Trump policy shift to help but highlights ongoing policy uncertainty

USD: Tech reprieve won’t help sentiment much

Equity markets in Asia are all in the green today with European and US equity futures higher too after President Trump late on Friday announced a reprieve for a wide array of tech products from the reciprocal tariffs. Consumer electronics is one of the largest portions of total imports from China to the US and will ease considerably the impact on companies like Apple. But this will hardly help restore investor confidence much and the angst in the markets last week over confidence in the US Treasury bond market and the dollar is likely to continue. For starters, the announcement from Trump on Friday evening only serves to highlight the lack of strategic thought within the administration to the potential damage being done to the US economy. In addition, Trump and the administration have been quick to signal this reprieve will not last long. Trump stated yesterday that “NOBODY is getting off the hook” and that the shift was merely a reflection of the plan to tariff the tech sector separately under the planned sector-specific tariffs on semiconductors and according to Trump on “the whole electronics supply chain”. Commerce Secretary Howard Lutnick stated that separate tariffs were coming in “a month or two” in order to make sure these products get re-shored as “we can’t be relying on China for fundamental things we need”. Bloomberg estimates that the total value of imports impacted by this reprieve is just under USD 400bn with around one-quarter coming from China. Still, the level of sector-specific tariffs are very likely to be less than the 125% reciprocal tariff rate charged on China now but more than the global 10% tariff rate so there is likely to be a permanent improvement for China but a worse rate for the rest of the world.

The reprieve is just another example of the elevated level of policy uncertainty that will continue to undermine confidence in US assets. The cleanest most obvious way to help investor confidence would be a reversal of the elevated reciprocal tariff rates on China like the rest of the world but that seems unlikely after China’s retaliations last week. Another step that would help would be a more credible fiscal outlook. Last week’s tax cutting legislation that will now be negotiated between House and Senate Republicans lacks credibility and is helping fuel the steepening of the UST bond yield curve. But given how hard Trump is pushing for further large tax cuts on top of extending the 2017 Tax Cuts and Jobs Act, a watered down bill seems very unlikely.

Uncertainty over China’s appetite for UST bonds is likely also playing a role in worsening investor confidence in US assets. As we highlighted in the FX Weekly on Friday (here), China has already been selling down its UST bond holdings for a number of years, possibly anticipating what might lie ahead. More timely Fed custody holdings data does not show any marked shift amongst all official entities although of course in theory other central banks could be buying more as China sells.

Still, in the near-term it is difficult to see any fundamental factor that will likely improve investor sentiment. Key levels were broken last week for the dollar (DXY index through the 100-level; EUR/USD breaking 2023 and 2024 highs) and rhetoric from Trump and Lutnick, despite the reprieve, does not point to any reason for optimism on a more fundamental shift in policy that would prompt a dollar recovery.

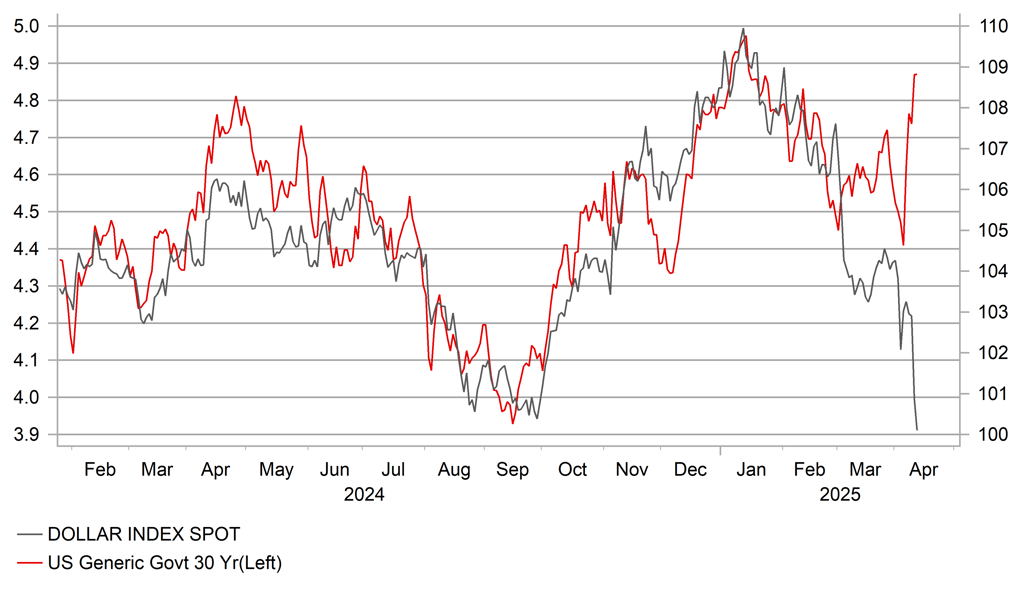

UST 30-YEAR HAS JUMPED BACK CLOSE TO THE HIGHS SEEN IN JANUARY WHILE THE DXY INDEX HAS PLUNGED TO LEVELS NOT SEEN SINCE 2022

Source: Bloomberg, Macrobond & MUFG GMR

EUR & CAD: Key G10 central bank decision this week

The Bank of Canada will meet to decide its monetary stance on Wednesday while the ECB will announce its decision the following day against a backdrop of intense uncertainty following President Trump’s tariff policy announcements. The latest climbdown by Trump related to electronics, Apple phones and semiconductor chips may be a sign of further watering down of tariff measures ahead but central banks will likely emphasise caution and the potential for abrupt shifts in the monetary stance or guidance based on policy developments and inflation data and expectations.

The decision at this stage seems a little easier for the ECB. The EU has yet to respond to Trump’s tariff increases and hence from an inflation perspective, the risks are less of a threat. It seems plausible that at least for a 90-day period the EU will hold off to see how negotiations may evolve. But based on the information now available and given the risks, a 25bps rate cut is highly likely.

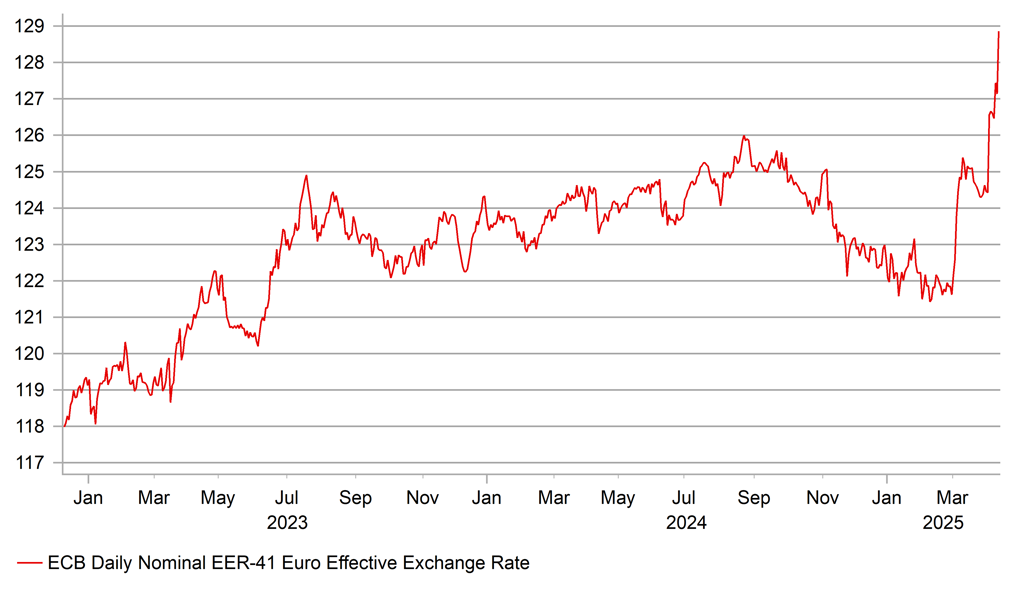

Prior to Trump’s actions, we assumed the ECB would cut to 2.00% but now we are adding one further rate cut to 1.75% with risks of the ECB having to cut further. FX moves since the tariff turmoil make a rate cut this week an easier decision. The technical assumptions used in the forecasts by the ECB in March, based on market conditions before the turmoil had the EER EUR-41 Index at 122.2 through the 2025-2027 period. The EER EUR-41 Index is now trading just below 129.0, a huge 5.5% advance relative to the forecast profile. That alone has the potential to lower the inflation estimate at the end of the forecast profile by between 0.1-0.2ppt leaving the inflation forecasts below the 2.0% target level. An ECB rate cut is fully priced so how Lagarde communicates on the scope for more cuts will be key for rates markets.

For the BoC, a rate cut is not fully priced at about a 25% chance. The Canadian retaliation response has been more forceful and hence inflation expectations are rising and the BoC has already been more active in cutting than other G10 central banks (bar the RBNZ). There is also a general election on 28th April so in total there is less urgency for the BoC to act now.

From an FX perspective, the impact from central bank decisions will likely be much less than usual. The traditionally reliable driver of FX, the rates spread link has completely broken down as the dollar suffers from a loss of confidence. Based on data since the start of 2024, the 2-year EU-US swap spread is currently implying EUR/USD trading at about 1.0600 while the same spread for Canada implies USD/CAD trading at around 1.4300.

EER EUR-41 HAS SURGED 5.5% FROM ECB PROJECTED LEVELS IN MARCH

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

13:30 |

Wholesale Sales ex-Petroleum MoM |

Feb |

0.40% |

1.20% |

! |

|

US |

16:00 |

NY Fed 1-Year Inflation Expectations |

Mar |

3.13% |

! |

|

|

US |

18:00 |

Fed's Waller speaks on economy |

!!! |

|||

|

US |

23:00 |

Fed's Harker speaks |

!!! |

Source: Bloomberg