BoJ speech signals options open to hike

USD: Weaker dollar on gradual tariff plan but BoJ leaves options open

The US dollar weakened into the New York close yesterday following report that the key figures in Trump’s economic team are devising a plan to introduce trade tariffs gradually, possibly month by month at a smaller rate in order to curtail any sudden inflation spike and to ensure maximum leverage in negotiations with trading partners. The likes of Scott Bessent, the Treasury Secretary nominee Kevin Hassett (National Economic Council Director) and Stephen Miran (nominee for Council of Economic Advisors head) are apparently in the early stage of devising a plan that could see tariffs increase monthly by between 2% to 5%. That’s about all the detail there is at this stage and hence the dollar sell-off has been relatively modest. Market participants likely also suspect we could get a quick denial from Trump just like other softer trade tariff plans.

President-elect Trump is sensitive to financial market developments and the move higher in yields and lower for the S&P 500 could certainly have an influence in the type of tariff plan announced. A gradual approach does make sense in that regard. The S&P 500 yesterday dropped on an intra-day basis below the closing level the day of the election confirming the full retracement of the post-election equity market rally. Higher yields and inflation concerns are in part due to concerns over trade tariffs and hence Trump could be persuaded with a more conservative approach. We also don’t know if the tariff increases on a monthly basis refers to a universal tariff plan on all countries or just specific countries like China, Mexico and Canada.

USD/JPY also declined into the New York close on the back of these tariff reports but then rebounded in response to the comments in a speech by Deputy Governor Himino. This speech was the last scheduled speech by any senior BoJ official ahead of the meeting on 24th January and hence was important for the financial markets. But we are not much the wiser in the aftermath of the speech with certainly no strong signal provided by Himino on the prospect of a hike being delivered at the meeting. Himino did state that the board “will have a discussion to decide whether to raise the policy rate or not, based on the outlook to be compiled”. Other comments from Himino certainly gave the impression that the broader economic conditions are in place and therefore the justification to hike is there if a hike was agreed. He expressed confidence that wage growth this year would be as strong as last year and suggested Trump’s inauguration would give the BoJ a sense of the “broad direction of policies” going forward. He also expressed optimism on the outlook for the US economy. Governor Ueda has previously stated that a positive wage outlook and some information on US economic policy were required in order to hike again.

In a sense, it was difficult for the BoJ at this juncture ahead of inauguration to provide strong guidance on a rate hike so Deputy Governor Himino signalled as much as he could at this stage. His speech didn’t include a very clear and stronger signal of a rate hike next week but the speech also included enough to not rule out the possibility of a hike. 15bps is now priced implying a 25bp hike is 60% priced. The BoJ’s intent here may be to keep their options open and USD/JPY could play a role here. A jump in USD/JPY and a move higher in US yields on the back of tariff announcements after inauguration may be the green light for the BoJ to hike at next week’s meeting.

UST 10YR YIELD IS 50BPS HIGHER SINCE THE ELECTION WHILE THE S&P 500 HAS NEARLY FULLY RETRACED THE POST-ELECTION RALLY

Source: Bloomberg, Macrobond & MUFG GMR

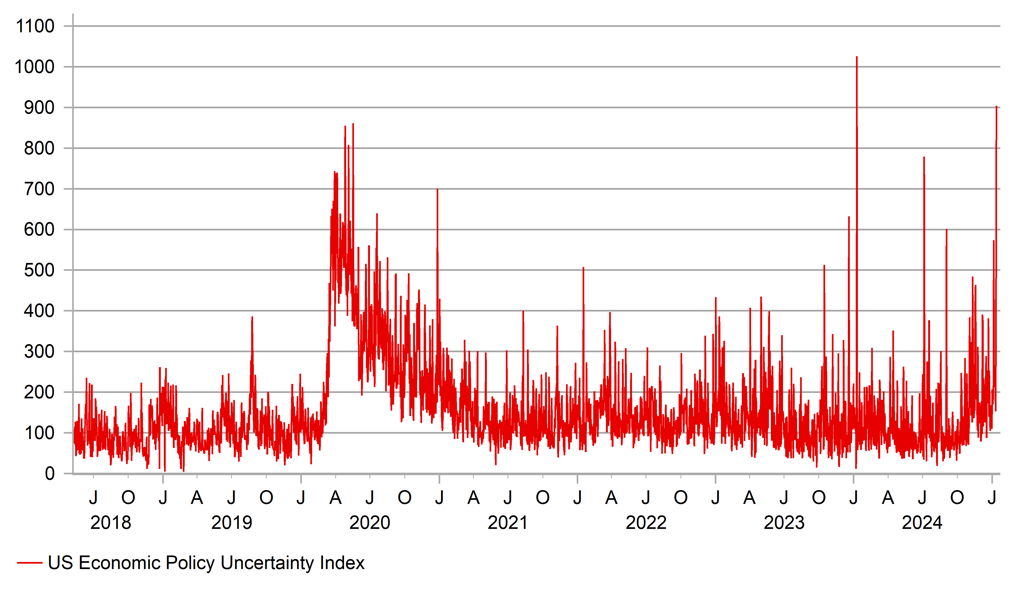

USD: Cabinet nomination hearings to provide clarity

As can be seen above, the US is currently experiencing an elevated level of US economic policy uncertainty which has picked up in general since the turn of the year with the latest data point a spike to near historic high levels. This likely in part reflects the approaching inauguration of President-elect Trump next Monday with uncertainty high over the aggressiveness of his policy announcements, in particular on trade tariffs that are expected possibly on the same day as inauguration. Ahead of inauguration this week we have the start of nomination hearings for Trump’s cabinet picks. What will be revealing will be the degree of influence Trump has in the Senate. The Republicans have a 53-47 majority in the Senate and how easy or difficult some of these nominations get through the Senate will provide a good indication of the degree of free rein Trump will have in the White House.

Pete Hegseth will testify before the Senate Armed Services Committee today with allegations of sexual misconduct and alcohol abuse hanging over his nomination. Recent reports suggest he has made progress in building support for a successful nomination with Trump fully supporting his nomination. Hegseth’s is the most contentious nomination this week with most others expected to be relatively smooth. Scott Bessent will testify to the Senate Banking Committee on Thursday and is likely to have an easy route to confirmation. Tulsi Gabbard and RFK Junior, the other main contentious picks for positions, have not yet been scheduled. Howard Lutnick, although less contentious will be a focus for the markets given his key position as Commerce Secretary and as the person possibly set to lead the implementation of trade tariffs.

It remains clear (based on sharp dollar selling on a Washington Post article on a softer tariff approach and yesterday’s smaller dollar drop) that market participants are positioned for an aggressive approach to trade tariffs by Trump with policies to be announced quickly. Any sign of a divergence from that would likely see the dollar reverse course abruptly in the days following inauguration next Monday. We expect Trump to largely meet current high expectations for an aggressive approach to trade tariffs.

ELEVATED US ECONOMIC POLICY UNCERTAINTY

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

08:30 |

BoE Breeden Speaks |

-- |

-- |

-- |

!!! |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Nov |

0.0% |

0.0% |

! |

|

US |

11:00 |

NFIB Small Business Optimism |

Dec |

101.3 |

101.7 |

! |

|

CH |

11:00 |

M2 Money Stock (YoY) |

Dec |

7.3% |

7.1% |

! |

|

CH |

11:00 |

New Loans |

Dec |

890.0B |

580.0B |

!! |

|

CH |

11:00 |

Outstanding Loan Growth (YoY) |

Dec |

7.6% |

7.7% |

! |

|

CH |

11:00 |

Chinese Total Social Financing |

Dec |

2,000.0B |

2,340.0B |

! |

|

US |

13:30 |

Core PPI (MoM) |

Dec |

0.2% |

0.2% |

!!! |

|

US |

13:30 |

Core PPI (YoY) |

Dec |

3.7% |

3.4% |

!! |

|

US |

13:30 |

PPI (MoM) |

Dec |

0.4% |

0.4% |

!!! |

|

US |

13:30 |

PPI (YoY) |

Dec |

3.4% |

3.0% |

!! |

|

US |

15:05 |

IBD/TIPP Economic Optimism |

Jan |

55.1 |

54.0 |

! |

|

US |

17:00 |

EIA Short-Term Energy Outlook |

-- |

-- |

-- |

! |

|

US |

20:05 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg