JPY & CHF giving back recent strong gains

USD/JPY: Scaling back of Fed rate cut expectations provide support

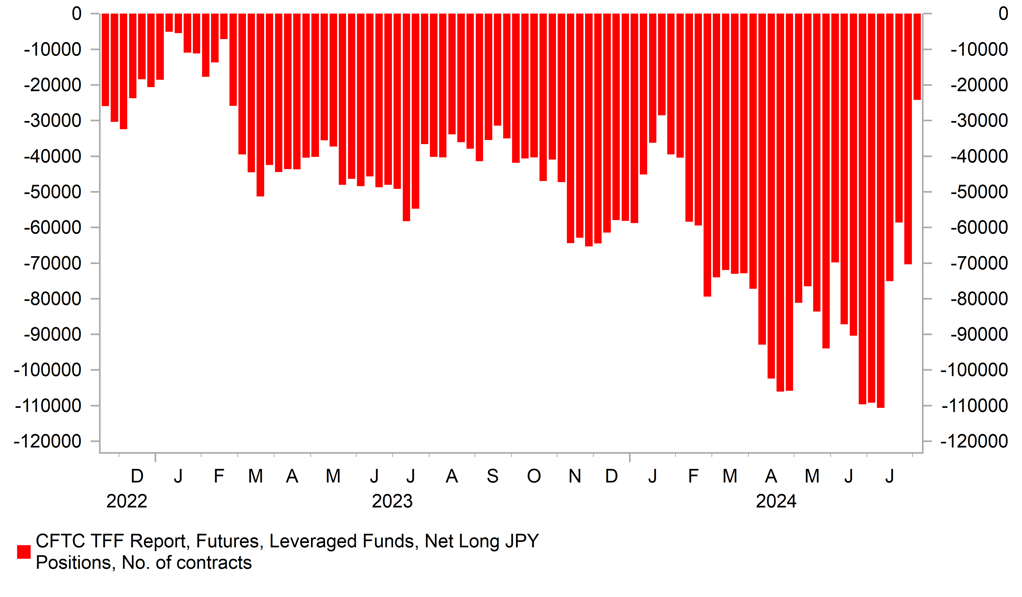

It has been a much quieter start to this week than last week as financial markets continue to stabilize. After the Nikkei 225 index plunged by around 13% last Monday, it has continued to recover lost ground overnight rising by a further 0.6% but remains round -1.2% below levels recorded prior to last week’s sell-off. In the FX market, the low yielding safe haven currencies of the yen and Swiss franc are continuing to give back strong gains from last week. It has resulted in USD/JPY rising back above the 147.00-level and EUR/CHF back closer to the 0.9500-level. The price action overnight highlights that FX markets are still being driven mainly by risk on/ risk off trading in the near-term. The sharp reduction in short yen positions held by Leveraged funds in the latest IMM report has likely provided some reassurance as well that the unwind of yen funded carry trades is now more complete. Yen shorts reached their lowest level since February 2023.

There has been a tentative improvement in global investor risk sentiment since BoJ Deputy Governor Uchida moved to dampen fears over a faster pace of rate hikes, and the release of the latest initial claims report provided some reassurance that the US labour market is not slowly sharply. It has encouraged US rate market participants to scale back expectations for more aggressive Fed rate cuts.

The yield on the 2-year US Treasury yield has risen by around 50bps from last week’s low of 3.65%. As the probability of the Fed starting their rate cut cycle with a larger 50bps cut in September has dropped back closer to 50:50. The total amount of easing in the year ahead is also moving back closer to 175bps of cuts. If global investor risk sentiment continues to improve in the week ahead, it is likely that market expectations for Fed rate cuts will continue to be scaled back. The main US economic data releases in the week ahead are the PPI report for July (Tues), the CPI report for July (Wed) and retail sales report for July (Thurs). We are expecting the July PPI and CPI reports to provide further evidence that US inflation is slowing. Core CPI is expected to increase by +0.2%M/M which if confirmed would be the third consecutive softer monthly reading. For the US rate market to become more confident that the Fed will deliver a larger 50bp cut in September, the core CPI reading will have to come in even weaker similar to in June when it increased by only +0.1%M/M. It provides high hurdle for a dovish policy surprise. The US dollar could regain some of lost ground if aggressive Fed rate cut expectations are scaled back further in the week ahead. Please see our latest FX Weekly report for more details (click here).

SIGNIFICANT UNWIND OF SPECULATIVE SHORT JPY POSITIONS

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Recovering lost ground after recent sell-off

The pound is continuing to recover lost ground at the start of this week supported by the improvement in global investor risk sentiment. It has resulted in EUR/GBP falling back below support from the 200-day moving average that comes in at around 0.8560 as the pair moves further below last week’s high of 0.8625. Similarly, cable is rising back towards the 1.2800-level after bouncing off support last week from the 200-day moving average at around 1.2660. The pound sell-off against the euro at the start of August was the biggest correction lower since last autumn/winter. The release of the latest IMM report revealed that long pound positions were cut back for the second consecutive week in the week ending 6th August although they still remained elevated. The pick-up in financial market volatility hurt high yielding carry currencies such as the pound, and it is now beginning to recover as financial market conditions stabilize.

During the pound sell-off, the BoE also started to lower rates although we are not convinced it was a significant driver of pound weakness. The UK rate market is still expecting a more gradual rate cutting cycle from the BoE in comparison to the Fed and even the ECB. There are currently around 100bp of BoE rate cuts priced in the for year ahead compared to around 175bps for the Fed and around 125-150bps for the ECB. The BoE’s decision to begin cutting rates this month was a very close call and the guidance indicated that they are not in rush to cut again. The releases of the latest UK labour market report (Tues), CPI report for July (Wed) and GDP report for Q2 (Thurs) will be important in helping the BoE to further assess inflation persistence risks in the UK. September rate cut expectations would have to intensify to prevent the pound from rebounding further this week if financial markets continue to stabilize.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

12:00 |

OPEC Monthly Report |

-- |

-- |

-- |

!! |

|

GE |

12:00 |

German Current Account Balance n.s.a |

Jun |

-- |

18.5B |

! |

|

CA |

13:30 |

Building Permits (MoM) |

Jun |

5.6% |

-12.2% |

!! |

|

US |

16:00 |

Consumer Inflation Expectations |

Jul |

-- |

3.0% |

! |

|

US |

19:00 |

Federal Budget Balance |

Jul |

-254.3B |

-66.0B |

!! |

Source: Bloomberg