EUR under pressure from political uncertainty & FOMC risks

EUR: Political risk premium to weigh on EUR

The EUR/USD rate has now dropped nearly two big figures from the high of 1.0900 before the US jobs report on Friday and while the Fed this evening could feasibly add to that downward momentum or help reverse it, the political risk aspect to EUR underperformance will likely persist to some degree through probably at least until the 2nd round of the parliamentary elections on 7th July. The euro was hit yesterday by the increased concerns over an alliance between Rassemblement National (RN) and Les Repubicans (LR). Such a scenario increases the risk of an outright majority although as we laid out in our FX Focus piece on Monday (here), we see that scenario of an outright majority as a low risk outcome.

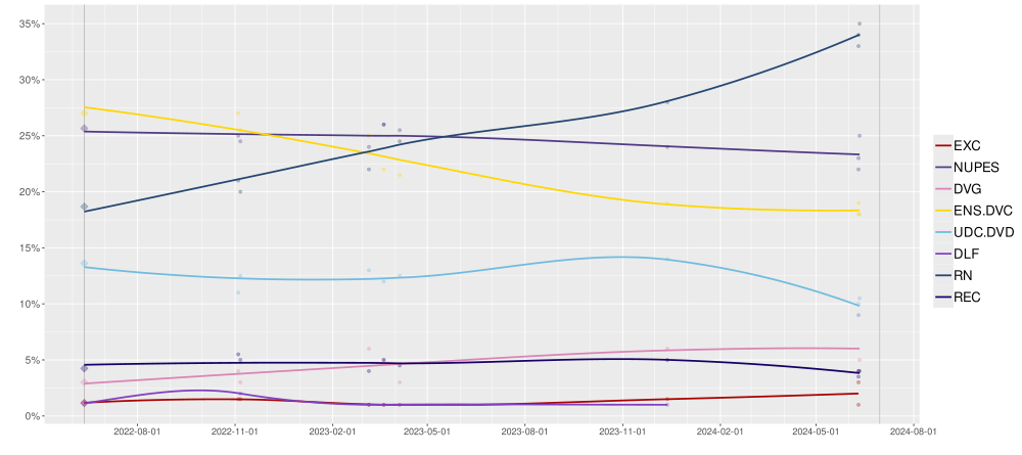

We gave such a low scenario to this outcome not because we didn’t see an alignment as a feasible risk but because an alignment with a unified LR party is highly unlikely. We still believe that’s the case and therefore an alignment with RN would likely split LR. We have now had 2 opinion polls released since the election was called by President Macron on Sunday by Harris Interactive and Opinion Way. The polls have RN on 33%/34% with its far-right partners (Reconquete) on 4%/5%. The new formed (forming) far-left / left alliance is on 31%/29%. The centre-right including LR polled 9%/10% while Ensemble, including Macron’s Renaissance polled 18%/19%.

Assuming some form of split in LR on a move to align with RN, it is therefore extremely difficult to see a far-right led overall majority in parliament. It was for this reason we gave such a scenario a very low probability. Our most likely scenario still seems most plausible – some form of a hung parliament. We essentially have three clear blocks – a far-left block, a centrist block and a far-right block. For sure, RN has the upper hand and will likely be the largest single party but a path to govern in order to legislate it’s key policy proposals remains very narrow. But understandably, with France’s fiscal position already poor and RN proposing policies like lowering the pension age to 60 from 64, scrapping income tax for the under-30s, increasing agricultural subsidies and increasing notably energy subsidies for low-income families, the fiscal costs would worsen the deficit profile. This is on top of throwing into doubt the need for a consolidation in the upcoming budget. This is what is driving the OAT/Bund spread wider and does not in our view reflect “break-up risk” Indeed, RN’s view on the EU has softened considerably with their leader, Jordan Bardella stating recently that he is not anti-EU, just anti-the way the EU works”. The policies of leaving the EU or the single currency has long been dropped by RN.

Still, as we cited in our FX Focus piece on Monday, the prospect of a further increase in the political risk premium priced into the euro remains high with even the current most plausible best-outcome looking like some degree of hung parliament. That’s a bad outcome especially coupled with increased power for RN. EUR/USD downside risks will intensify especially if the Fed is hawkish this evening.

INITIAL POLLING PUT RN WELL AHEAD ON 34%/35% FOLLOWED BY THE LEFT-ALLIANCE (NUPES) ON 22%/23% & ENSEMBLE ON 18%/19%

Source: Wikipedia; as of 12th June 2024

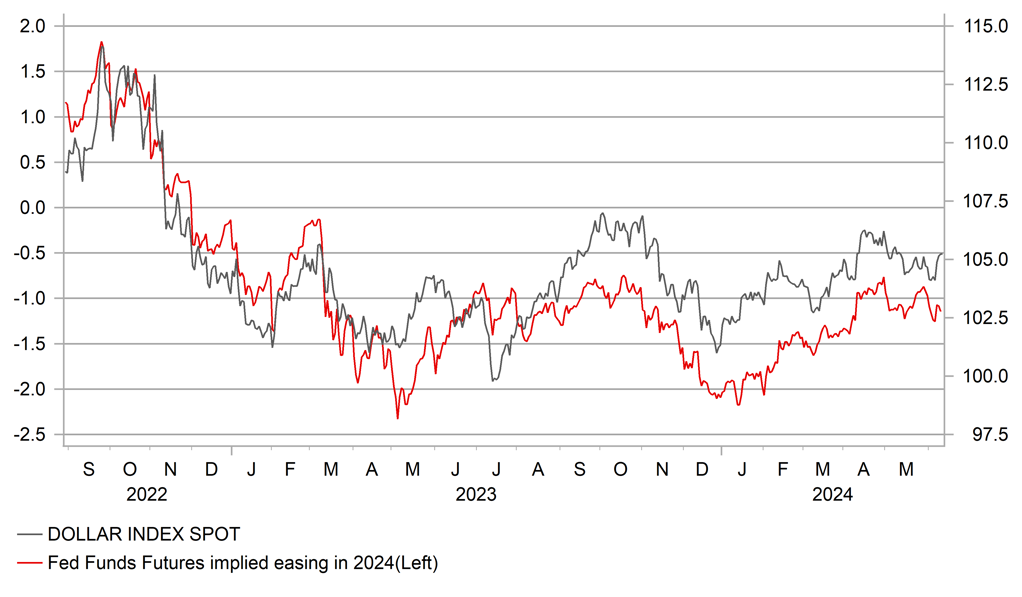

USD: FOMC finely balanced between one or two dots

The FOMC meeting this evening will be key for the US dollar and ahead of that we have the May CPI data which could of course shape the outcome and the tone of the message from Fed Chair Powell. The headline MoM rate is set to slow to just 0.1% but the core rate is set to remain at the April pace of 0.3%. Goods disinflation is expected to lead the way so if there is a downside surprise today it will likely come from a weaker services inflation print. The big part of that will be rents and while a slowdown is due to unfold, the timing of that remains very unclear. Certainly a softer core services or rent inflation reading would likely help alter expectations to a more dovish communication from the Fed later. It would help Chair Powell signal to the market that the monetary policy stance is tight enough to bring inflation back to target.

There will be three key focuses this evening – the Fed statement; the Summary of Economic Projections; and the press conference. The statement from 1st May still looks broadly consistent with conditions today so the statement will be similar to May. The dots is what will likely be much more important. The market seems divided close to 50-50 on whether the Fed will drop one or two dots from the median. There is currently 36bps of cuts priced so if the Fed signals two cuts for 2024 we will likely see a drop in yields and the dollar while a signal of just one cut will see yields rise and the dollar strengthen. One possible caveat that could be important is what the Fed signals for 2025. In March the Fed was signalling three cuts in 2025 and three cuts in 2026. If the reduction in 2024 is offset partially or fully in 2025 it will limit the dollar strengthening reaction. We lean slightly to the Fed removing just one dot and signalling two cuts this year but it really is finely balanced. We would certainly expect a drop to just one dot to be offset by an increase of at least one dot in 2025.

The press conference will be key also. We see no reason (especially if CPI is at least as expected or weaker) for Powell to abandon the view that policy is restrictive enough and will maintain the key message that cuts are coming, but have been delayed. That type of messaging will help curtail dollar strength on a one-dot scenario. Given the political uncertainty in Europe, we would need a two-dot outcome and a reasonably dovish press conference to prompt any meaningful bounce in EUR/USD.

FED IMPLIED EASING EXPECTED OVER 18MTHS VS DXY

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:30 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-5.2% |

! |

|

GE |

12:00 |

German Current Account Balance n.s.a |

Apr |

-- |

27.6B |

! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

-- |

-- |

0.7% |

!! |

|

US |

13:30 |

Core CPI (MoM) |

May |

0.3% |

0.3% |

!!!!! |

|

US |

13:30 |

Core CPI (YoY) |

May |

3.5% |

3.6% |

!!!! |

|

US |

13:30 |

CPI (YoY) |

May |

3.4% |

3.4% |

!!!! |

|

US |

13:30 |

CPI (MoM) |

May |

0.1% |

0.3% |

!!!! |

|

US |

13:30 |

Real Earnings (MoM) |

May |

-- |

-0.4% |

! |

|

EC |

14:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

14:45 |

ECB McCaul Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

Cleveland CPI (MoM) |

May |

-- |

0.3% |

!! |

|

US |

16:00 |

Thomson Reuters IPSOS PCSI |

Jun |

-- |

54.31 |

! |

|

CA |

16:00 |

Thomson Reuters IPSOS PCSI (MoM) |

Jun |

-- |

47.25 |

! |

|

US |

19:00 |

Federal Budget Balance |

May |

-259.3B |

210.0B |

! |

|

US |

19:00 |

FOMC Economic Projections |

-- |

-- |

-- |

!!!!! |

|

US |

19:00 |

FOMC Statement |

-- |

-- |

-- |

!!!!! |

|

US |

19:00 |

Fed Interest Rate Decision |

-- |

5.50% |

5.50% |

!!!!! |

|

US |

19:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!!!! |

|

CA |

20:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

GE |

20:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg