Fed rate cut speculation delivers setback for USD

USD/JPY: Weak US CPI report triggers sharp sell-off

The US dollar has continued to trade at weaker levels overnight following yesterday’s sell-off triggered by the release of the much weaker than expected US CPI report for June. It has resulted in the dollar index falling back to support provided by the 200-day moving average which comes in at around 104.40. The recent weakening trend for the US dollar has been reinforced by building expectations for the Fed to become more active at cutting rates in the year ahead in response to slowing US inflation. The US rate market has moved to fully price in a 25bps rate cut in September and around 136bps of rate cuts by July of next year. It has resulted in the yield on the 2-year US Treasury bond falling sharply by around 10bps towards 4.50%. The case for the Fed to become more active in cutting rates was encouraged by the release of the US CPI report for June that provided the strongest evidence yet that inflation in the US continues to slow back towards the Fed’s target.

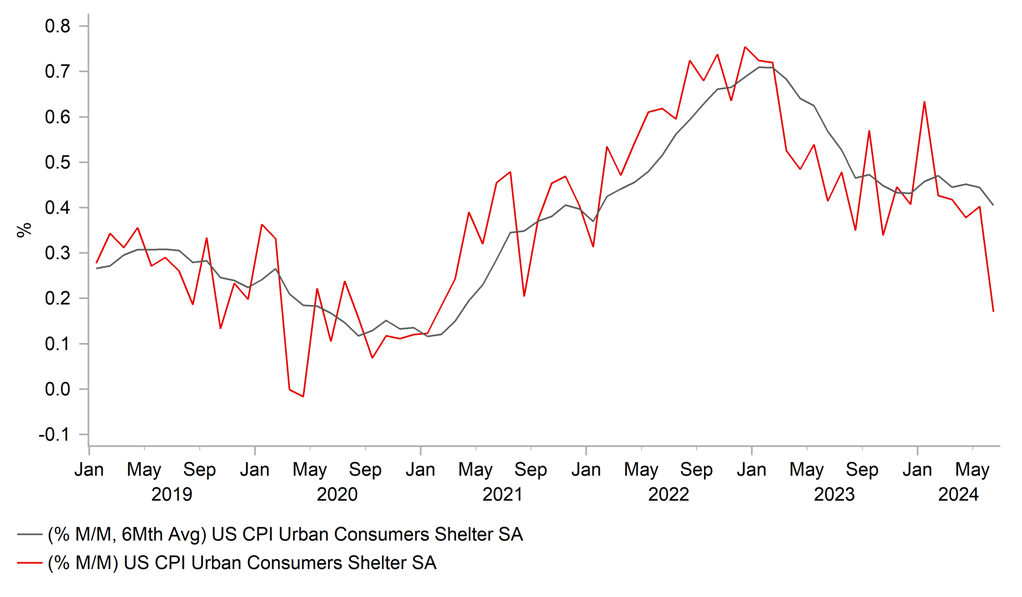

The report revealed that core inflation increased by just 0.065%M/M in June which was the lowest reading since January 2021. Fed Chair Powell has highlighted that he is watching closely core services inflation excluding shelter costs which fell by -0.05%M/M in June following a decline of -0.04%M/M in May. It was also notable that there was finally a step down in the pace of rental inflation which has been anticipated for some time based on falling rental prices. Owners equivalent rent increased by 0.28%M/M and rent by 0.26%M/M which were the weakest readings since 2021. Overall, the report has given us more confidence that the pick-up in inflation at the start of this year in Q1 was temporary. It is more “good data” that the Fed was looking for to give them more confidence that they can begin to cut rates. It supports our outlook for the Fed to begin cutting rates in September. A rate cut as soon as this month’s FOMC meeting is still likely too soon although the Fed could provide a stronger signal that it is moving closer to cutting rates. The developments should keep the US dollar on a softer footing in the near-term and create supportive conditions for FX carry trades heading into the summer.

The biggest FX mover yesterday was the yen following the release of the much weaker US CPI report for June. USD/JPY fell sharply from around 161.40 prior to the release of the US CPI report to a low of 157.44. The pair has since recovered some lost ground overnight rising back above the 159.00-level. Reuters reported yesterday that Japan intervened to support the yen just after the release of the US CPI report although it has not been officially confirmed. Government officials reportedly told TV Asahi and the Mainichi Shimbun that Japan intervened again. Japan’s top currency official Masato Kanda told reporters yesterday that he wasn’t in a position to say if the move was intervention, and followed up those comments overnight by stating that the narrowing of the yield gap between the US and Japan, and speculation was probably behind those moves. USD/JPY had become increasingly detached from yield spreads recently while short yen positions built up by Leveraged funds have risen to their highest levels since back in 2017. If Japan intervened again yesterday, it would suggest a change in strategy to a more pro-active approach rather than reactive. Reinforcing the move lower in USD/JPY after the much weaker US CPI report will have triggered a bigger squeeze of short yen positions. The yen has been supported as well overnight by reports that the BoJ carried out a rate check at around 8.30am in Tokyo trading hours.

The heightened risk of further intervention from Japan and pullback in US yields and the USD more broadly should discourage speculators from quickly rebuilding short yen positions in the near-term although we are not yet convinced that the peak is now in place for USD/JPY. Even though the yen has strengthened it does not alter our forecast for the BoJ to tighten policy further later this month. We still expect the BoJ to deliver a 15bps rate hike and to announce details of their plans to slow down the pace of JGB purchases from around JPY6 trillion/month at present. It continues to pose upside risks for Japanese yields although the adjustment higher in yields has failed to provide more support for the yen so far this year.

A STEP LOWER FOR US HOUSING COSTS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

GE |

12:00 |

German Current Account Balance n.s.a |

May |

-- |

25.9B |

! |

|

US |

13:30 |

Core PPI (MoM) |

Jun |

0.2% |

0.0% |

!! |

|

US |

13:30 |

PPI (MoM) |

Jun |

0.1% |

-0.2% |

!!! |

|

CA |

13:30 |

Building Permits (MoM) |

May |

-5.0% |

20.5% |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Jul |

66.3 |

65.9 |

! |

Source: Bloomberg