Trump trade tariffs threat encouraging stronger USD

JPY: Fed & BoJ policies in focus amidst political uncertainty in Japan

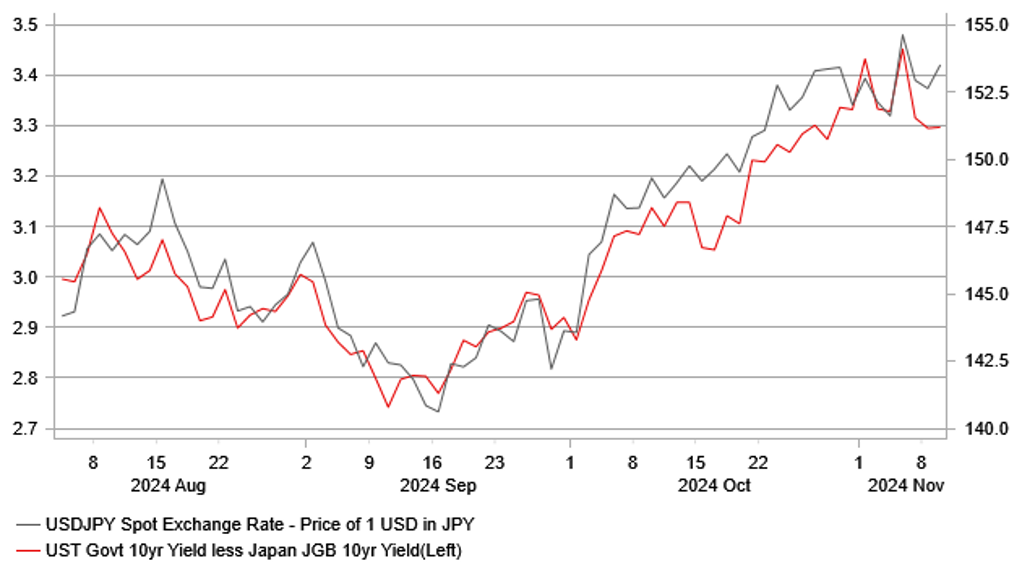

The yen has been the worst performing G10 currency at the start of this week. It has resulted in USD/JPY rising back above 153.50 overnight as it moves further above last week’s low of 151.30. After initially rising sharply after the US election victory for Donald Trump when USD/JPY hit a high of 154.71 on 7th November, the pair has struggled to extend its advance. Similar price action has also been evident in the US bond market where US yields peaked just after last week’s US election results. The 10-year US Treasury yield hit a high of 4.48% on 6th November but has since fallen back to 4.30%. The Fed’s decision to stick to their plans to deliver another rate cut at last week’s meeting while signalling they remain on course to deliver another 25bps cut at the December FOMC meeting has helped to put a dampener at least in the near-term on the recent upward trends for US yields and USD/JPY. There are still around 16bps of rate cuts priced into the US rate market for the December FOMC meeting. At the same time, the US rate market had already moved a long way to price out more aggressive rate cuts from the Fed in the run up to the US election. The yield on the 2-year US Treasury bond had already risen by around 62bps from the low in late September up to the day before the US election, and has since risen by a further 7bps. It leaves the US rate market pricing in just over a further 100bps of cuts by the end of next year. It highlights that market participants have become less confident that the Fed will bring their policy rate back to their estimate of the neutral rate at just below 3.00%.

At the same time, the Japanese rate market is less confident that the BoJ will hike rate again this year. The release of the minutes from the BoJ’s latest policy meeting in October were released overnight and provided no clear indication that they are considering raising rates again as soon as the next policy meeting in December. It fits with our updated forecast for the BoJ to deliver their next rate hike in January rather than December. The BoJ did emphasize though that it is important to communicate effectively its core message that “if the outlook for economic activity and prices will be realized, they will continue to raise the policy rate accordingly”. One board member noted that “with monetary policies of the BoJ and Fed moving in opposite directions, the markets, particularly foreign exchange markets, could see large fluctuations”. While the minutes do not rule another rate hike as soon as December, the yen would likely have to weaken sharply heading into year-end to force the BoJ to bring forward rate hike plans. One reason why we delayed our own forecast for the next BoJ hike to January has been political uncertainty in Japan after the ruling government lost their majority in the Lower House. Prime Minister Shigeru Ishiba won a runoff vote in the final round of the Lower House ballot overnight securing 221 votes compared to 160 for opposition party leader Yoshiko Noda. The LDP and Komeito are expected to continue as a minority government with support from the DPP.

USD/JPY vs. LONG-TERM YIELD SPREAD

Source: Bloomberg & Macrobond

EUR/USD: German politics & US trade policy add to uncertainty

The euro has continued to weaken at the start of this week resulting in EUR/USD breaking below support at the 1.0700-level. The main development over the weekend has been reports that German Chancellor Olaf Scholz has opened the door to holding an earlier confidence vote in parliament by several weeks before Christmas that potentially could bring forward a snap election to February. He stated “to ask for a confidence vote before Christmas – if everyone jointly takes that view, that’s absolutely no problem for me”. A shorter period of political uncertainty in German would be a more favourable outcome at a time when Donald Trump is set to take power at the start of next year and move to implement higher tariffs on imports from the EU.

The sensitivity of the euro to the threat of higher US import tariffs was evident at the end of last week when it was reported late on Friday by the FT that Robert Lighthizer would be returning as the US Trade Representative. However, Reuters as since reported that one of the sources familiar with the matter called the FT report “untrue”. Robert Lighthizer has refused to comment on the report as well. Robert Lighthizer was one of the leading figures during Trump’s first term as President, and he oversaw the imposition of higher tariffs on imports from China and the renegotiation of the North Amercian Free Trade Agreement. The re-appointment of Robert Lighthizer as Us Trade Representative would fit with Trump’s plans to raise tariffs further on imports from China and other major trading partners of the US. The heightened risk of the US imposing higher tariffs on imports from the EU was one of the reasons why we recommended a new short EUR/USD trade in our latest FX weekly report (click here).

However, a Politico report released earlier this year (click here) suggested as well that Robert Lighthizer is considering ways to weaken the US dollar. Unilaterally or through negotiations with foreign nations using the threat of tariffs. He reportedly brought up currency devaluation during Trump’s first term but faced opposition from former Treasury Secretary Mnuchin and former National Economic Council Chair Gary Cohn. Lighthizer’s ideal situation as outlined in his 2023 book, is to try to strike a grand bargain with foreign governments on currency, similar to the Plaza Accords struck by the Reagan administration in 1985. Higher tariffs could be used to force other countries to agree to revalue their currencies against the US dollar.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

18:00 |

German Buba Balz Speaks |

-- |

-- |

-- |

!! |

|

AU |

23:30 |

Westpac Consumer Sentiment |

Nov |

-- |

6.2% |

! |

|

JP |

23:50 |

M2 Money Stock (YoY) |

-- |

1.5% |

1.3% |

! |

Source: Bloomberg