Fed policy update overshadowed by weak US CPI report

USD: Weak US CPI report casts doubt on Fed’s hawkish policy update

The US dollar has stabilized overnight at weaker levels after yesterday’s volatile trading session. The dollar index is currently trading at just above the 104.80 after hitting an intra-day low yesterday of 104.26. The US dollar has recovered some of the lost ground after the Fed’s hawkish policy update. The updated DOT plot signalled that the Fed is now planning to cut rates only one time this year down from the three rate cuts planned at the March FOMC meeting. The breakdown of the votes was finely balanced with four members expecting no rate cuts this year up from two in March, seven members expecting to cut rates once, and eight members expecting to cut rates twice. The hawkish update to plans for rate cuts this year was partially offset by the Fed adding in one additional rate cut into plans for next year when it is now expecting to deliver 100bps of cuts by the end of 2025. It sends a dovish signal that it is more a case of delaying rather than abandoning plans for lower rates in the coming years. The median projection for the Fed funds rate at the end of 2026 was also left unchanged at 3.1% although the FOMC participants did modestly lift their estimates for the longer run neutral policy rate by 0.2ppt to 2.8%.

The US rate market and ourselves are not fully convinced that the Fed will deliver only one rate cut this year as currently planned. There are still around 43bps of cuts priced in by the December FOMC meeting. Those doubts were supported by comments from Fed Chair Powell in the press conference in which he described the softer than expected US CPI report for May that was released earlier in the day as “encouraging”, and noted that although the committee was briefed on them, “most people generally don’t” update their projections when such data arrive in the middle of policy meetings. The comments hint that the updated projections revealed overnight were already somewhat stale, and after fully incorporating the softer inflation in May, it could tip the Fed back in favour of delivering multiple rate cuts in the 2H of this year. The updated policy statement did at least acknowledge that there had been “modest further progress” in returning inflation back towards their 2.0% target even though the core PCE deflator forecast for this year was revised higher by 0.2ppt to 2.8%.

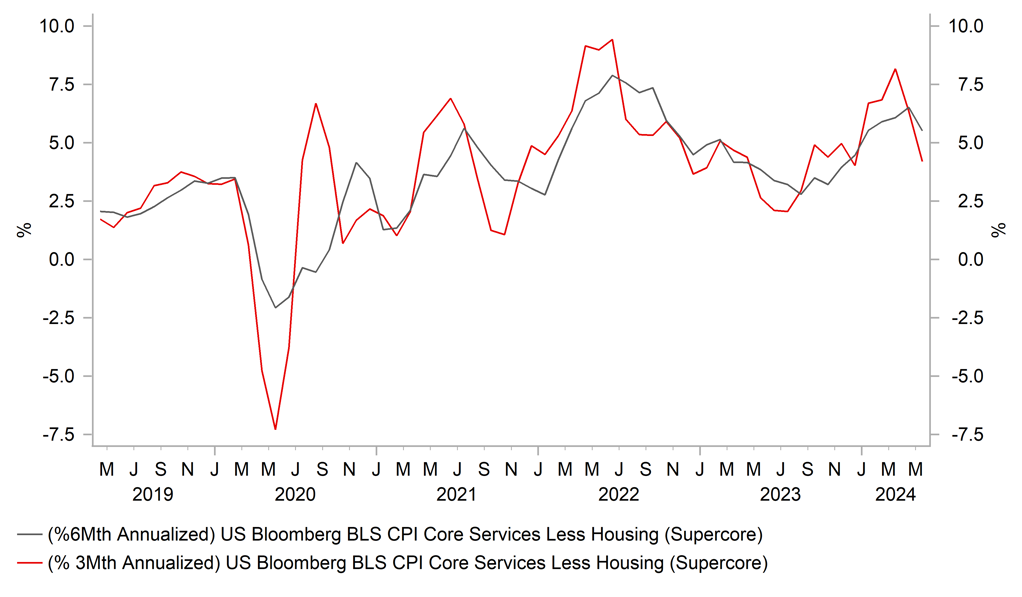

The release yesterday of the latest US CPI report for May provided further reassurance for the Fed that the pick-up in inflation pressures at the start of this year was not the start of a more sustained period of higher inflation. The report revealed that core inflation slowed for the second consecutive month in Q2. The May core inflation reading of +0.16M/M was the smallest monthly increase since August 2021. The breakdown revealed that core goods inflation declined marginally for the third consecutive month by -0.04% M/M driven by new vehicle prices (-0.5% M/M). The good news for the Fed was that there a significant slowdown in core services inflation even though growth in rent and OER ticked up slightly. Core services inflation slowed to +0.22%M/M in May down from +0.41%M/M in April. After stripping out housing inflation that continues to prove persistent despite market-based measures of rents slowing, core services inflation actually fell marginally by -0.04%M/M. It is a measure of inflation that Chair Powell has been tracking closely and will encourage the Fed to consider cutting rates sooner if sustained in the coming months. The measure was though dragged lower by a sharp -3.6% M/M decline airline fares which likely overeggs the scale of the slowdown in May. While the PPI report for May is not released yet, the CPI indicates that the core PCE deflator could increase by just +0.1%M/M in May which would help bring the annual rate closer to 2.5% as it continues to moves towards the Fed’s 2.0% target.

Overall, the report backs our forecast for the Fed to cut rates multiple times this year (click here) as slowing inflation opens the door for lower rates. A view that would be backed up as well if the labour market were to weaken more than expected. The Fed’s updated projections revealed that they remain optimistic that the unemployment rate will remain relatively stable and hold at just above 4.0% even though it has been trending gradually higher for almost a year. The Fed delivering multiple rate cuts remains a key assumption behind our forecast for a weaker US dollar in the 2H of this year.

US CORE INFLATION IS SLOWING AGAIN AFTER PICK-UP IN Q1

Source: Bloomberg, Macrobond & MUFG GMR

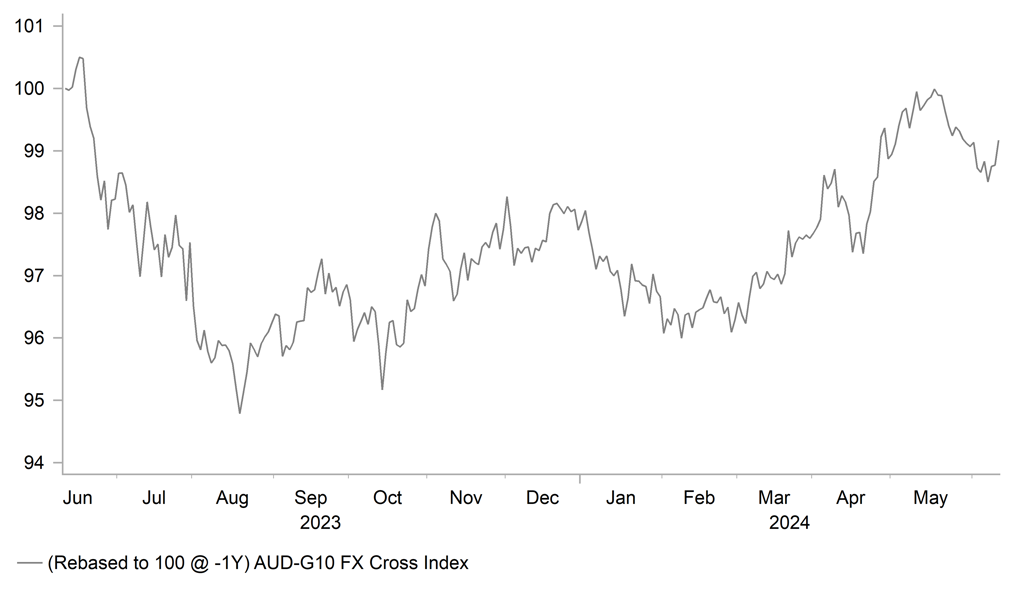

AUD: Strong domestic labour market & China trade risks

The main economic data release overnight was the latest labour market report from Australia. The report revealed that employment growth continued to remain strong in May when the Australian economy added another 39.7k jobs. It is roughly in line with the average for job gains so far this year of 40.7k/month. It marks a step up from last year’s average of 31.9k job gains/month. It was the second consecutive month that job growth has proven stronger than expected in Australia, and has resulted in the unemployment rate falling by 0.1 point to 4.0% in May. It is broadly in line with the RBA’s economic projections so should not significantly alter the RBA’s plans for monetary policy. It has though made Australian rate market participants less confident that the RBA will cut rates this year. A rate cut at the last RBA policy meeting this year is December is currently judged as close to a 50:50 call. The Australian dollar has derived more support in recent months from the hawkish repricing of RBA rate cut expectations alongside the broad-based rebound in high beta G10 currencies encouraged by stronger global growth at the start of this year.

One downside risk for the Australian dollar through the rest of this year is the potential for trade tensions between China and other major economies to intensify ahead of the US election in November. A development that could hurt investor sentiment towards the Aussie as well as Asian currencies. The European Commission announced yesterday that it will impose a baseline level of tariffs calculated at 21% on imported electric vehicles from China. It comes on top of the EU’s existing 10% tariff on cars. The tariffs are set to apply from 4th July. According to the green lobby group Transport & Environment, nearly one in five European sales of fully electric vehicles last year was sourced from China. Market participants are now waiting to see if China will respond by imposing tit-for-tat tariff hikes on imports from the EU.

AUD HAS STRENGTHENED IN RECENT MONTHS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Apr |

0.1% |

0.6% |

!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

US |

12:00 |

Cleveland CPI (MoM) |

May |

-- |

0.3% |

! |

|

US |

13:30 |

PPI ex. Food/Energy/Transport (MoM) |

May |

-- |

0.4% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

225K |

229K |

!!! |

|

EC |

14:30 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

CA |

14:35 |

BoC Deputy Gov Kozicki Speaks |

-- |

-- |

-- |

!! |

|

US |

17:00 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg