Stars aligning for further USD strength ahead of Trump’s second term

USD: Upward momentum reinforced by robust NFP report

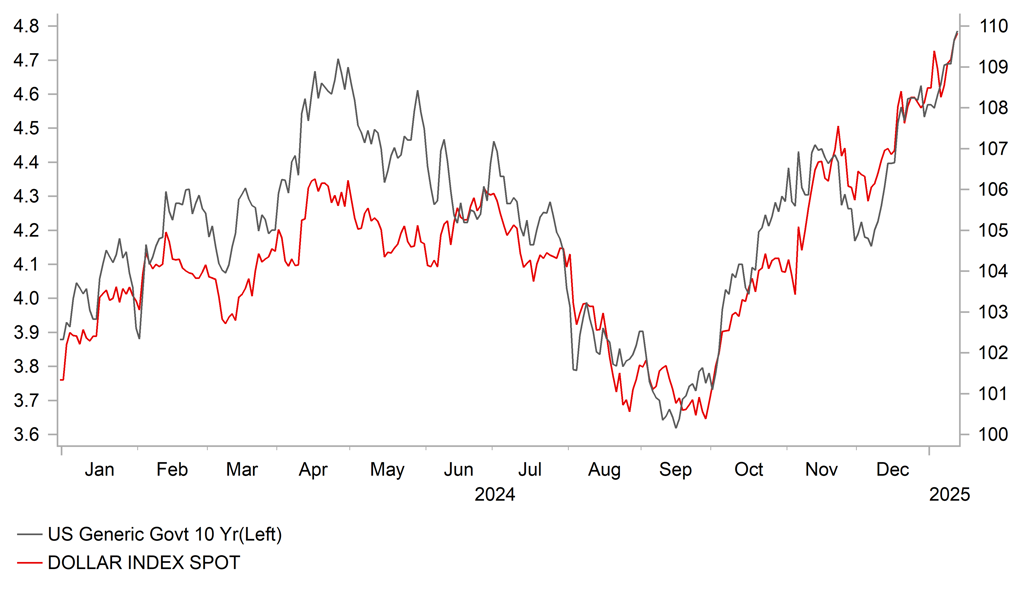

The US dollar has continued to strengthen at the start of this week lifting the dollar index to within touching distance of the 110.00-level for the first time since November 2022. The US dollar’s upward momentum has been reinforced by the release of the much stronger than expected nonfarm payrolls report for December. It has cast further doubts on the need for the Fed to keep lowering rates this year. The US rate market is now only pricing in one further 25bps rate cut from the Fed with the next cut not expected until around the middle of this year. The scaling back of Fed rate cut expectations has added to upward pressure on US yields. The 2-year US Treasury yield closed above resistance from the 200-day moving average at around 4.35% for the first time since June of last year, and the 10-year US Treasury yield hit a fresh high of 4.79%.

The release of the latest nonfarm payrolls report for December revealed that the US economy added a robust 256k jobs. The second consecutive month of stronger job gains following gains of 212k in November. Employment has bounced back strongly following temporary disruption from the hurricane and strikes that took place in October when the US economy added only 43k jobs. On average over the last three to six months, the US economy has added around 165k-170k jobs/month which represents only a modest slowdown from average job gains over the previous twelve months to the end of June of around 210k jobs/month. It has even encouraged some tentative optimism that labour demand might be starting to pick-up in an anticipation of Trump’s second term although more evidence is needed to confirm. It will further reduce pressure on the Fed to lower rates and gives them more time to assess how the outlook for the US economy is evolving at the start of Trump’s second term with the unemployment rate stabilizing at just above 4% in the second half of last year. The Fed’s plans to lower rates further by 50bps this year is built on the assumption that inflation will continue to slow. Market participants will be watching closely the release of the latest US CPI and PPI reports for December in the week ahead to see if the softer inflation reported in November has continued. However, even if there was a second consecutive month of softer US inflation it is difficult to see it triggering a significant dovish repricing of Fed rate hike expectations at the current juncture and reversal of US dollar strength given inflationary fears related to Trump’s policy agenda.

At the same time, long-term US yields are being lifted by rising market-based measures of inflation expectations. The 10-year US break-even rate has risen by around 10bps since the start of this year to its highest level since October 2023 supported by the rebound in the price of oil. The price of Brent has extended its advance at the start of this week rising back above USD80/barrel. Upward pressure on oil prices has been reinforced at the end of last week by the US imposing its most aggressive sanctions on Russia’s oil industry as the Biden administration looks for last-minute ways to boost Ukraine’s leverage in possible peace negotiations when Donald Trump becomes president. The measures announced on Friday target two firms that handle more than a quarter of Russia’s seaborne oil exports, as well as vital insurers and traders linked to hundreds of cargos. The US also broadened sanctions on tankers that have already proved disruptive. Gazprom Neft and Surgutneftegas exported about 970k barrels/day of oil by sea in the first 10 months of 2024 according to Bloomberg which accounts for around 30% of total flows on tankers.

NFP REPORT REINFORCES UWPARD MOMENTUM FOR TRUMP TRADES

Source: Bloomberg, Macrobond & MUFG GMR

GBP: No let up for GBP weakness amidst global bond market sell-off

The pound has continued to underperform at the start of this week with EUR/GBP rising back above the 0.8400-level and cable falling closer to the 1.2100-level. The continued move higher in global bond yields will keep downward pressure on the pound in the near-term and was one of the main reasons why we recommended a new short cable trade idea in our latest FX Weekly report (click here). At the same time, the rebound in the price of oil is negative development for European economies including the UK although the scale of the move is not yet likely to have a significant negative impact. At the margin it will add to the BoE’s ongoing caution over cutting rates further alongside the recent weakening of the pound.

The release of the latest UK CPI report for December will be watched closely in the week ahead to assess if inflation in the UK continues to prove sticky especially in the services sector. Another sticky inflation report would normally encourage a stronger pound by pushing back BoE rate cut expectations. However, in the current market environment where the ongoing sell-off in Gilts is creating more concern amongst market participations over the government fiscal positions, even a stronger UK inflation report could be viewed more negatively for the pound.

Higher UK yields if they persist will increase pressure on the government to adjust fiscal policy plans. It has already been estimated that the increased cost of government funding is likely to use up all of the government’s fiscal headroom estimated at GBP9.9 billion in the Autumn Budget. Treasury officials have already tried to provide reassurance to market participants that the government will respect their self-imposed fiscal rules and tighten fiscal policy if judged as necessary by the independent Office for Budget Responsibility (OBR). The Spring Forecast takes place on 26th March and Spending Review in late Spring. The British press have already reported that the government is considering emergency tax hikes or spending cuts if required, and attempt to boost investor confidence in the their growth strategy. The Autumn Budget continues to draw criticism for outlining front-loaded fiscal stimulus which contributed to the BoE’s caution over cutting rates further.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

SECO Consumer Climate |

-- |

-38 |

-37 |

!! |

|

CA |

11:00 |

Leading Index (MoM) |

Dec |

-- |

0.28% |

! |

|

US |

15:00 |

CB Employment Trends Index |

Dec |

-- |

109.55 |

! |

|

US |

16:00 |

Consumer Inflation Expectations |

Dec |

-- |

3.0% |

! |

|

US |

19:00 |

Federal Budget Balance |

Dec |

-67.6B |

-367.0B |

!! |

|

JP |

23:50 |

Adjusted Current Account |

Nov |

2.59T |

2.41T |

!! |

Source: Bloomberg