Stronger CPI but rates & FX impact muted

USD: Limited FX & rates impact is understandable

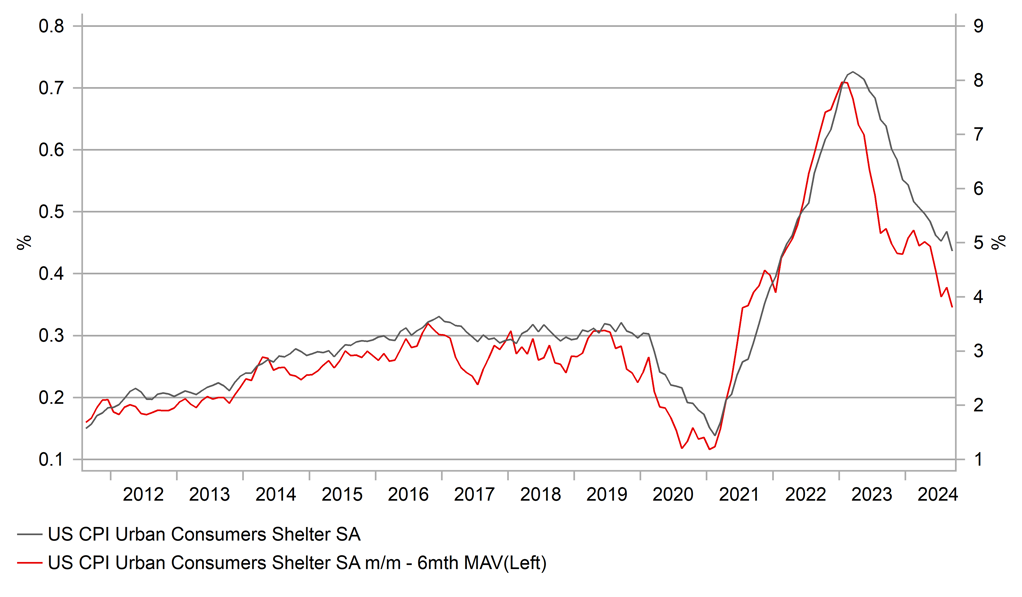

From a low of 3.50% on 25th September, the 2-year yield advanced 59bps to the high following the CPI data yesterday but the yield has since retraced more than 10bps from that intra-day high which suggests to us that the move higher had over-extended. A significant amount of easing has been now taken out of the OIS curve in the US and it is difficult to justify the move extending further from here, even after, on the face of it, an inflation report that was stronger than expected. But that’s on the face of it with the headline and core m/m rate 0.1ppt stronger than expected. However, the good news is that there was further compelling evidence that the long lag in rental inflation slowing may be finally coming to an end with a weaker than expected rental price increase. The 6mth moving average of the m/m change in shelter fell to a new low of 0.345% which points to the scope for a further deceleration in the annual rate assuming we do not get any surprise rebound. Actual rents have already returned to pre-covid levels and this happening in the CPI data will ease inflation concerns further.

There were some upside surprises of course given the good news in rents was offset to provide the overall upside surprise. Some were volatile like airline fares, which recorded another big gain of 3.2% m/m following a 3.9% gain in August. That scale of increase is unsustainable. After two m/m declines medical care jumped by 0.4% in September while apparel gained 1.1%.

The lack of reaction in rates and FX reflected a number of factors. Firstly, while the headline readings were stronger than expected, the data wasn’t strong enough to put in doubt the likelihood of a 25bp cut at the next FOMC meeting on 7th November. Secondly, we also had some Fed officials commenting after the data that further confirmed the data wasn’t a game-changer. Vice Chair Williams spoke and cited “pretty steady disinflation” evident in the data despite some “wiggles”. Fed President Barkin stated that he was “increasingly confident” on the outlook for inflation while Fed President Goolsbee pointed to the trend over the last 18mths that shows inflation “has come down a lot”. Finally, the initial claims data, released at the same time as the CPI revealed a larger jump than expected, increasing to 258k, the largest total since August 2023. It would appear through that there is a high chance that this spike is weather-related after hurricane Helene although we can’t be sure to what extent yet.

Still, while there are logical reasons as to why the rates and FX markets didn’t react notably to the CPI data, the rates retracement does suggest that perhaps the jump in rates following the strong jobs data has now run its course which should imply limited further US dollar strength going forward over the near-term.

6MTH MAV OF M/M CHANGE IN SHELTER INDICATES FURTHER SLOWING IN ANNUAL RATE LIES AHEAD

Source: Macrobond & MUFG GMR

EUR: Few surprises in France budget with ECB set to cut

The French government last night revealed the details of the budget that will now be scrutinised in parliament with the objective for it to be passed by the end of the year. As expected, the budget lays out plans fiscal consolidation totalling EUR 60.6bn with just over EUR 40bn coming from spending cuts and a little less than EUR 20bn from tax increases. A temporary levy on profitable companies and a tax on maritime transport companies are some measures to lift tax revenues as is higher tax rates on 65,000 wealthier households. A delay to the indexation of pensions from January to July will also add to savings. This pension measure has been criticised by Marine Le Pen and her RN party but there has been little indication that RN will be willing at this stage to trigger a no-confidence motion in the government which would easily pass with the support of the Left Alliance.

