BoJ ‘go-slow’ policy changes to keep yen weak

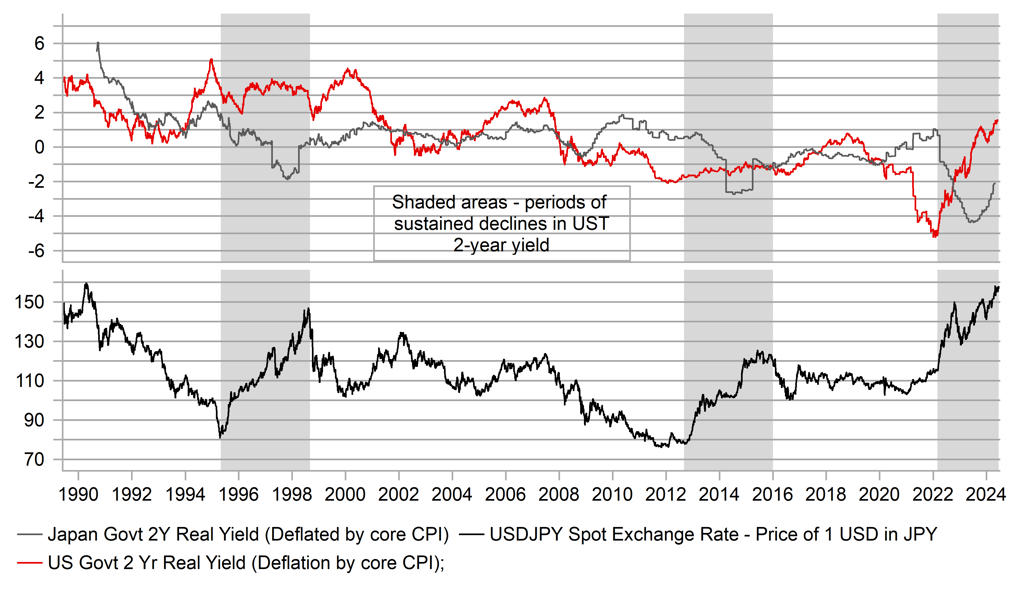

JPY: BoJ signal July JGB change, rate hike less clear

The yen is weaker today understandably given the BoJ has once again failed to meet market (and our) expectations that had moved to expecting the commencement of a slower pace of purchases of JGBs from the current pace of close to JPY 6trn. There was one dissenter – Toyoaki Nakamura. This is not hugely surprising and his dissent wasn’t outright. He supports the slowing of JGB purchases but felt the steps to decide and agree a framework should only happen after assessing developments in economic activity and prices revealed in the July 2024 Outlook Report. The delay by one meeting to the start of slower JGB buying is not hugely significant – the 10yr yield is down 2bps – but it is more significant from a signalling perspective and again underlines BoJ caution that raises expectations of a ‘go-slow’ reversal of the BoJ’s ultra-easy stance.

The implication of this cautious decision means expectations of a July rate hike have also eased. Like other central banks there is a desire from the BoJ to separate monetary policy and short-term policy rate decisions from the policies on the balance sheet which central bankers like to communicate as more technical and not monetary policy-related. So the July meeting will be about JGB buying and hence a rate hike decision will come after that. However, it could also be argued that the decision to slow the pace of JGBs has been taken today – the statement reads – “The Bank decided by an 8-1 majority vote, that it would reduce its purchases amount of JGBs thereafter to ensure that long-term interest rates would be formed more freely in financial markets”. The July announcement is only about the details.

Governor Ueda has given little away in the press conference and again has highlighted the continued caution. Uncertainties over the inflation outlook remained “high” Ueda has stated and that the BoJ was “paying close attention” to the FX impact on inflation, acknowledging that further weakness could lift inflation. However, he has confirmed that the cut to JGB purchases will be “substantial” and that a rate hike would be justified if upside inflation risks “intensify”. Ueda did also confirm that a rate hike in July is a possibility and will depend on the data.

Governor Ueda is still speaking but from the initial tone it does looks more likely that the yen will remain weaker. That’s very much the norm post-BoJ meetings. Over the last year of meetings, USD/JPY has been higher after all meetings bar one (7-1). We still see scope for a July hike but of course the probability has come down and over the short-term the yen could suffer further as investors push back on pricing risks of a more aggressive tightening cycle.

SHORT-TERM REAL YIELD DIVERGENCE BETWEEN JAPAN & THE US TO LAST LONGER AS BOJ CAUTION PERSISTS

Source: Bloomberg, Macrobond

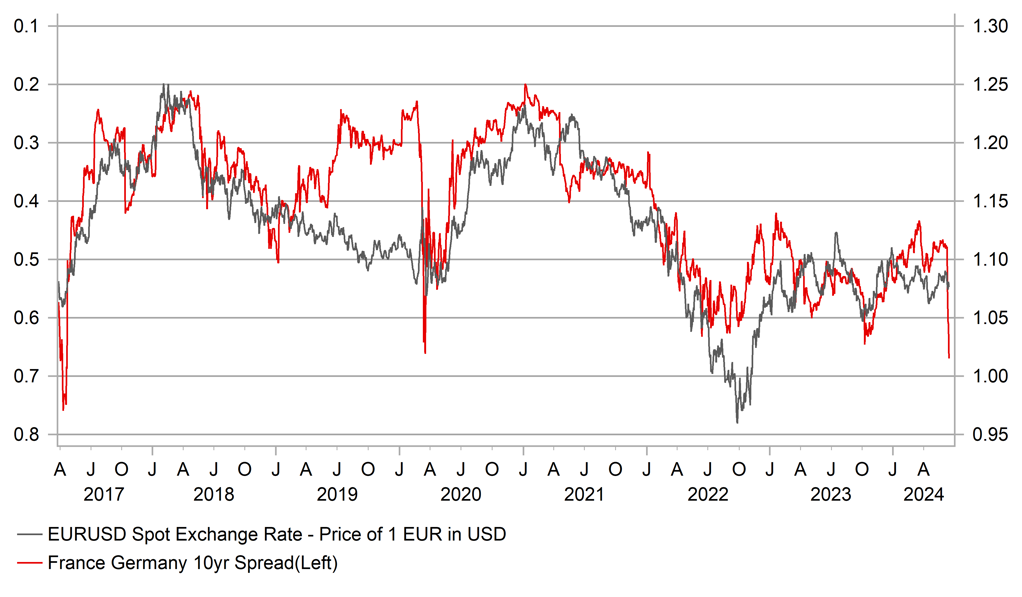

EUR/USD: More weaker inflation but EUR/USD falls

Yesterday was a good example of how the political cloud hanging over the euro is likely to continue to weigh on performance over the coming weeks. We had some weak data prints from the US at 13:30 BST – initial claims and PPI – US yields fell and the US dollar weakened but then a little over an hour later we saw the 10-year OAT/Bund spread widen through the 65bp level and EUR/USD turned abruptly lower. The OAT/Bund spread is now at 73bps, breaking above the energy-crisis and global pandemic highs to reach the widest spread since the 2017 French presidential elections when the financial market first feared the risk of a Le Pen presidency. It didn’t happen then, nor in 2022 but the markets now rightly fear it could be ‘third time lucky’!

There was nothing specific to trigger the move in the OAT/Bund spread but widening through the pandemic highs and back to 2017 levels has certainly worsened sentiment. As can be seen above, there is quite a tight co-movement between the OAT/Bund spread and EUR/USD and given there’s a high risk of the political risk premium building further, EUR/USD risks are certainly to the downside. The wide on the spread in 2017 was 76bps (closing rate basis) which coincided with EUR/USD falling to around the 1.0600-level. That’s certainly very achievable and if risks increase notably we could certainly see EUR/USD test the 1.0500-level in the coming weeks.

Still, there were other factors against the euro back in 2017 that don’t look as compelling today. Trump had announced his plans for large tax cuts, the Fed was in the middle of more active monetary tightening and we were in the early days of the Brexit shock, which also hit euro sentiment.

However, now in our opinion, we are at the peak of the Fed tightening cycle with inflation weakening once again, labour market data is set to weaken (there was a notable jump in initial claims yesterday) that will lead to the Fed this year easing more than the once signalled by the FOMC yesterday – we think three times. The June jobs data will be on 5th July, the Friday in between the two parliamentary election rounds. Other employment data means we see downside risks and a weaker jobs report will act against EUR/USD declines. Nonetheless, we would still expect the euro to underperform until we get clarity on the political landscape after 7th July.

10-YEAR OAT/BUND SPREAD (INVERTED) VS EUR/USD – POLITICAL RISKS WILL CONTINUE TO WEIGH ON EUR PERFORMANCE

Source: Bloomberg, Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Inflation Expectations |

-- |

-- |

3.0% |

! |

|

EC |

10:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

EC |

10:00 |

Trade Balance |

Apr |

17.0B |

24.1B |

! |

|

CH |

12:00 |

M2 Money Stock (YoY) |

May |

7.1% |

7.2% |

! |

|

CH |

12:00 |

New Loans |

May |

2,250.0B |

730.0B |

!! |

|

CH |

12:00 |

Outstanding Loan Growth (YoY) |

May |

-- |

9.6% |

! |

|

CH |

12:00 |

Chinese Total Social Financing |

May |

-- |

-200.0B |

!! |

|

US |

13:30 |

Export Price Index (MoM) |

May |

0.0% |

0.5% |

! |

|

US |

13:30 |

Import Price Index (MoM) |

May |

0.0% |

0.9% |

! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Apr |

1.3% |

-2.1% |

! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Apr |

2.6% |

-1.1% |

!! |

|

EC |

14:30 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Jun |

-- |

3.3% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Jun |

-- |

3.0% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Jun |

70.0 |

68.8 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jun |

72.1 |

69.1 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Jun |

71.0 |

69.6 |

! |

|

US |

16:00 |

Fed Monetary Policy Report |

-- |

-- |

-- |

!!! |

|

EC |

18:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg