USD remains on softer footing after US PPI & Trump tariff plans

USD: Devil in the details for Trump’s reciprocal tariff plans

The US dollar is ending the week trading on a softer footing with the dollar index on course to record its second consecutive week of losses, and fourth week of losses out of the last five. It has resulted in the dollar index falling back to support at the 107.00-level overnight as it continues to move further below the high from 13th January set at 110.18. The softer US dollar has been encouraged both by the release yesterday of the latest US PPI report for January and President Trump’s “reciprocal tariff” plans which follows on quickly from the initial negative impact from investor optimism over a potential peace deal for Ukraine (click here). The release of the latest PPI report has helped to dampen some of the concerns over stronger US inflation at the start of this year triggered by the significant upside surprise in the CPI report for January from earlier this week. The PPI report revealed that components that will feed directly into the Fed’s preferred measure of inflation the PCE deflator generally came in softer in January. There was notable weakness in categories such as airfares, many medical services and imputed financial fees. As a result, it has brought down estimates for the core PCE deflator back down to around 0.2-0.3%M/M similar to estimates prior to the release of the much stronger US CPI report. In comparison in January of last year, the core PCE deflator increased by 0.5%M/M which provides reassurance that the disinflationary trend remains in place. While it does not provide justification for the Fed to cut rates soon it has helped to bring forward expectations for the timing of the next Fed rate cut a little. The US rate market is now pricing in around 16bps of cuts by the July FOMC meeting whereas the timing of the first cut had been pushed out further towards autumn after the stronger US CPI report.

The second development yesterday that triggered a weaker US dollar was the order from President Trump directing the US Trade Representative and Commerce Secretary to propose new “reciprocal tariffs” on a country-by-country basis in an effort to rebalance trade relations. The big structural change to the trading system could take months to complete before higher tariffs are imposed. Howard Lutnick, President Trump’s nominee to lead the Commerce Department told reporters that all studies should be complete by 1st April and that President Trump would then act immediately afterward. The initial US dollar sell-off again appears to reflect some relief that higher tariffs will not be imposed immediately although a couple of months delay before implementation is still a relatively small period of time in comparison to Trump’s four-year term. It would give other countries some time to prepare and negotiate with President Trump in the coming months in an attempt to avoid/water down tariff hikes.

The finer details of how President Trump will implement “reciprocal tariffs” remains unclear which will rest on the methodology that Howard Lutnick and Jamieson Greer the new US Trade Representative will come up with. President Trump is directing that “reciprocity” is based not just on the tariffs imposed by other countries on US imports, but also a range of other non-tariff factors including: i) other countries’ taxes such as VAT imposed on US imports, ii) exchanges rates, and iii) regulations which are more difficult to quantify and considered on a case-by-case basis. It will create additional uncertainty over the potential negative impact of the tariffs. There is a higher risk now that the “reciprocal tariffs” will be implemented widely and could prove more disruptive. The incorporation of non-tariff factors makes a big difference.

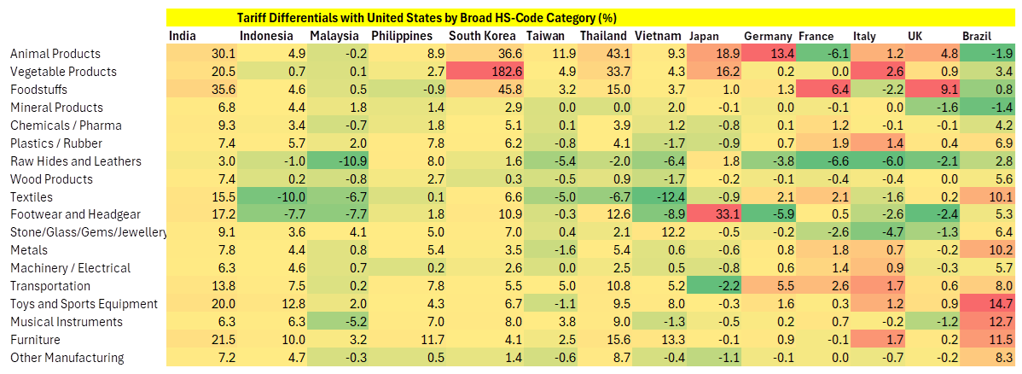

The difference in average tariff rates between the US and other major developed economies is relatively small but larger for emerging market economies. But if you include value added taxes (VAT) which are applied to US imports then it could require President Trump to put in place much higher tariffs against other major economies as well. President Trump has already voiced concern that the EU unfairly applies VAT on US imports even though it is not the same as a trade tariff. Furthermore, trying to quantify how much tariffs should be raised against each country based on exchange rates and domestic regulations will be even more difficult to quantify. Other major currencies are significantly undervalued against the US dollar especially the yen. President Trump has previously voiced concern about the weak yen, and that overseas regulations make it more difficult for US automakers to complete on a “level playing field” abroad. President Trump also told reporters yesterday that he would enact tariffs hikes on cars, semiconductors and pharmaceuticals “over and above” the reciprocal tariffs at a later date.

Taking everything into consideration, we are not convinced that the initial US dollar sell-off on the back of investor relief that the “reciprocal tariffs” will not be implemented until at least April will be sustained for long. The final methodology for determining what tariff hikes to implement will be important in determining how disruptive they are for global trade and growth. We are more wary of a more disruptive outcome now that non-tariff factors will be included. Ongoing trade policy uncertainty should remain supportive for the US dollar as well until there is more clarity.

TARIFF DIFFERENTIALS WITH US

Source: Bloomberg, Macrobond, World Bank WITS & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Employment Change (QoQ) |

Q4 |

0.1% |

0.2% |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q4 |

0.0% |

0.4% |

!! |

|

US |

13:30 |

Core Retail Sales (MoM) |

Jan |

0.3% |

0.4% |

!!! |

|

US |

13:30 |

Import Price Index (MoM) |

Jan |

0.4% |

0.1% |

!! |

|

US |

13:30 |

Retail Control (MoM) |

Jan |

0.3% |

0.7% |

!! |

|

US |

14:15 |

Industrial Production (MoM) |

Jan |

0.3% |

0.9% |

!! |

|

CA |

14:30 |

BoC Senior Loan Officer Survey |

Q4 |

-- |

1.7 |

! |

|

US |

20:00 |

Fed Logan Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg