USD remains on defensive amidst loss of confidence in US regional banks

Lee Hardman

Senior currency Analyst

Global Markets Division for EMEA

T: +44 (0)20 7577 1968

MUFG Bank, Ltd.

A member of MUFG, a global financial group

USD: Loss of confidence in US regional banks triggers plunge in global yields

The US dollar has remained at weaker levels during the Asian trading session after extending its sharp correction lower at the start of his week. The traditional safe haven currencies of the Swiss franc and yen have been two of the main beneficiaries from both the pick-up in risk aversion amongst investors and the scaling back of Fed rate hike expectations. It has resulted in USD/CHF falling sharply from an intra- high at the end of last week of 0.9439 to an intra-day low of 0.9072 yesterday. Similarly, USD/JPY has fallen from an intra-day high at the end of last week of 137.91 to an intra-day low yesterday of 132.29. The S&P regional banks equity index continued to fall sharply yesterday extending its sharp sell-off since last week to over 20% which highlights that measures announced by the US authorities over the week end (click here) while timely and forceful have not fully restored confidence in regional banks. The weakness likely reflects in part concern that the policy mix so far only provides protection for all depositors but threatens troubled banks with early seizure by the FDIC at equity and bondholders expense. One could argue that the deposit guarantee may not prove sufficient to prevent some depositors from continuing to shift their depositors out of regional banks and into safer larger banks. Further sharp falls in regional bank equity prices could reinforce nervousness amongst depositors as well. Unless confidence in regional banks is restored quickly it is likely that the US authorities will have to announce further support measures. Recent developments are clearly negative for banks profitability as they will now face higher funding costs as they have to pay up to attract and maintain deposits. It is likely to have negative implications for the extension of loans and credit into the economy that will reinforce the dampening impact on the economy from tighter monetary policy.

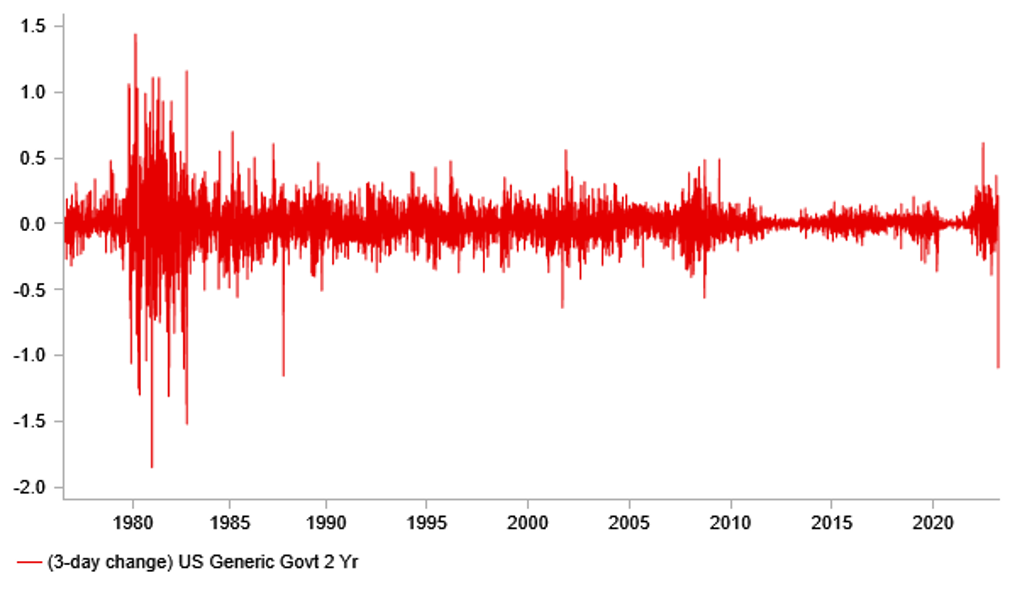

The loss of confidence in US regional banks and sharp tightening in financial conditions has triggered an extreme reaction in global fixed income markets where yields have plunged since late last week. The yield on the 2-year US Treasury bond has dropped from a peak late last weak at 5.08% to an intra-day low overnight 3.82% as it has fallen back towards support from its 200-day moving average that comes in at 3.89%. It has been the largest drop in US yields in such a short space of time since the Black Monday shock in October 1987. US rate market participants have gone from pricing in 100bps of further Fed rate hikes to not even fully pricing in one more 25bps hike and are now expecting the Fed to cut rates by at least 50bp by September. The dramatic shift in rate hike expectations highlights that market participants currently view the regional bank crisis as a strong indication that the Fed’s hiking cycle is coming to an end. While it could prove to be an overreaction, the developments do provide further evidence the sharp rise in US rates over the past year or so is still feeding through with a lag, and will help to further slow the US economy and inflation going forward. It supports our decision to maintain our outlook for a weaker US dollar this year despite the recent rebound in February.

The recent dovish repricing in the US rate market will face its first test today when the latest US CPI report for February is released this afternoon. The Bloomberg consensus is looking for another firm report with headline and core inflation both expected to increase by 0.4%. In light of ongoing concerns over the health of US regional banks, it will take a significant upside inflation surprise to trigger a sharp rebound in US yields and the US dollar. The US rate market is currently attaching around a 50:50 probability between the Fed hiking rates by a further 25bps next week or leaving rates on hold until confidence in regional banks returns.

Biggest drop in yields since Black Monday

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: SVB shock triggers an initial bout of position adjustment

The performance of emerging market currencies has been mixed over the past week although there has been a clear pick-up in EM FX volatility that has risen to year to date highs. The worst performing emerging market currencies over the past week have been the MXN (-4.6% vs. USD) and HUF (-2.4%) and the BRL (-1.1%). In contrast, the ZAR (+1.7% vs. USD), PLN (+1.6%), and CNY (+1.5% vs. USD) have all strengthened against the USD.

The price action in emerging market currencies over the past week highlights that the fallout from the Silicon Valley Bank crisis has triggered an initial bout of position adjustment. The high yielding currencies of the MXN and HUF had been two of the best performing emerging market currencies this year boosted by carry demand attracted by the higher yields on offer in Mexico and Hungary. However, over the past week they have been hit the hardest by the pick-up in volatility triggered by the Silicon Valley Bank crisis that has made carry trades relatively less attractive. It has resulted in USD/MXN rising sharply from the year to date low from last week at 17.898 up to an intra-day high today at 19.179 as it moves closer to last year’s closing price of 19.500. Similar price action has been evident for EUR/HUF that has rebounded from an intra-day low of 372.38 at the start of this month to intra-day high today of 394.13 as it moves back towards last year’s closing price of 399.64. While US policymakers have taken quick and decisive action to dampen the risk of deposit run at other regional banks, the MXN and HUF remain at risk of a deeper sell-off if those measures fail to quickly restore confidence in the US regional banks and financial markets remain more volatile in the near-term. At the other end of the spectrum EM currencies that had underperformed so far this year such as the ZAR have rebounded initially as the Silicon Valley Bank crisis has flared up.

The pick-up in risk aversion amongst global investors has meant that the emerging market currencies have derived little support so far from the sharp adjustment lower in US yields. The Silicon Valley Bank crisis has weighed down on global equity and commodity markets. MSCI’s emerging market equity index has now fallen by around 10% from the year to date high in January, and Bloomberg’s commodity price index has fallen to its lowest level since the start of last year. Risk aversion and global slowdown fears have prevented emerging market currencies from strengthening against the USD even as Fed rate hike expectations have been scaled back sharply in the near-term. Please see our latest EM EMEA Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Jan |

-0.1% |

1.6% |

! |

|

US |

10:00 |

NFIB Small Business Optimism |

Feb |

-- |

90.3 |

! |

|

US |

12:30 |

Core CPI (MoM) |

Feb |

0.4% |

0.4% |

!!! |

|

US |

12:30 |

CPI (MoM) |

Feb |

0.4% |

0.5% |

!!! |

|

US |

21:20 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:50 |

Monetary Policy Meeting Minutes |

-- |

-- |

-- |

!! |

Source: Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Jan |

-0.1% |

1.6% |

! |

|

US |

10:00 |

NFIB Small Business Optimism |

Feb |

-- |

90.3 |

! |

|

US |

12:30 |

Core CPI (MoM) |

Feb |

0.4% |

0.4% |

!!! |

|

US |

12:30 |

CPI (MoM) |

Feb |

0.4% |

0.5% |

!!! |

|

US |

21:20 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:50 |

Monetary Policy Meeting Minutes |

-- |

-- |

-- |

!! |

Source: Bloomberg