EUR boosted by Ukraine peace deal optimism

EUR/USD: Ukraine peace deal optimism offsets impact from US CPI report

The euro has strengthened alongside other European currencies following the news yesterday that US President Trump has held talks with Russian President Putin which has boosted investor optimism that a ceasefire deal can reached to end the conflict in Ukraine. It has helped to lift EUR/USD to a high overnight of 1.0440 up from yesterday’s low of 1.0317. Similarly, the Russian rouble and the Central European currencies of the Czech koruna, Hungarian forint and Polish zloty are the best four performing emerging market currencies so far this week. According to reports, US President Trump agreed in a phone call with Russian President Putin to start negotiating an end to the war in Ukraine. President Trump described the call as “lengthy and highly productive”, and stated that their teams would start negotiations immediately and he’ll probably meet President Putin in Saudi Arabia in the “not-too-distant future”. Earlier in the day, new US defence secretary Pete Hegseth told NATO allies that the US wouldn’t contribute troops to secure peace, called eventual NATO membership for Ukraine unrealistic and said Ukraine would probably have to accept the loss of some territory. While saying the US remains committed to Ukraine’s sovereignty and to NATO, he challenged European nations to “step into the arena” and take more responsibility for the continents security. It has reportedly prompted some initial concern from European officials that the US was giving in to some of President Putin’s key demands without getting anything in return. The EU has since stated that Ukraine and Europe must be part of negotiations, Kyiv should be provided with strong security guarantees, and that “just and lasting” peace is a necessary condition for strong transatlantic security.

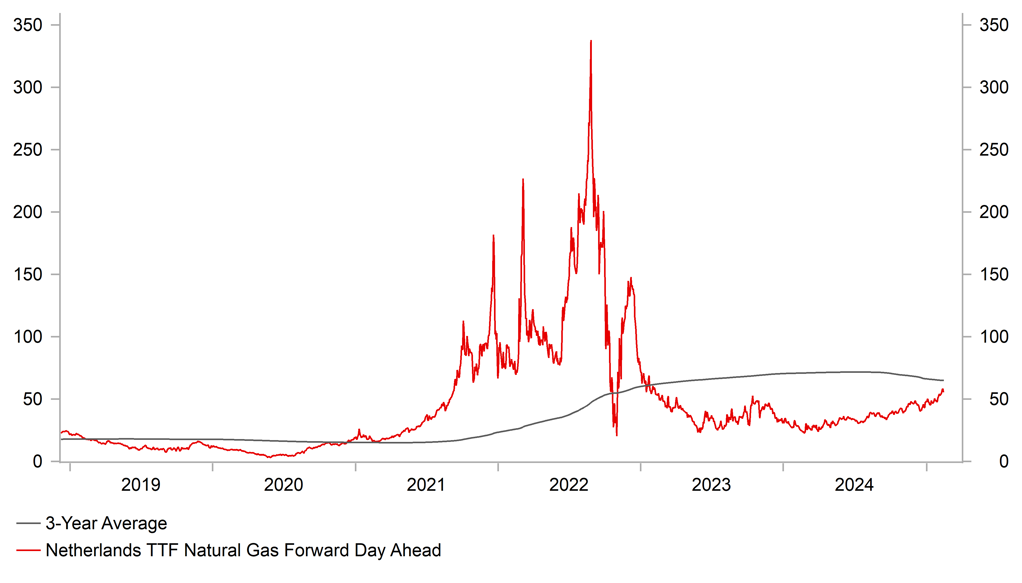

A deal to end the conflict in Ukraine would help to further ease the geopolitical risk premium priced into regional assets providing support for European currencies. The biggest potential positive impact for European economies and currencies will depend on if energy supplies from Russia are restored and how quickly. Natural gas prices in Europe have risen by around 120% over the past year with upward pressure increasing at the start of this year in response to tightening supply and demand conditions. Storage has now fallen below 50% full in Europe and is tracking around 20 percentage points below last year’s level. Europe will need to import more LNG over the summer in order to slow storage withdrawals and meet the EU’s 90% storage fill target by 1st November. A major downside risks to the current bullish price action for the price of natural gas would be the return of significant volumes of Russian gas to Europe in the event of a peace deal in Ukraine.

A recent report in the FT stated that parties in the EU are debating a return to Russian gas as part of a potential Ukraine peace deal. The majority of players mentioned in the report were Hungarian officials who have already indicated that they would open to the return of Russian gas flows. However, it remains unclear to what extent larger western buyers such as Germany and Italy would be open to switching back on Russian supplies after painfully weaning themselves of cheap Russian energy since the Ukraine conflict started. According to reports, the Ukrainian pipeline would be the most viable option for increasing Russian gas flows to the EU within moths of a potential peace deal. The return of significant Russian gas flows to major European economies would deliver a positive shock helping to strengthen the economic recovery and putting further downward pressure on inflation in the near-term. It would encourage the ECB to keep lowering rates towards neutral territory estimated at between 1.75% to 2.25%. Germany’s economy and industrial sector has been stagnating in recent years undermined by higher energy costs. It is a potential development that would support our forecasts (click here) for the euro rebound against the US dollar later this year. Alternatively, a slower return or more limited return of Russian gas would dampen upside for the euro and other European currencies.

Optimism over the potential positive impact of a Ukraine peace deal has weighed on US dollar and offset support from higher US yields following the release yesterday of the much stronger US CPI report for January. The report revealed that headline and core inflation increased robustly by 0.5%M/M and 0.4%M/M respectively in January. It will make the Fed even more cautious over cutting rates further in the near-term following on quickly from the release of another solid US employment report for January. The US rate market has reacted accordingly to further push back the timing of the next Fed rate cut to the autumn of this year. The 10-year US Treasury yield jumped sharply by around 8-10bps lifting it back above 4.60% to reflect higher inflation risk a less Fed easing going forward. It helped to lift USD/JPY as well up to a high of 154.80. There were a couple of caveats which suggest that the Fed is unlikely to overreact to the stronger CPI report. Firstly, it has been suggested that the monthly inflation increase is exaggerated by residual seasonality and some of the strong inflation component such as auto insurance and hospital services do not feed into the Fed’s preferred core PCE deflator measure of inflation. It is still clear though that there is no compelling reason for the Fed to cut rates again soon.

HIGHER ENERGY PRICES IN EUROPE ARE A HEADWIND TO GROWTH

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

European Union Economic Forecasts |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Dec |

-0.6% |

0.2% |

!! |

|

UK |

12:30 |

NIESR Monthly GDP Tracker |

Jan |

-- |

0.0% |

!! |

|

US |

13:30 |

Core PPI (MoM) |

Jan |

0.3% |

0.0% |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

217K |

219K |

!!! |

|

US |

13:30 |

PPI (MoM) |

Jan |

0.3% |

0.2% |

!!! |

|

GE |

17:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg