JPY weakness continues to trigger change in rhetoric from Japanese officials

JPY: BoJ Governor Ueda’s hawkish comments provide support for JPY

The yen has strengthened sharply overnight following hawkish comments from BoJ Governor Ueda. It has resulted in USD/JPY falling back towards the 146.00-level as it moves further below last week’s high of 147.87. The main trigger for the reversal of yen weakness were comments from BoJ Governor Ueda to the Yomiuri newspaper stating that it’s possible that they will have enough information and data by year end to judge if wages will continue to rise which is a condition for tightening monetary policy. He also added that if the BoJ becomes confident that prices and wages will keep going up sustainably, ending its negative interest rate is among the options available. When asked about the timing of when negative interest rates could be lifted, he said it was an option if prices and the economy proved stronger than expected. The BoJ would need to judge that the inflation target could still be achieved after lifting the policy rate. Our view is that the comments are clearly intended to offer more support for the yen in the near-term and to deter further speculative selling of the yen. As we saw last week, the Japanese government has become increasingly concerned by yen weakness when

it raised the intervention threat to the highest level (click here). BoJ Governor Ueda’s comments maybe intended to try to buy some time. It will make market participants more wary that if the yen continues to weaken the BoJ could under more pressure from the government to bring forward plans to tighten policy and raise rates. Our analysts in Tokyo have expressed a similar view to Governor Ueda overnight. They expect wage developments to give the BoJ more confidence that higher inflation can be sustained by the end of this year, and are currently forecasting an end to YCC in Q1 of next year quickly followed by a 0.20 point rate hike in Q2. The ongoing shift to tighter BoJ policy supports our outlook (click here) for the yen to rebound in the year ahead from deeply undervalued levels although it may yet fall to fresh lows in the coming months. More hawkish rhetoric from the BoJ and the heightened threat of intervention though should help to dampen the scale of any further yen sell-off.

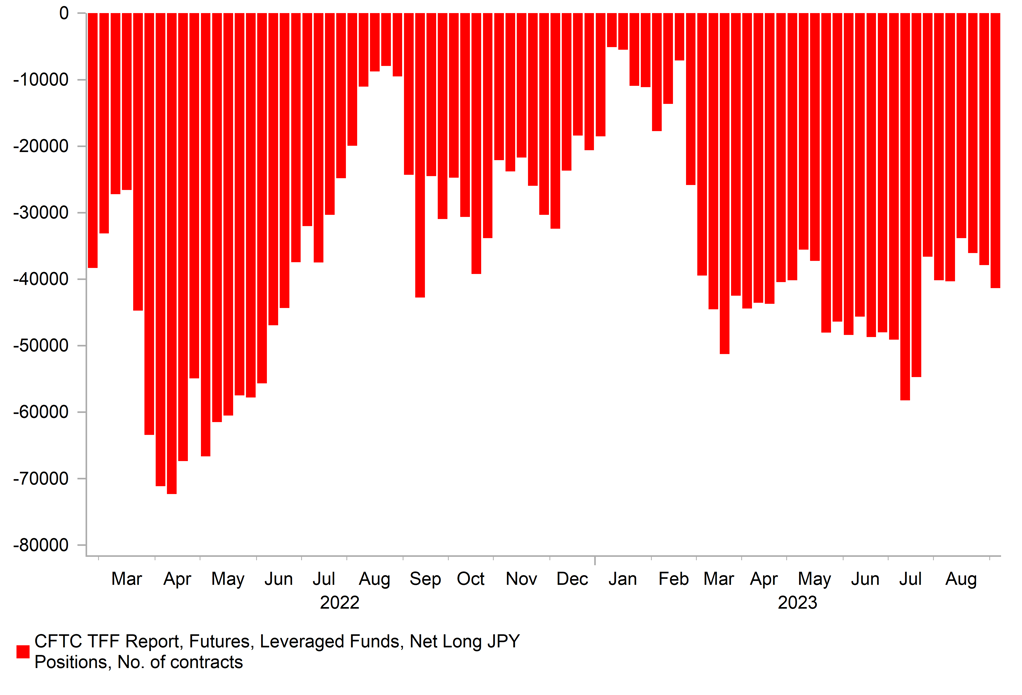

SPECULATIVE JPY SHORTS HAD BEEN REBUILDNG OVER THE SUMMER

Source: Bloomberg, Macrobond & MUFG Research calculations

USD: Will US CPI report shift market focus from diverging growth outlook?

The US dollar has corrected lower at the start of this week driven by the move lower in USD/JPY. The setback for the US dollar follows on from eight consecutive weeks of higher closes for the dollar index which has been attempting to break above the 105.00-level on a sustained basis. It has struggled to do since the middle of December of last year. Our short-valuation models for the major FX pairs of EUR/USD, GBP/USD & USD/JPY have started to signal that US dollar strength is not fully backed up by short-term fundamentals drivers (click here) and appears to be overshooting in the near-term.

The US dollar has been benefitting from the improvement in the relative growth outlook for the US compared to China and Europe. The New York Fed Staff’s latest Nowcast of US GDP growth was released on Friday and is currently calculating GDP growth of 2.25% for the current period up from 2.09% at the end of the prior week. It has risen from around 1.5% over the summer period. It provides a further indication that GDP growth is expected to pick-up in Q3 after averaging an annualized rate of just over 2% in the 1H of this year. With growth continuing to run above the Fed’s longer run central tendency forecast of 1.7-2.0%, the data is giving market participants more confidence that the US economy is proving more resilient to higher rates. At the start of this year the US economy was expected to expand by just 0.3%.

The contrast between the resilience of the US economy and weaker growth outside of the US in China and Europe has become more marked in recent months boosting the appeal of the US dollar even as US inflation has slowed more quickly than expected and reinforced expectations that the Fed will pause heir rate hike cycle this month. It has meant that growth expectations have become more important recently in driving FX markets relative to inflation. We expect that to remain the case for the US dollar in the week ahead when the latest US CPI report for August is released on Wednesday. The report is expected to reveal a sizeable increase for headline inflation of 0.6%M/M but core inflation is expected to increase more modestly by 0.2% after slowing notably in recent months. It would take a significant upside surprise for core inflation to alter market expectations for the Fed to leave rates on hold at the 20th September FOMC meeting. A the same time the US rate market does not appear overly concerned yet by the recent rally in the price of oil. The price of Brent has climbed back above USD90/barrel to the highest level since November of last year as it moves further above the June low (+27%). The 10-year US break-even rate has remained relatively steady continuing to trade between 2.20% and 2.40% since late last year.

While there is a risk that the US dollar’s correction lower extends further in the week ahead, we are not yet convinced that it will prove sustainable. As a result, we continue to recommend holding a long USD/SEK trade idea (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

Total Sight Deposits CHF |

Sep-08 |

-- |

467.6b |

!! |

|

IT |

09:00 |

Industrial Production MoM |

Jul |

-0.3% |

0.5% |

!! |

|

EC |

10:00 |

EU Commission Economic Forecast |

!! |

|||

|

US |

16:00 |

NY Fed 1-Yr Inflation Expectations |

Aug |

-- |

3.6% |

!! |

Source: Bloomberg