FX market remains in holding pattern ahead of US inflation data

JPY: BoJ reduces amount of JGB purchases lifting yields but not the yen

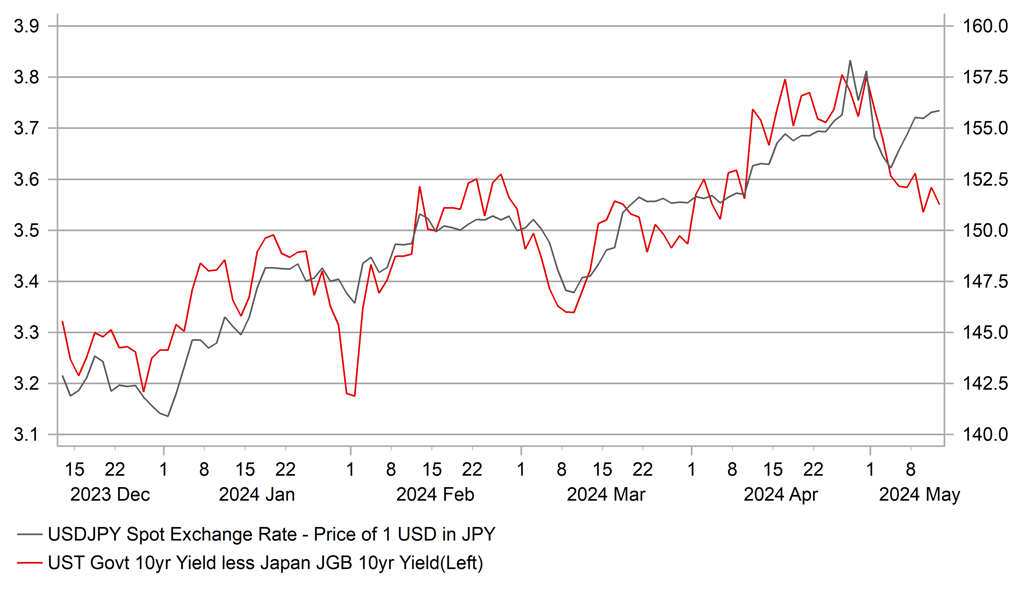

It has been relatively quiet start to the week with major currency pairs trading within tight trading ranges ahead of the release of the latest US CPI (Wednesday) and PPI (Tuesday) reports for April. USD/JPY has continued move gradually higher back towards the 156.00-level overnight even as yields in Japan have adjusted higher offering limited support. The 10-year JGB yield has increased by a further 3bps rising to 0.94% which is the highest level since November of last year when it peaked at 0.97%. The main trigger for the further adjustment higher in Japanese yields overnight was the announcement from the BoJ that it offered to purchase a smaller amount of government bonds in a regular operation on Monday. The BoJ said it would purchase JPY425 billion of 5-10-year JGBs which compares to JPY475.5 billion purchased in the same operation last month on 24th April. While it is still within the planned range for the quarter, it is the first reduction in the purchase amount since late in December. As a result, it will be viewed as the first small step towards slowing the monthly purchase amount of JGBs from around JPY6 trillion in recent months.

As we highlighted in our latest FX Weekly report (click here) the BoJ appears to becoming under more pressure from the government to tighten policy in response to yen weakness. After meeting with Prime Minister Kishida last week, BoJ Governor Ueda changed his tone on the yen when he stated that a policy response maybe required and that FX was an important factor impacting inflation. The minutes from the last BoJ meeting also indicated a more hawkish tone by expressing more concern over yen weakness. We believe that recent comments support our forecast for the BoJ to tighten policy sooner by raising rates again by 15bps in July although we can’t rule out an earlier move in June. An earlier hike in June though could look like the BoJ has given in to political interference. We still believe there is room for yields to continue adjusting higher in Japan given that terminal policy rate expectations remain too low. So far the ongoing adjustment higher in Japanese yields has had limited impact on the yen as it has been offset by higher US yields. However, it does not mean that the tightening of BoJ policy is not important. It should help to bring USD/JPY back below the 150.00-level later this year when the Fed starts to cut rates as well, and there is a clearer narrowing of policy divergence between the BoJ and Fed.

USD/JPY VS. 10-YEAR US-JAPAN GOVT. YIELD SPREAD

Source: Macrobond, Bloomberg & MUFG Research

USD: All eyes on US inflation data to see if USD can regain upward momentum

The USD has lost upward momentum over the past month. After hitting a high on 16th April at 106.52, the dollar index since corrected modestly lower by just over 1.0% as it has fallen back towards the 105.00-level. The recent loss of upward momentum for the USD has resulted in G10 FX volatility falling back towards year to date lows after it threatened to break higher in April. A favourable development for FX carry trades.

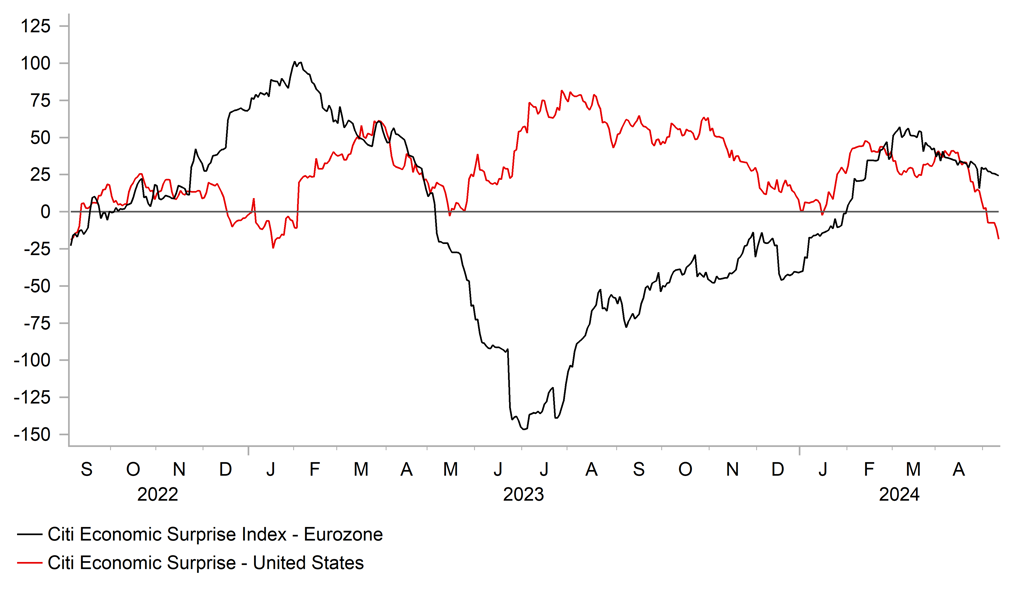

One of the reasons why the USD has lost upward momentum has been building evidence that economic growth has picked up outside of the US at the start of this year. The strength of the economic recovery has been more pronounced than expected in Europe. The euro-zone economy expanded by 0.3%Q/Q in Q1 which was the fastest quarter of growth since Q2 2022. Furthermore, it has been confirmed that the UK economy exited technical recession in Q1 when it expanded well above expectations by 0.6%Q/Q in Q1. Leading indicators are suggesting that improving growth momentum will continue heading into the middle of this year. In the UK some payback weakness is likely in Q2. China’s economy has picked up as well at the start of this year expanding by 1.6%Q/Q in Q1. The release of the latest monthly activity data (retail sales, FAI & IP) for April in the week ahead will be watched closely to see if upward momentum can be sustained.

At the same time, the US economy has continued to grow strongly at the start of this year although there been more signs recently that growth could slow more going forward. The US economy slowed modestly to an annualized rate of 1.6%% in Q1 following robust but unsustainable growth of 4.1% in the 2H of last year. More recently, the run of US economic data at the beginning of Q2 has started to disappoint. The widely followed Citi US Economic Surprise Index on Bloomberg has fallen into negative territory and to the lowest level since January of last year. It highlights that the recent run of upward revisions to US GDP forecasts is coming to an end. The Bloomberg consensus US GDP forecast for this year has already been already been raised by 1.1ppt to 2.4% since the end of last year.

The risk of a bigger correction lower for the USD would increase in the coming months if hard evidence begins to emerge as well backing up the soft survey data that is pointing towards much weaker US growth. The USD sell-off following the release of the latest nonfarm payrolls report for April and last week’s initial claims highlights that there is more concern that stronger employment growth at the start of this year will not be sustained. A sharp slowdown in employment growth in the coming months would support our forecast for the Fed to deliver multiple rate cuts in the second half of this year. We continue to believe that the US rate market has gone too far in scaling back expectations for Fed rate cuts this year.

The main challenge in the week ahead to our view that US rates and the USD are in the process of peaking out will be the release of the latest US inflation reports (CPI & PPI) for April. A fourth consecutive monthly upside inflation surprise is required to inject fresh upward momentum into US rates and the USD in the near-term. Whereas in line or softer prints could see the USD give back more of the gains from the start of this year. A fourth consecutive upside inflation surprise would increase the likelihood of the Fed dropping more rate cuts from their updated plans at the next FOMC meeting on 12th June. It is still difficult though to see the Fed completely dropping plans for rate cuts this year after planning 3 cuts not so long ago in March. The Fed’s reluctance to deliver an even more hawkish policy update at their last policy meeting on 1st May is another reason why the USD has lost upward momentum recently.

In summary, we are wary of chasing the USD higher right now even as monetary policy is beginning to diverge between the Fed and European central banks who are moving to cut rates earlier. We are waiting for confirmation that US yields and the USD are peaking out.

RELATIVE CYCLICAL MOMENTUM BECOMING LESS SUPPORTIVE FOR USD

Source: Macrobond, Bloomberg & MUFG Research

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

GE |

12:00 |

German Current Account Balance n.s.a |

Mar |

-- |

29.8B |

! |

|

US |

14:00 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

! |

|

US |

14:00 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

Consumer Inflation Expectations |

-- |

-- |

3.00% |

! |

|

SZ |

17:45 |

SNB Chairman Thomas Jordan speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg