USD supported by stronger US CPI report

USD: US CPI report surprises to upside again but USD reaction is muted

The US dollar has continued to trade at modestly stronger levels overnight after the release yesterday of the stronger than expected US CPI report for February. The dollar index initially strengthened by around 0.3% in the hours after the release of the US CPI report but has since given back most of those gains in what was a surprisingly muted overall reaction. In contrast, there been a relatively bigger reaction in the US bond market where the yields on the 2-year and 10-year US Treasury bonds have both increased by around 5bps. The upward adjustment for US yields reflects less confidence amongst market participants that the Fed will cut rates as early or deeply as previously expected after inflation surprised to the upside for the second consecutive month at the start of this year. It has prompted the US rate market to move back more in line with the Fed’s plans from December for three rate cuts this year. At next week’s FOMC meeting on 20th March, the Fed will update those plans but market participants do not appear overly concerned at this stage that officials will indicate a preference for an even slower pace of cuts in light of the recent pick-up in inflation.

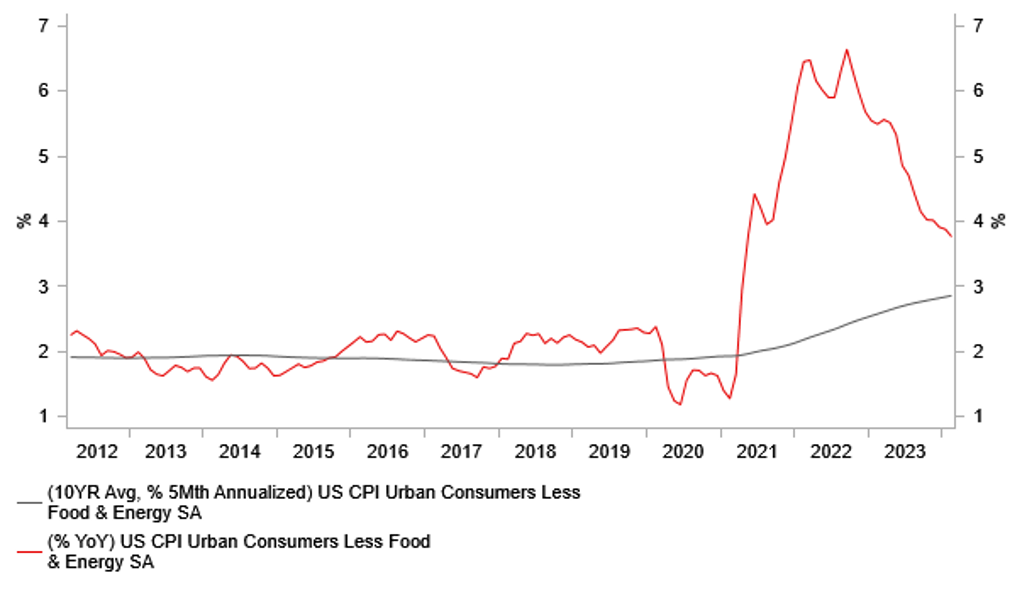

At the very least we are expecting the Fed next week to display more concern over upside inflation risks even if their plans for the number of rate cuts this year remains unchanged. The release yesterday of the US CPI for February revealed that core inflation increased for the second consecutive month by 0.4%M/M after it averaged monthly increases of 0.3%M/M during the 2H of last year. On a three-month annualized rate, core CPI has increased from 4.0% up to 4.2%. The breakdown revealed that core goods inflation was stronger than expected recording the first positive monthly increase of 0.11%M/M since May 2023. While core services inflation was more in line with expectations as it slowed to a monthly increase of +0.46%M/M down from +0.66%M/M in January. The slowdown in core services inflation was helped by a moderation in owners equivalent rent (OER) that increased by +0.44%M/M in February down from +0.56%M/M in January. Core inflation was also boosted by a very strong increase in airline fares that increased by 3.57%M/M in February. It is likely that the jump in airline fares is one-off, and it will not feed into the PCE deflator measure of inflation that the Fed mainly focuses on for setting policy. So while the Fed will likely be more cautious over the outlook for inflation to slow further to their target based on yesterday’s stronger CPI report, the release of the latest PCE deflator report for February at the end of this month is expected to continue to show a relatively more favourable picture for inflation. It is one of the reasons why market participants are not expecting a significant change to the Fed’s plans for three rate cuts this year at next week’s FOMC meeting which is helping to dampen upward pressure on the US dollar from yesterday’s CPI report.

US INFLATION HAS PROVEN MORE STICKY IN RECENT MONTHS

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Stronger wage agreements to encourage gradual policy normalization

USD/JPY initially rose back above the 148.00-level yesterday just after the release of the US CPI report but has since fallen back towards 147.50 overnight. The yen derived some support overnight from announcements by large companies that they have agreed to stronger wage settlements. Bloomberg has highlighted the announcement from Toyota Motor Corp that it has met its labour union demands for increases in salary and bonuses in full for the fourth straight year. Toyota’s union had been seeking a bonus equivalent to 7.6 months of salary last month. Although the union doesn’t disclose exact figures for the wage hike and bonus, Toyota Chief Human Resources Officer stated that they were at the highest ever level. As Bloomberg noted, Honda Motor Co. and Mazda Motor Corp had already announced last month that they will raise wages by 5.6% and 6.8% respectively from a year earlier. Overall, the developments are supportive for our outlook for stronger wage growth in the upcoming fiscal year. In response to questions in parliament overnight, BoJ Governor Ueda reiterated that the results of the spring wage talks will be an important point to monitor, and that he’ll make a comprehensive check of the economy an inflation in order to make an appropriate policy decision.

We continue to expect positive wage negotiation results this week to give the green light for the BoJ to begin to tighten policy next week. In order to dampen the market impact from exiting negative rates and yield curve control, the BoJ will be keen to emphasize that it will be a gradual process of policy normalization unlike the aggressive rate hike cycles implemented by other major central banks in recent years. A message that was reiterated in a BoJ sources piece released by Bloomberg yesterday in which it stated that the BoJ is likely to move slowly in raising interest rates above zero even if it decides to end negative rates according to people familiar with the BoJ’s thinking. The report suggests that BoJ members are cautious about signalling the need for a series of rate hikes. If the BoJ delivers cautious forward guidance alongside hiking rates that casts doubt on the need for further hikes, it could result in the yen weakening further in the near-term by encouraging the use of yen-funded carry trades.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Industrial Production (YoY) |

Jan |

-2.9% |

1.2% |

! |

|

UK |

12:00 |

NIESR Monthly GDP Tracker |

-- |

0.0% |

-0.1% |

!! |

|

JP |

23:50 |

Foreign Bonds Buying |

-- |

-- |

484.6B |

! |

Source: Bloomberg