar index has weakened following the last two US CPI reports by an average of -0.4% in the first hour after the softer reports for April and May were released. Prior to that the dollar index increased on average by 0.6% in the first hour following the release of the stronger reports for January to March. Recent price action highlights that US CPI releases have had a significant impact on US dollar performance this year. A reading of 0.2M/M or 0.3M/M for core CPI should keep the Fed on track to begin lowering rates at the September meeting.

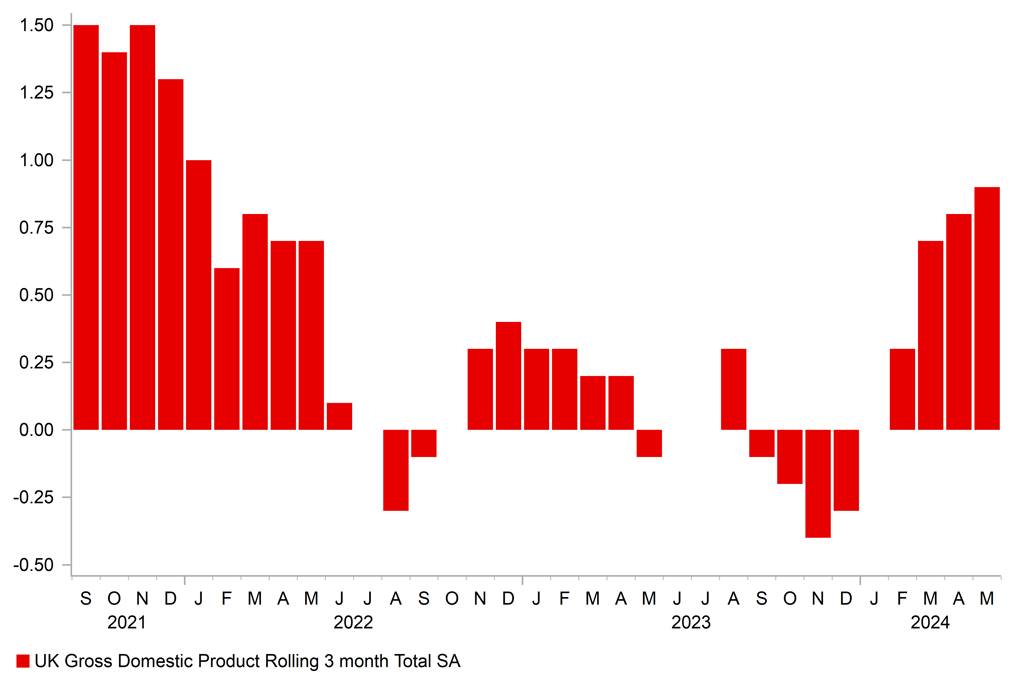

IMPROVING CYCLICAL MOMENTUM FOR UK ECONOMY

Source: Bloomberg, Macrobond & MUFG GMR

GBP: BoE Chief Economist Pill dampens August rate cut expectations

The pound has continued to trade at stronger levels following a speech delivered yesterday by BoE Chief Economist Huw Pill. It has resulted in the pound rising back close to recent highs against the US dollar (GBP/USD at 1.2860) and euro (EUR/GBP at 0.8397). In a speech entitled “Transformation and conjuncture”, BoE Chief Economist Huw Pill laid out his latest thoughts on monetary policy. The overall tone of the comments suggested that he is not yet ready to change his vote in favour of a rate cut at the August MPC meeting. The accompanying minutes from the BoE’s last policy meeting in June had indicated that some of the seven MPC members who voted to keep rates on hold thought the decision was finely balanced which had encouraged market speculation that the first rate cut could be delivered as soon as next month.

However, the comments from Huw Pill yesterday did not provide further encouragement that a policy shift is imminent. He stated that the three key indicators of inflation persistence: labour market tightness, pay growth and services inflation have all recently hinted at the margin towards some upside risk to his assessment of inflation persistence. That hawkish comment was partly counterbalanced by his clarification that these are noisy data series month to month although he believes it was hard to dispute the case that inflation persistence in the UK continues to prove persistent. He then attempted to dampen expectations over how much further insight MPC members will be able to glean from data releases ahead of the August MPC meeting and expressed his opinion that the MPC should be cautious in seeing any single data as either necessary or sufficient to trigger a reassessment of persistent inflation risks and the policy outlook. In addition, he noted that the MPC also has to take into account the passing of time. The BoE like the Fed is becoming more wary that keeping rates at restrictive rates for longer increases the risk of a sharper economic slowdown. The UK labour market has been displaying more evidence of weakness in recent months. On balance, the comments don’t suggest that the Chief Economist Pill is currently poised to vote for a cut next month. The UK rate market has moved accordingly to scale BoE rate cut expectations. A rate cut in August is currently judged as close to a 50:50 call. The direction of travel remains clear though that rates are heading lower which is still viewed as matter of “when-rather-than if” by Chief Economist Pill.

The pound has also been supported this morning by the release of further evidence revealing that the UK economy is recovering more strongly than expected at the start of this year. The monthly GDP report has revealed that the UK economy increased by 0.4%M/M in May following flat growth in April. Service sector and construction activity both proved to be stronger than expected in May when they expanded by 0.3%M/M and 1.9%M/M respectively. It follows robust growth of 0.7%Q/Q in Q1. The BoE staff forecasts were looking for growth of around 0.5%Q/Q in Q2.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

BOE Credit Conditions Survey |

-- |

-- |

-- |

!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Core CPI (MoM) |

Jun |

0.2% |

0.2% |

!!! |

|

US |

13:30 |

CPI (MoM) |

Jun |

0.1% |

0.0% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

236K |

238K |

!!! |

|

US |

16:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg