JPY giving back gains amidst heightened geopolitical risks in Middle East

JPY: Heightened geopolitical risks in Middle East threaten risk asset recovery

The yen has continued to weaken at the start of this week resulting in USD/JPY rising back towards the 148.00-level. The ongoing reversal of yen strength is also helping to support the rebound in Japanese equity markets. The Nikkei 225 index has risen strongly overnight by just over 3%, and now fully reversed the 13% plunge from last Monday. The return of more stable financial market conditions is a welcome development. The improvement in global investor risk sentiment has seen the high beta G10 commodity currencies of the New Zealand dollar (+1.4% vs. USD), Norwegian krone (+1.2%), Australian dollar (+1.1%) outperform over the past week while the low yielding safe haven currencies of the yen (-2.3% vs. USD) and Swiss franc (-1.9%) have given back recent strong gains. One area of concern that has the potential to at least temporarily disrupt the tentative improvement in global investor risk sentiment this week are geopolitical risks in the Middle East. It has been reported that an Iranian attack against Israel has grown even more likely and may come as soon as this week according to officials. White House spokesman John Kirby stated yesterday that the US and its allies “have to be prepared for what could be a significant set of attacks”. Israel believes “it’s increasingly likely that there’ll be an attack” by Iran and its proxies, and “we share those concerns”. The last time Iran attacked Israel was in April when it fired hundreds of ballistic missiles and drones of which almost all were intercepted. Israel then responded with a limited drone operation but elected not to escalate further. Markets participants are now waiting to see how Iran will respond to the assassinations by Israel of Hamas leader Ismail Haniyeh and the top military commander of Hezbollah, Fouad Shukr. The price of oil has rebounded back above USD80/barrel over the past week alongside the improvement in global financial market conditions but market participants do not appear overly concerned that the supply of oil will be negatively impacted by the escalating tensions in the Middle East.

One additional downside risk for the New Zealand dollar in particular is tomorrow’s RBNZ policy update. We expect the RBNZ to deliver a significant dovish shift in their policy stance. There are currently around 19bps of rate cuts priced in ahead of tomorrow’s meeting highlighting that markets are expecting the RBNZ to kick off their monetary easing cycle in response to weak growth and slowing inflation in New Zealand. The RBNZ had previously signalled that they were planning to wait until next year to begin lowering rates. With the policy rate currently at 5.50% and well above estimates of the neutral rates which the RBNZ judges could be just below 4.00% with elevated inflation expectations and closer to 2.50% on average in the long-term, there is plenty of room for the RBNZ to lower rates in the year ahead.

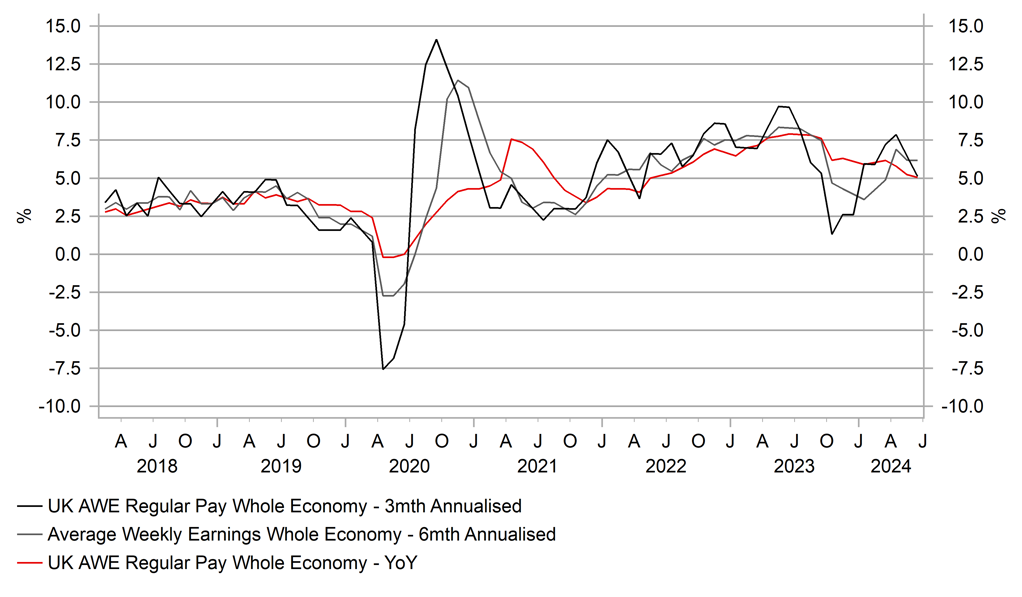

SLOWING UK WAGE GROWTH BUT STILL UNCOMFORTABLY HIGH

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Labour market report market reinforces rebound for pound

The pound has continued to recover lost ground at the start of the European trading session following the release of the latest UK labour market report. It has resulted in EUR/GBP dropping back below 0.8550 and cable rising back above the 1.2800-level. The pound is currently on course for fifth consecutive day of gains against the US dollar that mainly reflects the ongoing improvement in financial market conditions. The higher yielding pound was hit recently by the pick-up in financial market volatility. Elevated long pound positions also made it vulnerable amidst the broad-based adjustment in positioning.

The pound’s rebound has been reinforced this morning by the release of the latest UK labour market report which has prompted market participants to scale back near-term BoE rate cut expectations. The report revealed that payroll employees increased by an estimated +24k in July and by 252k over the past year. At the same time, the unemployment rate dropped by +0.1 point to 4.2% in Q2 as the number of unemployed fell by -51k. While the report suggests that the labour is not as weak as feared, there was further encouraging that wage growth is slowing. Average regular earnings excluding bonuses slowed to 5.4% in April to June compared to the previous reading of 5.8%. Median pay growth is running at similar pace. The slowdown is not sufficient to encourage expectations that the BoE will deliver back to back cuts in September.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Aug |

32.6 |

41.8 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Jul |

91.5 |

91.5 |

! |

|

US |

13:30 |

PPI (YoY) |

Jul |

2.3% |

2.6% |

! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

5.1% |

! |

|

US |

18:15 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg