Euro is trading on softer footing heading into ECB meeting

USD/JPY: Delayed BoJ rate hike expectations trump impact from US CPI report

The yen has continued to weaken overnight resulting in USD/JPY moving back closer to the 153.00-level after the pair failed to break below support at the 150.00-level at the start of this month. It leaves the yen as the worst performing G10 currency so far this month. The weaker yen has been encouraged by the recent scaling back of rate hike expectations ahead of next week’s BoJ policy meeting. At the start of this month the Japanese rate market was pricing in around 16bps of hikes for this month but has since scaled back expectations and is currently pricing in only around 4bps of hikes. Market participants have become more confident that the BoJ will wait before hiking rates again at least until the following meeting in January when there is around 19bps of hikes priced in. The dovish shift in BoJ rate hike expectations was encouraged further yesterday by the release of a Bloomberg report entitled the “BoJ is said to see little cost to waiting for the next rate hike”. According to people familiar with the matter, BoJ officials see little cost to waiting before raising rates while still being open to a hike next week depending on the data and market developments. The release this evening of the latest Tankan survey for Q3 will be one of the final important data releases before next week’s BoJ and Fed policy meetings. The report added that even if the BoJ decides to wait until January or a while longer, the authorities see it as not entailing a huge cost because signs point to limited risk that inflation might overshoot. At the same time, some officials are not against a rate hike at next week’s meeting if it is proposed. Another rate hike though is viewed as just a “matter of time” with the economy and inflation in line with their projections. A view that was echoed by a Market News report overnight stating that the BoJ has renewed its internal assessment of underlying inflation, last made public in April, as remaining around 1.5% with officials keen to send a message that tightening will continue. The reassessment will reportedly allow the BoJ to continue to assert that underlying inflation should gradually trend toward the 2% target in the send half of its projection period until March 2027, in the absence of fresh shocks.

USD/JPY did briefly dip back towards the 152.00-level yesterday after the release of the latest US CPI report for November but the correction lower proved to be short-lived. With the US CPI report revealing no significant upside surprise it has given market participants more confidence to fully price in the Fed cutting rates by a further 25bps at next week’s FOMC meeting. The report revealed that headline and core inflation both increased by +0.31%M/M in November. The main surprise in the report came from core services inflation which slowed to a monthly increase of 0.28%M/M down from previous increases of 0.35%M/M in October and 0.36%M/M in September. It was driven by a deceleration both rents and OER. The details of the report have raised expectations that the core PCE deflator for November when it is released next week will show that the Fed’s preferred measure of core inflation has slowed after stronger increases of 0.26%M/M/M and 0.27%M/M in September and October.

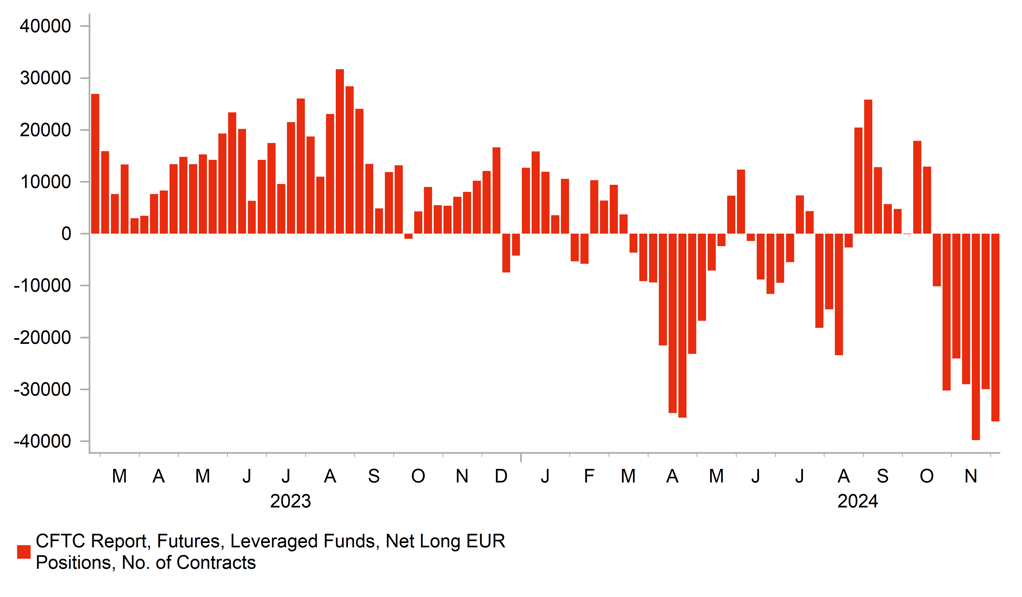

SHORT EURO POSITIONS REMAIN POPULAR SINCE US ELECTION

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Will today’s ECB policy meeting provide trigger for a further sell-off?

The euro has traded on a softer footing ahead of today’s ECB policy meeting. After hitting a high of 1.0630 just after the release of last week’s nonfarm payrolls for November, EUR/USD has since fallen back towards support at the 1.0500-level. The pair has fallen this week even as the US rate market has moved to more fully price in another Fed rate cut next week. Similarly, the euro has weakened further against the pound as well resulting in EUR/GBP falling to new year to date low yesterday of 0.8225 as it moves closer to the low from March 2022 at 0.8203. EUR/GBP has not fallen below the 0.8200-level since the initial fallout from the Brexit referendum back in June 2016. Price action this week highlights that the weakening trend for the euro remains firmly in place in the near-term.

Short euro positions have been built up in the run up to and following the US election. A second Trump presidency is viewed as adding to downside risks for the euro-zone economy and the euro in the coming years. The risk of trade disruption will be one area of focus for President Lagarde to address in the press conference alongside recent unfavourable political developments in France. Having said that it’s likely premature to expect the ECB to significantly change policy today on the back of those risks. President Trump has not yet directly threatened to impose higher tariffs on the EU. As a result, we expect the ECB to stick to another 25bps rate cut today and refrain from signalling more strongly that it could cut rates by a larger 50bps at the start of next year. It may create some disappointment for euro-zone rate market participants who are pricing in a higher probability of a larger 50bps cut in Q1, and help to provide some temporary relief for the euro. With the policy rate moving closer to estimates of the neutral range, the ECB would likely have to become more convinced that policy rate needs to move into expansionary territory to strengthen the case for larger 50bps cuts. As we saw yesterday, the BoC indicated that there was less need now for further large 50bps cuts as their own policy rate fell into the estimated neutral range between 2.25% and 3.25%.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:30 |

SNB Interest Rate Decision |

Q4 |

0.75% |

1.00% |

!!! |

|

SZ |

08:30 |

SNB Monetary Policy Assessment |

-- |

-- |

-- |

!! |

|

SZ |

09:00 |

SNB Press Conference |

-- |

-- |

-- |

!!! |

|

UK |

12:00 |

NIESR GDP Estimate |

-- |

-- |

0.1% |

!! |

|

EC |

13:15 |

Deposit Facility Rate |

Dec |

3.00% |

3.25% |

!!! |

|

US |

13:30 |

Core PPI (MoM) |

Nov |

0.2% |

0.3% |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

221K |

224K |

!!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

EC |

15:15 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:50 |

Tankan Large Manufacturers Index |

Q4 |

13 |

13 |

!! |

Source: Bloomberg