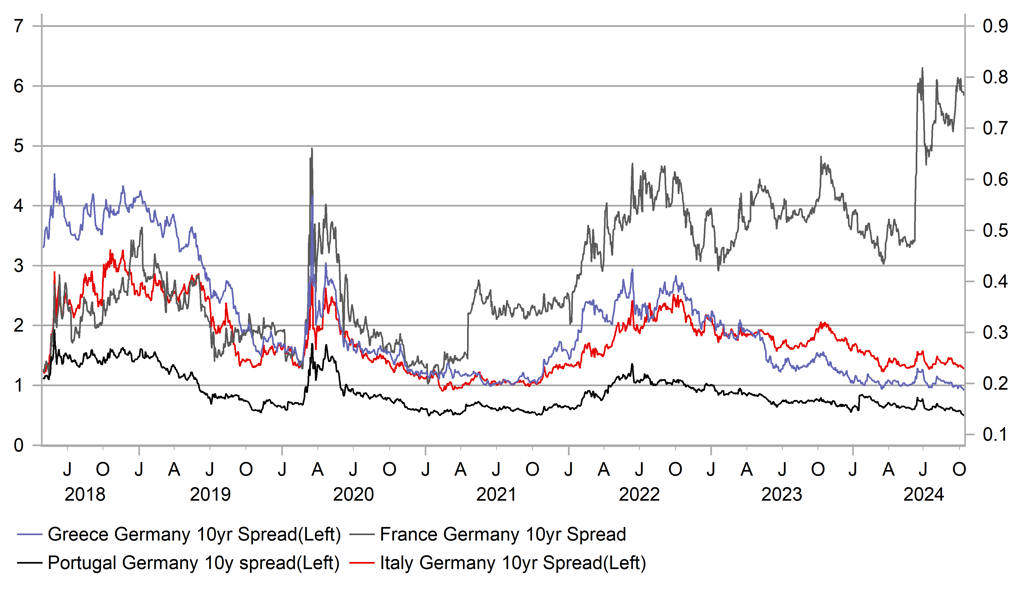

Without these measures, the budget deficit was set to rise from 6.1% this year to 7.0% next year. Now the deficit is expected to fall to 5.0%. This consolidation will be done against a GDP growth projection of 1.1% next year. That’s the element that investors may well decide lacks credibility, especially if we see incoming economic data weakening going forward. The sovereign ratings agencies may also deem that the details lack credibility. Later today, Fitch will provide an update on its review which currently stands at AA- following a downgrade from AA in April 2023. There is certainly a high chance that Fitch could put France on negative watch. Moodys will then provide its update in two weeks and finally S&P on 29th November. Moodys ratings is one notch above Fitch’s and S&P’s and hence there is a risk they could downgrade France on 25th October. Issuance of OATs will increase from EUR 285bn this year to a projected EUR 300bn next year to finance this budget, which was in line with expectations and hence should for now contain risks of a widening of the OAT/Bund spread.

The ECB cutting rates at a faster pace due to a faster drop in inflation will certainly help contain those risks as well. The minutes from the last ECB meeting were released yesterday and there was nothing in the details to reduce expectations of a rate cut next week. The minutes cited the view that the risk of undershooting the inflation target had become “non-negligible” which is significant and underlines the shifting views toward potential downside inflation risks. The OIS curve we believe is more accurately priced for the ECB than it is for the Fed at the moment. For the ECB, the neutral rate is hit by around mid-year but for the Fed the OIS curve implies monetary restriction will persist through to year-end next year. We believe this relative pricing will limit downside risks for EUR/USD from here.

HIGHER RISK PREMIUM FOR OATS MAINTAINED

Source: Bloomberg, Polymarket & MUFG Research

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

12:00 |

German Current Account Balance n.s.a |

Aug |

-- |

16.0B |

! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

Sep |

-- |

0.3% |

!! |

|

US |

13:30 |

Core PPI (MoM) |

Sep |

0.2% |

0.3% |

!!! |

|

US |

13:30 |

Core PPI (YoY) |

Sep |

2.7% |

2.4% |

!! |

|

US |

13:30 |

PPI (YoY) |

Sep |

1.6% |

1.7% |

! |

|

US |

13:30 |

PPI (MoM) |

Sep |

0.1% |

0.2% |

!!! |

|

CA |

13:30 |

Avg hourly wages Permanent employee |

Sep |

-- |

4.9% |

! |

|

CA |

13:30 |

Building Permits (MoM) |

Aug |

-7.1% |

22.1% |

!! |

|

CA |

13:30 |

Employment Change |

Sep |

29.8K |

22.1K |

!!! |

|

CA |

13:30 |

Unemployment Rate |

Sep |

6.7% |

6.6% |

!! |

|

US |

14:45 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Oct |

-- |

2.7% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Oct |

-- |

3.1% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Oct |

70.9 |

70.1 |

!! |

|

CA |

15:30 |

BoC Business Outlook Survey |

-- |

-- |

-- |

!! |

|

US |

15:45 |

Fed Logan Speaks |

-- |

-- |

-- |

! |

|

US |

18:10 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg