Scope for further USD gains

USD: China disappointment to help the dollar

The US dollar on a DXY basis has broken back above the 107-level today for the first time since 26th November helped by the decisions of the SNB and the ECB to cut rates yesterday – the SNB by more than the markets expected (see below). The dovish tone from the ECB could well be in contrast to what comes next week from the FOMC, which while set to cut rates by 25bps, could well signal much greater caution over the outlook for further cuts in 2025. The US dollar has been further helped by the disappointment after the end of the Central Economic Work Conference (CEWC) yesterday that failed to provide much in the way of detail on fiscal stimulus support for the economy. Perhaps this is more a reflection of market expectations being too high as the outcome from the CEWC is never to provide specific details on economic policy but more the top-down overview. The overall message was still consistent with greater efforts to stimulate growth in 2025. There was a particular emphasis on lifting personal consumption with “vigorous” efforts promised to boost consumption and help stabilise employment and lift income growth in line with overall economic growth.

Fiscal policy is what market participants want to hear more on but there was only a general commitment to “lift the fiscal deficit ratio” next year. The general-budget deficit was 3% in 2024 so going above that level will be significant as it rarely happens but there was little detail to what extent the increase would be. Further detail will likely have to wait until March at the National People’s Congress.

But communications earlier this week on monetary policy is having a clear impact on financial market moves. With a commitment to additional cuts to policy rates and required reserve ratios the 10-year government bond yield has plunged and fell to 1.77% today – a 25bp drop this month alone and to a new record low. The 10-year yield is down 80bps this year, a sharp contrast to the 45bp increase in the 10-year UST bond yield. The plunge in yields is doing little to provide support for equities with the CSI 300 down 2.4% today.

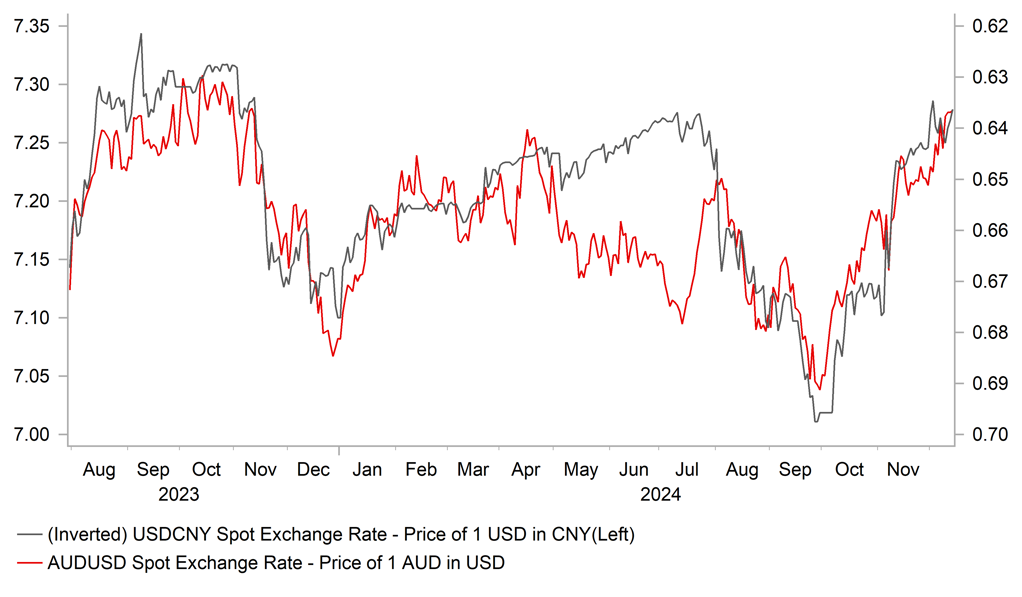

It’s clear monetary easing is coming very soon – any day over the coming weeks – which will ensure upward pressure on USD/CNY continues. The lack of detail on fiscal spending is likely in part to provide greatest flexibility in responding to Trump’s trade policy steps taken following his inauguration. But further substantial monetary easing is highly likely which will inevitably lift USD/CNY further even before we get Trump tariff details. The China factor remains another downside risk for EUR/USD and the likes of AUD/USD with terms of trade risks related to weak China demand.

AUD & CNY TRADING ALIGNED WITH DOWNSIDE RISKS FROM HERE

Source: Bloomberg, Macrobond & MUFG GMR

CHF: SNB surprises with bigger cut

Much of the focus yesterday was on the ECB decision which was largely as expected with the ECB cutting by 25bps to 3.00%. We wrote an FX Focus piece on yesterday’s meeting (here) with the key takeaway being that the ECB has shifted more dovish as expected and there is scope for the ECB to cut by a larger 50bps if it was deemed necessary to get to a neutral stance more quickly than originally planned. That means the downside risk skew for EUR/USD remains in place.

There was a bigger surprise earlier yesterday with the SNB’s decision to cut the key policy rate by 50bps to 0.50%. We have argued in the past that the SNB was being too cautious and was behind the curve given the speed in which inflation was falling in Switzerland. So we believe the SNB action yesterday was correct, albeit a little later than what was needed. It should help contain the appreciation of the franc although risks remain skewed favouring further appreciation.

The problem remains the same – that the SNB is quickly getting into issues related to hitting the lower bound. Of course by cutting by 50bps the lower bound is now closer in sight but the SNB also needs to send a signal to the markets that it is willing to go below zero percent and back into negative rates if required. The fact that this decision yesterday came in incoming SNB President Schlegel’s first policy meeting may be a signal of a bolder approach to policymaking going forward.

However, there was no strong message from the SNB on a willingness to go back into negative territory. Indeed, Schlegel argued that the pre-emptive nature of yesterday’s move reduces the risk of having to go to negative rates. But we think we may already be too late to avoid that. The annual inflation rate has fallen much more sharply than expected and is currently at just 0.7%. The SNB’s forecast for annual inflation was raised very slightly in the updated Monetary Policy Statement yesterday and is estimated to be at 0.7% by Q3 2027. Given the disinflation process in the euro-zone and other major developed economies still has a little further to go and given the risk related to a continued strong Swiss franc, that SNB forecast looks optimistic.

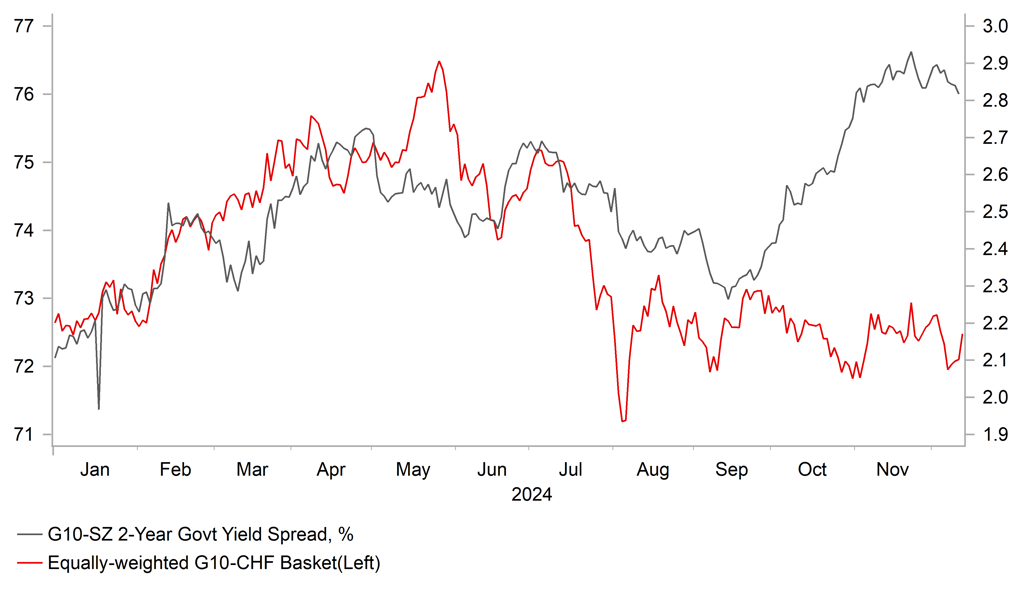

We doubt this 50bp cut will have much impact in altering the path of the franc. Just looking at OIS curves for next year, the SNB is priced to cut by nearly a further 50bps to zero percent. The ECB even after yesterday’s cut is still priced to cut a further 130bps with the Fed to cut another 80bps. The Swiss 10-year government bond yield is just 0..25%. Increased volatility, tariff-induced weak global growth and ongoing geopolitical risks certainly point to the need for the SNB to turn to negative rates and to increase its FX intervention. Until those policies become more apparent, the risk remains for the franc to strengthen further, mainly versus the euro and non-dollar currencies.

WIDER YIELD SPREADS HAVE FAILED TO WEAKEN CHF THIS YEAR

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Inflation Expectations |

-- |

-- |

2.7% |

! |

|

CH |

10:00 |

M2 Money Stock (YoY) |

Nov |

7.6% |

7.5% |

! |

|

CH |

10:00 |

New Loans |

Nov |

950.0B |

500.0B |

!! |

|

CH |

10:00 |

Outstanding Loan Growth (YoY) |

Nov |

7.9% |

8.0% |

! |

|

CH |

10:00 |

Chinese Total Social Financing |

Nov |

2,800.0B |

1,400.0B |

! |

|

EC |

10:00 |

Industrial Production (YoY) |

Oct |

-1.9% |

-2.8% |

! |

|

EC |

10:00 |

Industrial Production (MoM) |

Oct |

0.0% |

-2.0% |

!! |

|

UK |

13:00 |

NIESR GDP Estimate |

-- |

-- |

0.1% |

!! |

|

US |

13:30 |

Export Price Index (MoM) |

Nov |

-0.2% |

0.8% |

!! |

|

US |

13:30 |

Import Price Index (MoM) |

Nov |

-0.2% |

0.3% |

!! |

|

CA |

13:30 |

Capacity Utilization Rate |

Q3 |

78.9% |

79.1% |

! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Oct |

1.2% |

-0.5% |

! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Oct |

0.8% |

0.5% |

!! |

Source: Bloomberg