USD rebounds after stronger US CPI report

USD: Stronger US CPI report further dampens Fed rate cuts expectations

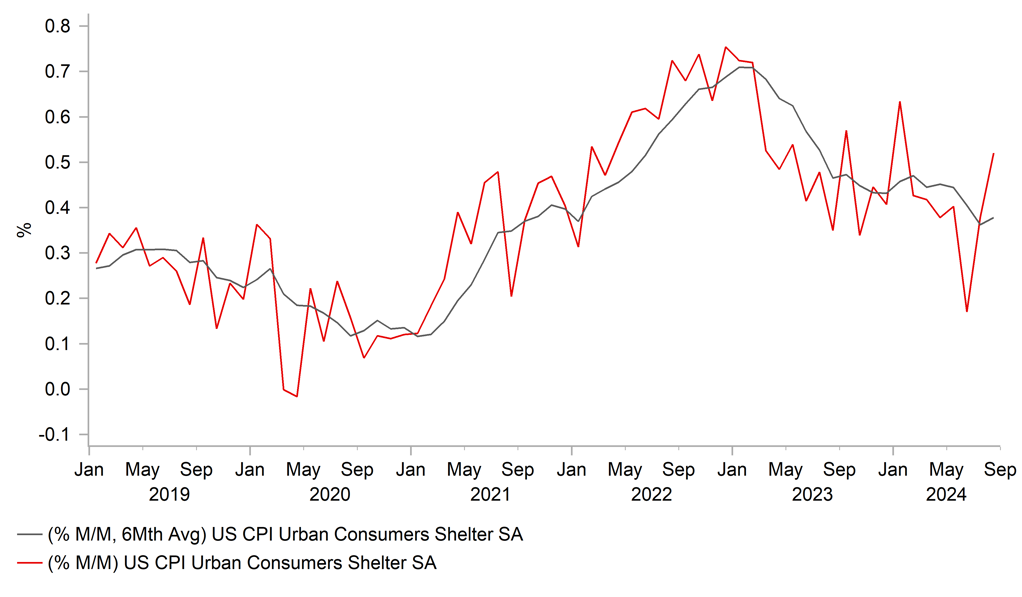

The US dollar has continued to trade on a stronger footing during the Asian trading session following the release of the stronger than expected US CPI report for August. It has further dampened market expectations for the Fed to deliver a larger 50bps cut when they begin their easing cycle next week. The US rate market is now pricing in around 29bps of cuts ahead of next week’s FOMC meeting reflecting greater confidence that the Fed will cut rates by only 25bps. It follows hot on the heels of the release at the end of last week of the nonfarm payrolls report for August that showed a pick up in employment growth. The stronger US CPI report for August has resulted in the 2-year US government bond yield rising by around 8bps helping to provide more support for the US dollar in the near-term. The US CPI report revealed that the core inflation increased more strongly than expected by 0.28%M/M in August. It was the first upside surprise for core inflation since April when the US CPI report for March was released. The upside surprise for core inflation was mainly driven by the owners equivalent rent component that increased by 0.5%M/M. Within core services, shelter inflation contributed +0.24ppts to the monthly increase of 0.4%M/M. It was the largest monthly contribution from shelter since January. The other main upward contribution to core services inflation in August came from transport services which added +0.07ppts including a 3.9%M/M increase in airline fares.

While the stronger US CPI report is unlikely to prevent the Fed from cutting rates, it is likely to make them more cautious about cutting rates more quickly in the near-term. The Fed are more likely to see the stronger report for August as a one-off given clear evidence of slowing inflation in the previous four months, loosening labour market conditions and falling commodity prices. At the same time, the upside surprise in the core CPI print was mainly driven by components that have a smaller weight in the core PCE deflator which is the Fed’s preferred inflation gauge. The core PCE deflator is still expected to increase at a slower pace of 0.2%M/M in August. To acknowledge that inflation has been softer than expected since the June FOMC meeting, the Fed are expected to lower their forecast for the core PCE deflator in Q4 from 2.8%.Y/Y. As a result the August CPI report does not significantly alter our outlook for a weaker US dollar. We still expect the weakening US labour market to encourage the Fed to speed up rate cuts later this year.

The adjustment higher in US yields has helped to lift USD/JPY back closer to the 143.00-level overnight after the pair hit a fresh year to date low yesterday at 140.71. The yen was initially boosted yesterday by further hawkish comments BoJ board member Junko Nakagawa who signalled that further rate hikes are likely. She stated that “I think that the degree of monetary easing will be adjusted if the outlook for Japan’s economy and inflation is realized. The current level of real rates is extremely low”. Her comments support out our view that the BoJ is likely to hike rates again this year in December. BoJ board member Naoki Tamura also spoke overnight and indicated his preference for higher rates. He stated “I believe that we need to raise the short-term rate to at least around 1.00% in the 2H of the BoJ’s projection period through fiscal year 2026”. He believes that the neutral policy rate is at least around 1.00%. He is viewed as one of the most hawkish BoJ officials which has helped to dampen the impact of his comments overnight on the yen.

SHELTER INFLATION BOUNCES BACK AFTER WEAKNESS IN JUNE

Source: Macrobond & Bloomberg

EUR/GBP: ECB to stick to gradual rate cut plans

The euro has fallen back against the US dollar ahead of today’s ECB policy meeting bringing the pair closer to the 1.1000-level. It has been mainly driven by the stronger US dollar leg rather than a weaker euro. In contrast, the euro has strengthened modestly against the pound resulting in EUR/GBP rising up towards 0.8450. The pound has weakened against the euro since the release yesterday of the monthly GDP report from the UK revealing that growth flat-lined for the second consecutive month in August. After surprisingly strong growth in the 1H of this year, the UK economy is losing upward momentum in the 2H of this year. The data broadly fits with the BoE’s view that GDP growth would slow to 0.4% in Q3 after expanding by 0.6% in Q2 although risks are now more titled to the downside. We do not expect the BoE to cut rates again until the November MPC meeting, but there is an increasing likelihood that the BoE could deliver back to back cuts in November and December that could trigger some reversal of pound strength if the BoE shifts to a faster pace of cuts later this year.

We expect the ECB to cut their policy rate again today by 25bps for the second time in the current easing cycle. The policy adjustment is fully priced in ahead of today’s policy meeting so the market reaction today will be mainly driven by updated policy guidance. As we highlighted in our latest FX Weekly report (click here), we expect the ECB to stick to their current plans for cautious easing. While President Lagarde is unlikely to rule out another cut as soon as next month, we believe it remains more likely that the ECB will wait until the December policy meeting to lower rates for a third time. A stronger signal for an October cut would be needed to trigger a bigger euro sell-off.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE Breeden Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:15 |

Deposit Facility Rate |

Sep |

3.50% |

3.75% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

227K |

227K |

!! |

|

US |

13:30 |

PPI (MoM) |

Aug |

0.1% |

0.1% |

!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

SZ |

15:25 |

SNB Chairman Thomas Jordan speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg