Will UK & US CPI reports challenge view BoE & Fed have finished hiking?

USD: Rebounds helps to lift USD/JPY closer to last year’s high

The US dollar has continued to trade at stronger levels overnight after staging a rebound last week. It has resulted in the dollar index reversing most of the initial sharp losses following the release of the weaker than expected nonfarm payrolls report for October. The US dollar has been supported by the scaling back of Fed rate cut expectations which has helped to lift short-term US yields. The implied yield on the December 2024 Fed fund futures contract has risen from a low of 4.42% on 3rd November up to 4.70% as market participants have moved to price out around one 25bps rate cut by the end of next year. It still leaves the US rate market almost fully pricing in around 75bps of cuts over that period. The relatively hawkish comments from Fed Chair Powell last week helped to dampen speculation over a bigger dovish shift in Fed policy. He stated that the FOMC “was not confident” that they had achieved a “sufficiently restrictive stance” which even leaves opens the possibility of the Fed delivering one final hike in the current tightening cycle. However, market participants remain unconvinced that further hikes will be required. There are still only 7bps of hikes priced in by the January FOMC meeting and Chair Powell while hawkish did not signal strongly that the Fed will follow through on previous plans to hike again as soon as in December.

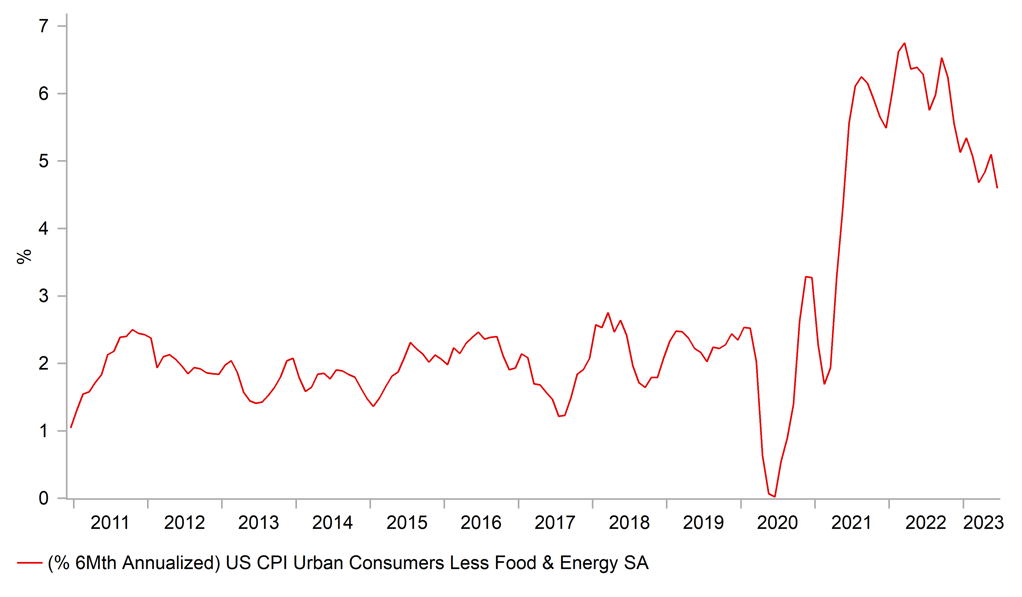

The Fed has been clear though that if above trend growth persists going forward it will have to consider further hikes. The current consensus outlook though is for a notable slowdown in US growth in the coming quarters after growth surged by close to 5% in Q3. The US economy is expected to expand by an annualized rate of 0.7% in Q4 and 0.3% in Q1 according to the latest Bloomberg consensus forecasts with most expect a period of below trend growth. Alongside the recent sharp tightening of US financial conditions since the middle of the year, and slowing US inflation the developments should favour the Fed remaining on hold. The main US economic data release in the week ahead will be the latest US CPI report for October. The report is expected reveal that headline inflation slowed to 3.3% in October down from 3.7% in September. The recent sharp drop in the price of gasoline is a favourable development, and reversed all of the move higher from Q3 as it moves closer to the year to date low. The Fed will be closely watching measures of core and service inflation as well. Core inflation has picked up in recent months after softer readings in the middle of the year. The annualized rate of core inflation has slowed over the last six months to 4.6% although it remains uncomfortably high for the Fed. Further evidence of slowing core inflation would be welcome news for the Fed in the week ahead. The US dollar stands to benefit if inflation proves more persistent the US thereby encouraging the Fed to keep higher rates in place for longer.

The other main development at the end of last week was the announcement by Moody’s that they have decided to place the US credit rating on “negative” outlook. Moody’s is the last of the three major rating agencies to maintain a top rating for the US government after Fitch downgraded the US credit rating in August and S&P downgraded the US credit rating all the way back in 2011. The announcement is expected to have limited direct impact on the US dollar although it could reinforce current bearish sentiment towards US government debt. Last week’s 30-year US Treasury auction revealed weak demand. Long-term US yields have risen sharply since the downgrade from Fitch in August which has helped to encourage a stronger dollar although we would argue that the move higher in yields mainly reflected a positive upgrade to the outlook for the US economy.

US INFLATION HAS BEEN SLOWING BUT REMAINS UNCOMFORTABLY HIGH

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK labour market & CPI reports in focus

After correcting lower throughout most of September, the pound has since been consolidating at lower levels over the past month. Cable attempted to break higher after the release of the weaker than expected nonfarm payrolls for October but failed to break above resistance from the 200-day moving average at around 1.2435. On the other hand, EUR/GBP has been attempting to break higher but is currently struggling to extend its advance beyond 0.8700-0.8750 after climbing above resistance from the 200-day moving average at around 0.8690 on 19th October.

The performance of the GBP so far this year has been tightly linked to short-term yield differentials. In the first half of this year, the GBP outperformed. It was the best performing G10 currency when it strengthened by 5.1% against the USD and by 3.2% against the EUR. The sharp strengthening of the GBP was mainly driven by the hawkish repricing of BoE rate hike expectations between March and June. The UK rate market over that period moved to price in a peak policy rate for the BoE of close to 6.50% which was expected to be the highest amongst major and other G10 central banks. Then in early July BoE rate hike expectations peaked out, and market participants have since continued to scale back expectations. The BoE’s latest policy update (click here) at the start of this month has reinforced expectations that the 0.25 point hike delivered in September was the last in the current tightening cycle. While the BoE did not rule out further hikes, the updated forward guidance placed more emphasis on maintaining restrictive rates for an “extended period of time”.

With the BoE now indicating more strongly that their rate hike cycle has peaked, market attention has naturally started to shift to when the BoE could begin to reverse policy tightening. It has already prompted BoE policymakers to actively discourage market participants from prematurely pricing in rate cuts. The BoE is now planning to leave rates on hold but it is less clear in outlining for how long. BoE Chief Economist Huw Pill gave the clearest indication so far that “for an extended period of time” could be consistent with the BoE leaving rates on hold though the 1H of this year and then beginning to cuts rates from the 2H of next year. He stated that current market pricing for the BoE to consider lowering rates from the middle of next year “doesn’t seem totally unreasonable, at least for me”. The UK rate market is currently pricing in around 14bps of BoE rate cuts by the June MPC meeting and 23bps by the August MPC meeting.

The release this week of the latest UK CPI report for October is expected to provide further evidence that inflation is slowing more sharply. The BoE expects the headline rate of inflation to fall to just under 5.0% in October mainly driven by lower energy prices. The OFGEM price cap increase of 80% in October 2022 will drop out of the CPI annual calculation of utility prices, resulting in a sharp drop. At the same time, food price inflation is expected to ease further from 12.1% in September to around 9% in Q4. As Chief Economic Huw Pill noted the sharper fall in headline inflation will help to make the UK appear less of an outlier compared to relatively lower rates of inflation in the euro-zone (CPI @ 2.9% in October) and US (CPI expected at 3.3% in October). However, the BoE has indicated that it will be mainly focusing on developments in core and services inflation where it is less clear so far that upward pressures have eased and remain elevated.

The BoE’s latest QIR highlighted that they remain concerned over persistent inflation risks when they also downgraded their growth forecast for the supply side of the economy. The medium-term equilibrium unemployment rate is judged to be temporarily higher at around 4.5%. It compares to the current unemployment rate of 4.0% and implies that the labour market will need to weaken even more to give the BoE confidence that inflation will return to target on a sustained basis. The BoE’s updated projections were revised higher to show the unemployment rate rising to 4.25% by the end of this year, 4.75% by the end of next year and 5.0% by the end of next year.

In these circumstances, we continue to expect the GBP to weaken further as the UK rate market moves to price in more BoE cuts into next year (currently around 55bps of cuts priced by December 2024). However it will require more evidence of slowing UK inflation and a softening labour market to drive it lower in the week ahead. Please see our latest FX Weekly report for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

Total Sight Deposits CHF |

Nov-10 |

-- |

474.6b |

! |

|

US |

16:00 |

NY Fed 1-Yr Inflation Expectations |

Oct |

-- |

3.7% |

! |

|

US |

19:00 |

Monthly Budget Statement |

Oct |

-$65.0b |

-$171.0b |

! |

Source: Bloomberg