One more hike view helped after CPI

USD: CPI print fuels December rate hike expectations

The macro data release of the week has helped rekindle expectations of another rate hike, in line with the current official guidance of the FOMC. The key inflation print was higher than expected but not dramatically so, with the headline 0.1ppt above consensus at 0.4% m/m. The Core CPI print was in line. The scale of the rebound in yields was therefore in our view as much about the scale of the decline that preceded the inflation data this week on the back of Fed official comment suggesting market rates was doing the work for the Fed than about the CPI data itself. The 2yr UST bond yield dropped 11bps on Tuesday as rate hike expectations receded and that move was nearly fully reversed in response to the CPI print.

But in reality we would argue that delving into the details of the report provides elements of good and bad news on CPI that do not give compelling evidence at this stage on the need for another rate hike. While rental inflation was strong, overall services inflation was strong and energy inflation picked up again, underlying goods inflation fell 0.4% with the annual rate turning negative to two decimal place (-0.03%). Core CPI, excluding shelter also continued to soften with the m/m rate at 0.07%; the 3mth annualised rate at 1.14% and the annual rate now below the 2.0% level at 1.95%. The services inflation pick-up was highlighted by the supercore CPI (core services ex housing) which jumped 0.61% in September – which was the third consecutive month-on-month acceleration. But we know actual rental inflation is a lot lower hence the sustainability of services inflation is questionable. Assuming rents will renew its m/m slowdown in line with actual rental inflation readings (Zillow) then the key data yesterday really was the decline in core CPI (4.4% to 4.1%) and the core CPI ex-housing falling below the 2.0% level for the first time since March 2021.

The pricing for a November rate hike has not budged much with the thinking here being that the latest rhetoric from Fed officials point to an increased appetite to stay on hold at that meeting given the move higher in market rates. The pricing for December is approaching a 50% probability but that seems high to us given the prospect of a government shutdown starting on 17th November.

The rebound of the dollar is understandable in the context of this data and the 10bp move higher across the yield curve (although this has corrected somewhat today) but the rates move may have been overdone given the prospects of a rate hike haven’t shifted dramatically for November.

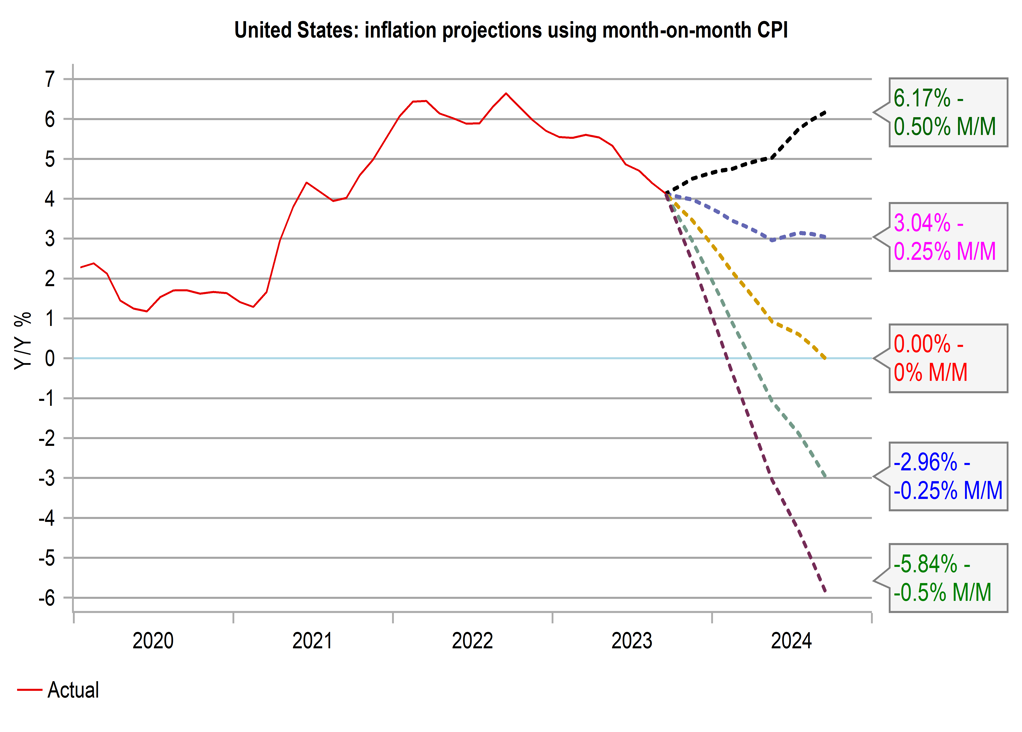

US CPI PROJECTIONS BASED ON M/M CHANGES TO SEPT 2024

Source: Bloomberg, Macrobond

USD: Supply troubles in UST bond market add to risks

Higher inflation in the US didn’t help risk appetite although the S&P 500 initially did not respond negatively to the higher CPI reading and higher yields. However, another poor UST bond auction looks to have been the catalyst for a sustained sell-off with the S&P 500 falling 1.4% from the high around the close of the London trading day to the intra-day low about two hours later. The equity market rebounded but still closed down 0.6%.

The 30-year UST bond auction yesterday was at a yield of 4.837%, close to 4bps higher than the yield in pre-auction trading despite the auction being the highest yielding since 2007. The 3-year auction on Tuesday tailed nearly 2bps to yield 4.74%, the highest since February 2007 with a bid-to-cover of 2.56, the lowest since February. The 10-year auction also tailed close to 2bps although he bid-to-cover was better at 2.50, compared to an average over the last 6mths of 2.44. Still, supply is going to remain an issue for the US Treasury market given the unprecedented fiscal outlook facing the US going forward.

What is happening right now with the fiscal deficit is alarming. The White House this week in a blog blamed the Trump tax cuts for the current deterioration in the fiscal position. In the first eleven months of the fiscal year, the US fiscal deficit has surged a huge 60% to reach USD 1.52trn. There has never been such a surge in the deficit in a year in which the economy has been expanding by over 2.0%. The Tax Cuts & Jobs Act introduced by Trump that included large tax cuts has put a large dent in the ability of the government to raise tax revenues – like capital gains tax.

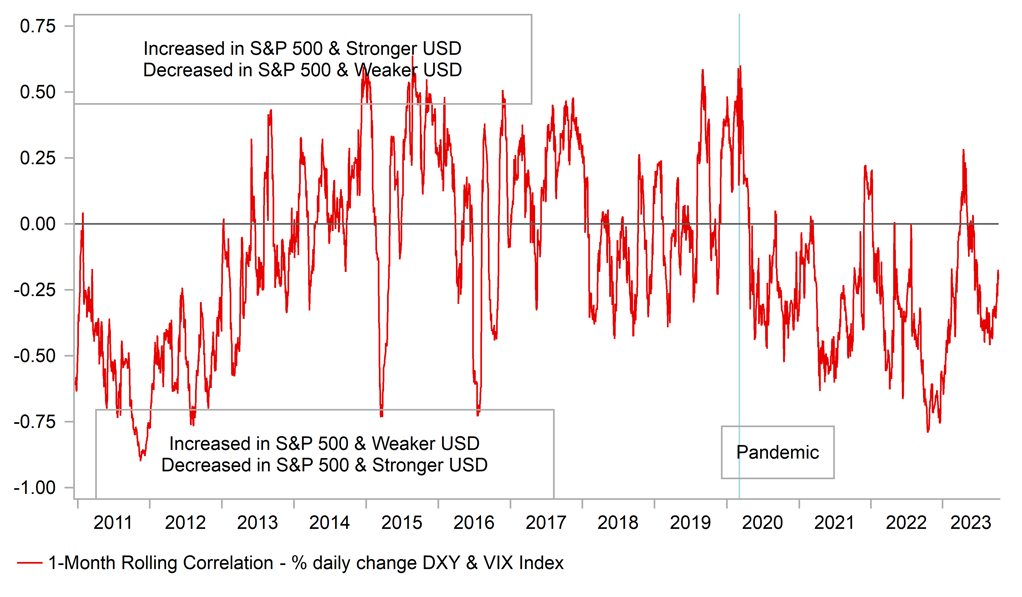

The IMF’s Fiscal Monitor released this month estimates the US fiscal deficit for this year at 8.2% but then over the five years to 2028 will average a still significant 7.1%. This is unsustainable and only reinforces the risks of higher yields in the US creating increasingly unfavourable financial market conditions which will prove US dollar supportive. The current correlation between the DXY and the S&P 500 (above) has been weakening but remains negative. This reflects the rebound in equities but how sustained that rebound will be is questionable. The more mid-cap heavy Russell 2000 fell 2.2% yesterday and is down 13.5% and close to recent lows. Further equity selling from here could well intensify and provide support for the dollar.

DXY / S&P 500 CORRELATION IS WEAKER BUT REMAINS NEGATIVE

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!!! |

|

CH |

09:00 |

M2 Money Stock (YoY) |

-- |

10.7% |

10.6% |

! |

|

CH |

09:00 |

Chinese Total Social Financing |

-- |

3,800.0B |

3,120.0B |

! |

|

EC |

10:00 |

Industrial Production (YoY) |

Aug |

-3.5% |

-2.2% |

! |

|

EC |

10:00 |

Industrial Production (MoM) |

Aug |

0.1% |

-1.1% |

!! |

|

US |

13:30 |

Export Price Index (YoY) |

-- |

-- |

-5.5% |

! |

|

US |

13:30 |

Export Price Index (MoM) |

Sep |

0.5% |

1.3% |

!! |

|

US |

13:30 |

Import Price Index (YoY) |

-- |

-- |

-3.0% |

! |

|

US |

13:30 |

Import Price Index (MoM) |

Sep |

0.5% |

0.5% |

!! |

|

US |

14:00 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!!! |

|

EC |

14:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Oct |

-- |

3.2% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Oct |

-- |

2.8% |

!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Oct |

65.5 |

66.0 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Oct |

67.4 |

68.1 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Oct |

70.4 |

71.4 |

! |

|

UK |

17:30 |

BoE MPC Member Cunliffe Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg