JPY outperforms on BoJ as Harris deemed the debate winner

USD/JPY: Sharp drop on BoJ; is there an FX impact from TV debate?

The FX market is showing some further signs of risk aversion this morning although more from the strong performance of the safe-haven currencies rather than poor performance of the high-beta currencies. The yen is the top performing G10 currency and the move was triggered by the comments from BoJ policy board member Junko Nakagawa indicating support for further rate increases. Nakagawa was very clear in repeating the view that rate hikes would be required if the forecast outlook was realised and reminded her audience on the fact that real rates remained “very low”. Nakagawa was quite specific stating that “there have been no major changes in Japanese economic fundamentals, with domestic companies’ profits at historically high levels”.

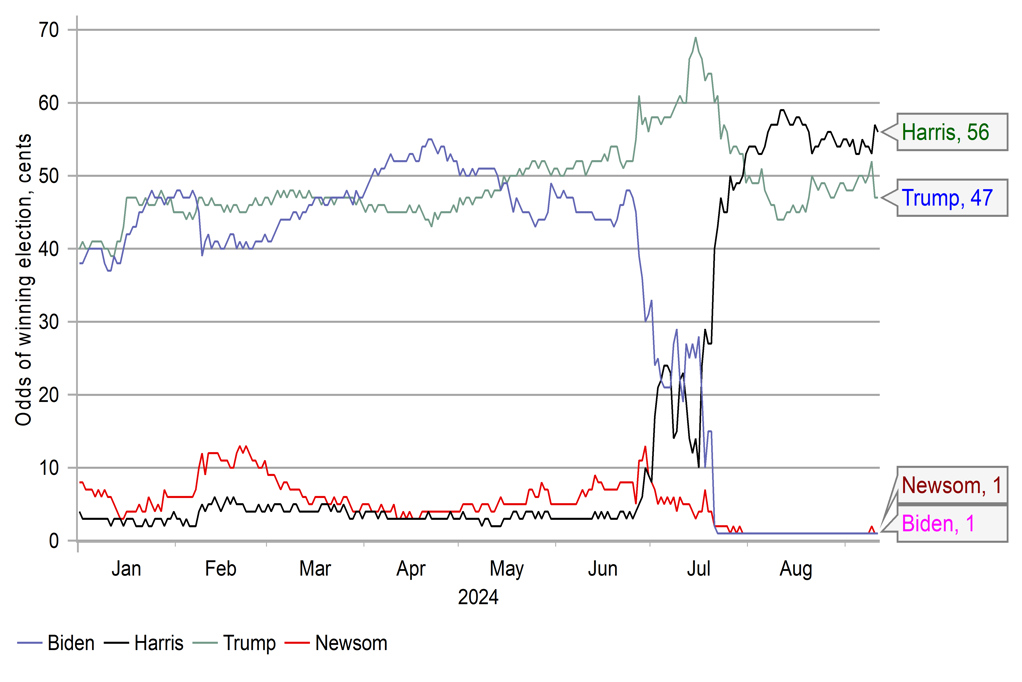

The BoJ comments came against a backdrop of a general increase in risk aversion. Brent crude oil fell below the USD 70p/bl level for the first time since December 2021 which will help reinforce concerns over weakening global demand and lower global yields to the benefit of the yen. While the S&P 500 finished slightly higher yesterday, the S&P future is down 0.5%, possibly driven in part at least by the performance of Vice President Kamal Harris who is deemed to have performed well in the TV debate against Donald Trump. As can be seen above, the Predict It betting market shows a widening of the gap with Harris gaining 4pts and Trump losing 5pts to open up a 10pt margin of gain for Harris. Given the corporate tax policies of Harris and her assumed less friendly business policies, the US equity markets could underperform if Harris can build on this evidence in the national polling over the coming days and weeks.

Today is a key day for Fed rate expectations with the release of the August CPI data. The consensus is for 0.2% m/m gains for both headline and core CPI which will result in a 0.4ppt drop in headline YoY CPI to 2.5% while the core is set to remain unchanged at 3.2%. The momentum in the inflation data is clear and we would be surprised to see a bad inflation report that alters expectations notably. A consensus print will likely see the markets maintain conviction on a 25bp cut next week with a downside surprise required to bring a 50bp cut back into play. As we have stated, the Fed should be cutting by 50bps next week given where the risks to the dual mandate now lie. When the focus was on inflation risks in 2022-23, the Fed hiked by 75bps four times and 50bps twice so with the risks now flipped from upside inflation risks to downside employment risks, a 50bp cut is justified.

34bps of easing is currently priced implying close to a 40% chance of a 50bp cut so any upside CPI surprise will certainly lift front-end yields and the dollar. A downside surprise would likely see a 50bp cut becoming a greater than 50% probability and hit the dollar further. We remain short USD/JPY as highlighted in our latest FX Weekly (here) and would expect today’s declines to extend further.

PREDICT IT BETTING MARKET SHOWS A POST-DEBATE GAIN FOR HARRIS

Source: Macrobond & Bloomberg

EUR: France reprieve as Japan investors cut exposure

The European Commission yesterday indicated that it would consider extending the deadline for France submitting its plan to reduce its budget deficit after France requested an extension. France’s budget deficit reached 5.5% of GDP in 2023 and Paris has committed to getting it back to 3.0% by 2027. The European Commission stated that extensions can in general be granted, “taking into consideration all relevant factors” put forward by the requesting country. The head of the finance committee in the National Assembly has stated that budgetary cuts of EUR 60bn are required to bring the deficit down and without cuts, the deficit is set to reach 6.2% of GDP in 2025. Last week, we highlighted here that Japanese investors had been heavy sellers of German bonds in June, highlighting the sensitivities to adverse political developments that were then in evidence following the EU-wide elections that saw the far-right perform well in Germany.

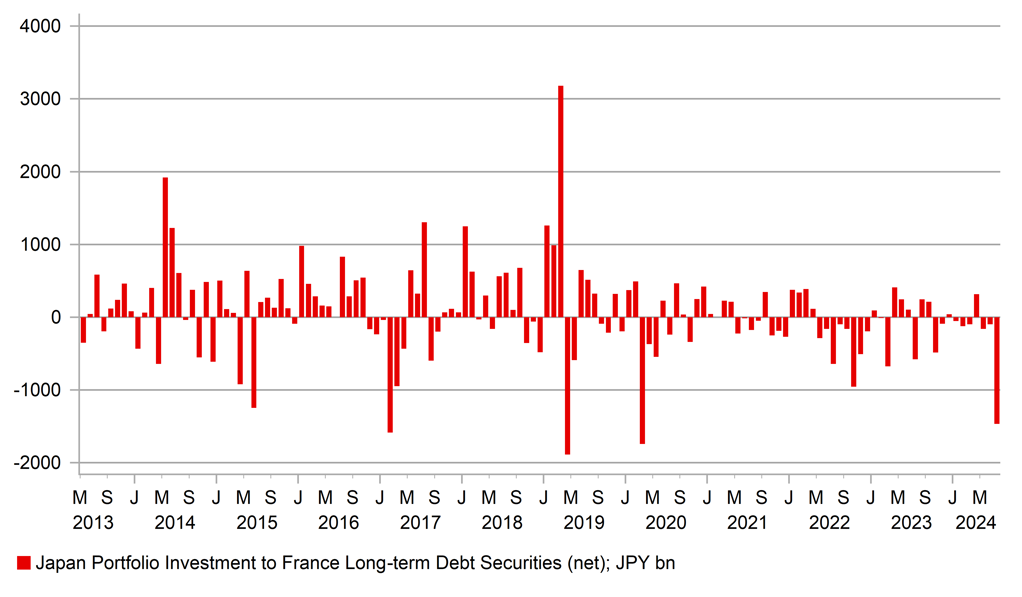

The Balanace of Payments data for July was released on Monday and the data confirmed this sensitivity to adverse political developments has now extended to France. Japanese investors sold JPY 1,467bn (EUR 8.6bn) in July, which was the largest selling of French debt since the onset of covid in March 2020. French debt market is often described as a popular destination for Japanese fixed income investors with the view that it is a core euro-zone debt market with some added yield premium over Germany. But the appetite for France debt has not been as strong in the post-covid period.

In the 6mths to June, Japanese investors sold JPY 218bn worth of French debt and that followed sales of JPY 497bn in 2023. Indeed, you have to go back to calendar year 2019 to find the last period of Japanese investors buying with purchases of JPY 4,257bn. So there has already been a sustained period of Japanese investors lightening up on their holdings of French paper which could diminish the risk of further large-scale selling. Of course, developments over the coming weeks and months will shape appetite but it’s not the case that Japan has been heavy buyers of French debt in recent years. We also know that Japanese investors weren’t just sellers of French debt – the BoP data shows net sales from Germany (again); the Netherlands, Italy and Spain. The consecutive months of selling of Netherlands debt (JPY 1,030bn combined) was a record total over two months. This heavy selling in Europe in July was in fact offset by buying of US debt. We also know that in July based on separate investor type data, Japanese banks were the biggest sellers of foreign bonds in July.

The speed of the appreciation of the yen in July versus the euro could well have played a role in this, certainly for those positions unhedged although if banks were the main sellers that may not have been the case. What we do know from previous examples is that political-event risk triggers do not tend to result in sustain periods of selling by Japanese investors but of course previous examples tend to have seen those specific political risks subside. At this juncture that is what we would expect in this case as well.

JAPANESE INVESTORS WERE HEAVY SELLERS OF OATS IN JULY AFTER THE UPTURN IN POLITICAL UNCERTAINTY

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CH |

09:00 |

M2 Money Stock (YoY) |

Aug |

6.2% |

6.3% |

! |

|

CH |

09:00 |

New Loans |

Aug |

810.0B |

260.0B |

!! |

|

CH |

09:00 |

Outstanding Loan Growth (YoY) |

Aug |

8.6% |

8.7% |

!! |

|

CH |

09:00 |

Chinese Total Social Financing |

Aug |

2,950.0B |

770.0B |

!! |

|

EC |

10:25 |

ECB McCaul Speaks |

-- |

-- |

-- |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

1.6% |

! |

|

US |

13:30 |

CPI (YoY) |

Aug |

2.6% |

2.9% |

!!!! |

|

US |

13:30 |

CPI (MoM) |

Aug |

0.2% |

0.2% |

!!!!! |

|

US |

13:30 |

Core CPI (MoM) |

Aug |

0.2% |

0.2% |

!!!!! |

|

US |

13:30 |

Core CPI (YoY) |

Aug |

3.2% |

3.2% |

!!!! |

|

US |

16:00 |

Cleveland CPI (MoM) |

Aug |

-- |

0.3% |

!! |

|

US |

18:00 |

10-Year Note Auction |

-- |

-- |

3.960% |

!!! |

Source: Bloomberg