All eyes on today’s US CPI report as political uncertainty increases in Japan

NZD: RBNZ throws in the towel on keeping rates higher for longer

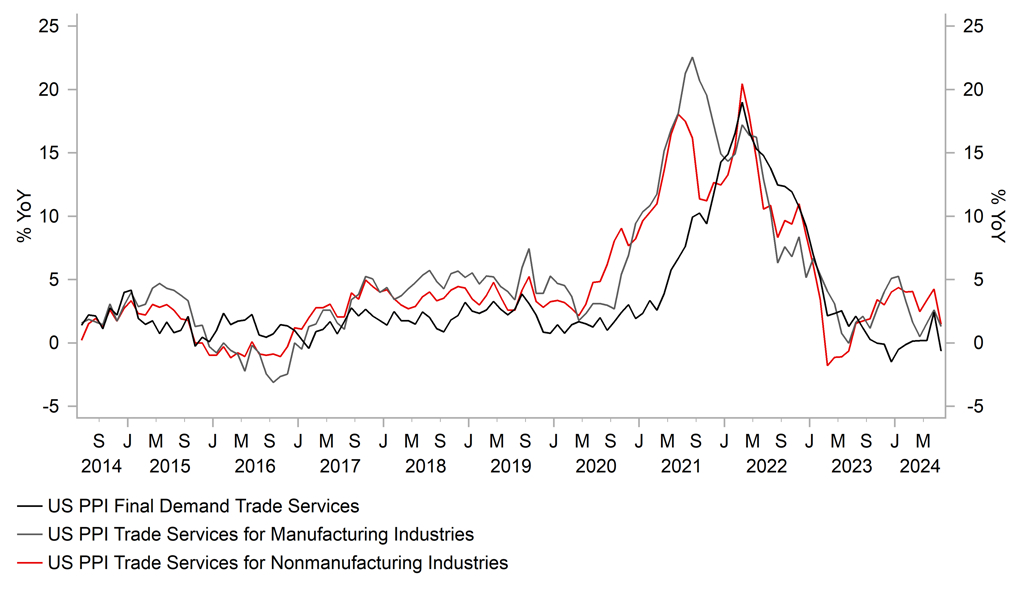

The US dollar has continued to trade at weaker levels overnight following the release of the softer than expected US PPI report for July. It has resulted in EUR/USD testing the top of the current 1.0500 to 1.1000 trading range that has held for most of the time since the end of 2022. The PPI report revealed that the headline rate of producer price inflation increased by just 0.1%M/M in July while the core measure was unchanged. The unchanged core PPI reading was largely due a large -1.3% decline in the trade services component which measures gross retail/wholesale margins. Producer price inflation has slowed markedly since the stronger readings recorded in the first two months of this year. The softer PPI reading for July has given market participants more confidence that the release later today of the latest US CPI report for July will also support expectations for the Fed to begin lowering rates in September. The yield on the 2-year US Treasury bond fell by around 6bps yesterday following the release of the US PPI report for July.

One currency which has weakened even more than the US dollar has been the New Zealand dollar which has weakened sharply overnight by around 1.0% against both the Australian dollar and US dollar. It has resulted in the NZD/USD rate falling back towards the 0.6000-level and the AUD/NZD rising back above the 1.1000-level. The New Zealand dollar has underperformed after the RBNZ’s dovish policy update. The RBNZ started an easing cycle much earlier than they had previously indicated by cutting rates for the first time overnight by 25bps to 5.25%. The RBNZ had previously indicated that they were not planning to begin cutting rates until the 2H of next year. A view that market participants never took too seriously in light of slowing inflation and weak growth in New Zealand alongside restrictive policy rates. The RBNZ decision to begin cutting rates last night reflected their increased confidence that consumer price inflation is returning to within the MPC’s 1.0-3.0% target band. The RBNZ also expects New Zealand’s economy to contract again in Q2 and Q3 which would be the third period of “technical” recession since the end of 2022. The RBNZ noted that the weakness in domestic economic activity is becoming more pronounced. The updated forward guidance signalled that the pace of further easing will depend on the Committee’s confidence that pricing behaviour remains consistent with a low inflation environment, and that inflation expectations are anchored around the 2% target. The RBNZ’s updated forecasts show that the policy rate is expected to end this year around 4.92% and fall further to around 4.36% by the middle of next year and 3.85% by the end of next year. Overall, the big dovish policy shift from the RBNZ today supports our short NZD trade idea (click here). The RBNZ may still need to cut rates even more quickly/deeply than indicated by the updated forecasts.

MARGIN INFLATION IN THE US HAS EASED

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Prime Minister Kishida’s decision not to seek re-election heightens uncertainty

The other main development overnight has been the announcement that Japan’s Prime Minister Kishida has decided not to run for a second term as leader of the LDP party in the upcoming election in September. He noted that “I will devote myself to supporting the new leader selected through the presidential election as foot solider”. Public support for Prime Minister Kishida had been declining for months reflecting voter frustration over his handling of a slush fund scandal, the rising cost of living and the weaker yen. He noted that the series of political finance scandals had eroded public trust and weighed on his decision not to seek re-election after holding the position as Prime Minister for nearly three years. It has also been reported that LDP executives are expected to decide next week on a date for the leadership election in September.

The yen initially strengthened modestly in response to the increase in political uncertainty in Japan resulting in USD/JPY falling to a low overnight of 146.08 but the pair has since recovered most of the lost ground. Market attention has already understandably shifted to who is likely to replace Kishida as Prime Minister. It is believed that he will not designate a successor which will lead to a full-scale contest for his replacement. According to our colleagues in Tokyo, the most popular potential candidates amongst the public to be the next leader of the LDP/Prime Minister former Defence Minister Shigeru Ishiba, Digital transformation Minister Taro Kono, Foreign Minister Yoko Kamikawa and Shinjori Koizumi, who is the son of a former premier. They have also highlighted other names who have been mentioned as potential replacements including the current Secretary General of the LDP Toshimitsu Motegi, the Minister for Economic Cecurity Senae Takaichi, and Takayuki Kobayashi who is a relatively young former bureaucrat and was the country’s first Economic Security minister.

Digital Transformation Minister Taro Kono and LDP Secretary General Toshimitsu Motegi have been vocal recently in calling for the BoJ to normalize monetary policy, while Senai Takaichi considers herself as late former Prime Minister Abe’s successor and would increase the risk of BoJ policy normalization being halted/slowed down. It is these three candidates who could have a bigger direct impact on yen performance if their chances of becoming the next prime minister were to rise in the coming weeks.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Employment Change (QoQ) |

Q2 |

0.2% |

0.3% |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q2 |

0.3% |

0.3% |

!! |

|

US |

13:30 |

Core CPI (MoM) |

Jul |

0.2% |

0.1% |

!!! |

|

US |

13:30 |

CPI (MoM) |

Jul |

0.2% |

-0.1% |

!!! |

|

NZ |

19:00 |

RBNZ Gov Orr Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg