USD extends advance in anticipation of heightened US & China tensions

USD/CNY: Trump appointing China hawks weighs on regional currencies

The US dollar has continued to strengthen at the start of this week with gains most evident overnight against the Australian dollar and Asian currencies. The looming prospect of an escalating trade war between the US and China after Donald Trump won the US election is reinforcing the adjustment lower for Asian currencies since the end of September. After hitting a low of 6.9713 on 26th September, USD/CNH rose back above the 7.2500-level overnight for the first time since the disorderly unwind of carry trades from back in early August. It leaves the pair on course to retest the year to date high from 3rd July at 7.3114. It follows reports that Donald Trump is set to pick two men with track records of harshly criticizing China for key posts in his new administration adding to investor concerns that relations between the two countries will deteriorate further in the coming years. Senator Marco Rubio is set to become the first sitting secretary of state to have been sanctioned by Beijing. Florida Representative Mike Waltz, who has called China a “greater threat” to the US than any other nation, is reportedly in line to be national security adviser. Furthermore, Elise Stefanik who is Trump’s nomination as US ambassador to the United Nations has also been outspoken on China citing national security and economic threats posed by the “Chinese Communist government” as one of her priorities when serving as congresswoman for New York.

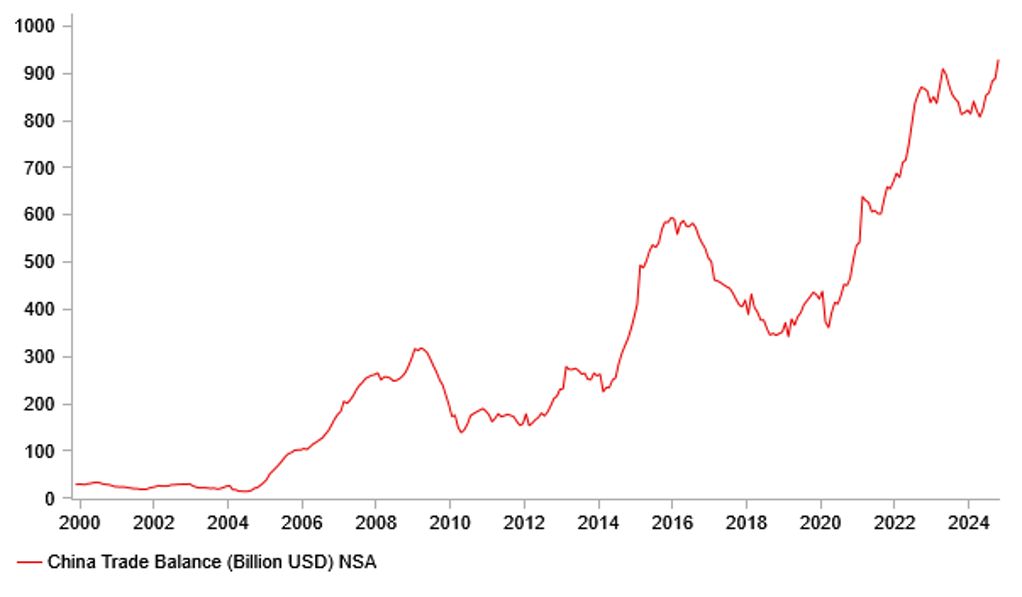

China’s rising trade surplus will be another area of mounting concern for the incoming Trump administration. Bloomberg reported yesterday that China’s trade surplus is on track to hit a fresh record high this year of almost USD1 trillion if it continues to widen at the same pace it has in the year to date. The goods trade surplus rose to USD785 billion in the first ten months of this year which is 16% higher than in the same period of 2023. It highlights that China has been relying more on exports to compensate for weakness in domestic demand. A strategy that will receive stronger pushback from the incoming Trump administration. At the same time, foreign companies have continued to pull money out of China. Foreign direct investment liabilities fell in the first nine months of this year, and are on course to be the first annual net outflow of FDI since at least 1900 when comparable data begins. We expect Chinese policymakers to allow the renminbi to weaken further to provide an offset to higher import tariffs that are likely to be imposed by Donald Trump during his second term as President. The growing size of China’s trade surplus indicates though that a an even weaker currency is not really required with the renminbi likely to become more undervalued.

CHINA’S RISING TRADE SURPLUS IS A RED FLAG FOR TRUMP

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Braced for further weakness after US election

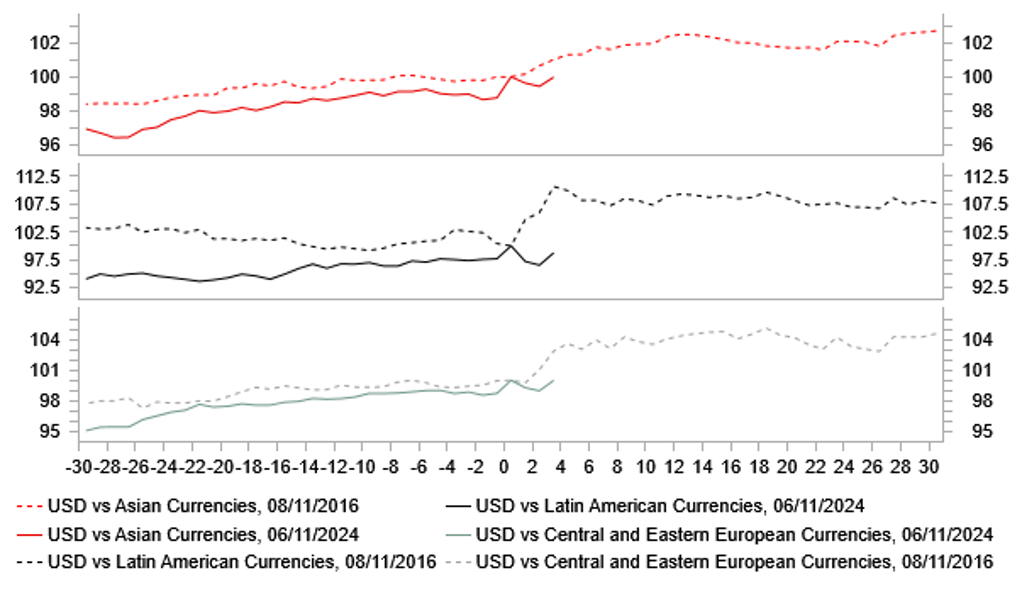

Emerging market currencies have on the whole weakened over the past week although they have held up better than some feared at least initially after the US election. It has still resulted in emerging market currencies falling to fresh year to date lows on average against the USD. The worst performing emerging market currencies since last Monday have been the THB (-3.1% vs. USD), HUF (-3.0%), ZAR (-2.8%), CLP (-2.6%), PLN (-2.5%) and CZK (-2.5%). In contrast, the Latam currencies of the COP (+1.7% vs. USD) and BRL (+0.5%) have outperformed. Measures of implied volatility for emerging market currencies have fallen back now that uncertainty over the outcome for the US election has eased.

The decisive election victory for Donald Trump and likely Red Sweep for the Republicans is viewed as the most bullish outcome for the USD although narrow majorities in both Houses of the Congress could still curtail room for manoeuvre when setting policies. Market attention is now quickly turning to who Donald Trump will pick to hold key positions in his incoming government. It has already been reported that Donald Trump has chosen Tom Homan to be his “border czar” and to implement tougher immigration policies. Trump’s picks to be US Treasury Secretary and Trade Representative will be more important for the FX market. The FT reported at the end of last week that Donald Trump has asked Robert Lighthizer to be the US trade Representative again although it is not confirmed. It was a role he carried out during Trump’s first term. He is a well-known trade hawk which fits with Trump’s policy agenda to significantly raise tariffs on imports from China and other major trading partners. A development that should encourage further emerging market currency weakness.

At the same time, Chinese policymakers have announced further details of their plans to provide support for the economy. The National People’s Congress Standing Committee approved a CNY10 trillion package for local authorities to bring off-balance sheet debt onto their books. The local government debt restructuring should reduce pressures from near-term debt repayment and lower debt servicing costs creating more room to execute budgeted spending to meet this year’s growth target. Finance Minister Lan also hinted that further fiscal measures to stabilize the housing market, inject bank capital and support domestic demand are in the pipeline but did not go into specifics. More forceful fiscal spending is more likely next year to provide an offset to the negative impact from higher tariffs imposed on imports to the US. The lack of details over further fiscal stimulus has left market participants disappointed and will contribute to further weakness in emerging market currencies heading into year end.

EM FX PERFORMANCE AROUND 2016 & 2024 US ELECTIONS

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Nov |

13.2 |

13.1 |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Nov |

20.5 |

20.1 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Oct |

91.9 |

91.5 |

! |

|

GE |

13:00 |

German Current Account Balance n.s.a |

Sep |

-- |

14.4B |

! |

|

US |

15:00 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

15:15 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

19:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Loan Officer Survey |

-- |

-- |

-- |

! |

Source: Bloomberg