Still waiting for a fresh trigger to shake up FX market

USD/JPY: FX majors are still struggling for direction

The major foreign exchange rates have remained stable overnight with the US dollar failing to extending its initial advance following the release of the stronger than expected US CPI report for February earlier this week. The dollar index has already given up all of those initial gains and is now trading back at levels that were in place prior to the release of the US CPI report for February. While the US dollar has failed to strengthen on the back of another US upside inflation surprise at the start of this year, the report has resulted in US yields moving higher. The 2-year and 10-year US Treasury bond yields have both increased by around 10bps as market participants become less confident that the Fed will begin to cut rates as early and as much as previously expected. While June is still judged as the most likely date for the Fed to begin cutting rates, the timing is being viewed as less of a done deal now. There are currently 19bps of cuts priced in in implying roughly around a 75% of cut in June. For the year as whole, the US rate market has moved back to pricing in around 75bps of cuts bringing it back in line with the Fed’s plans from the December FOMC meeting.

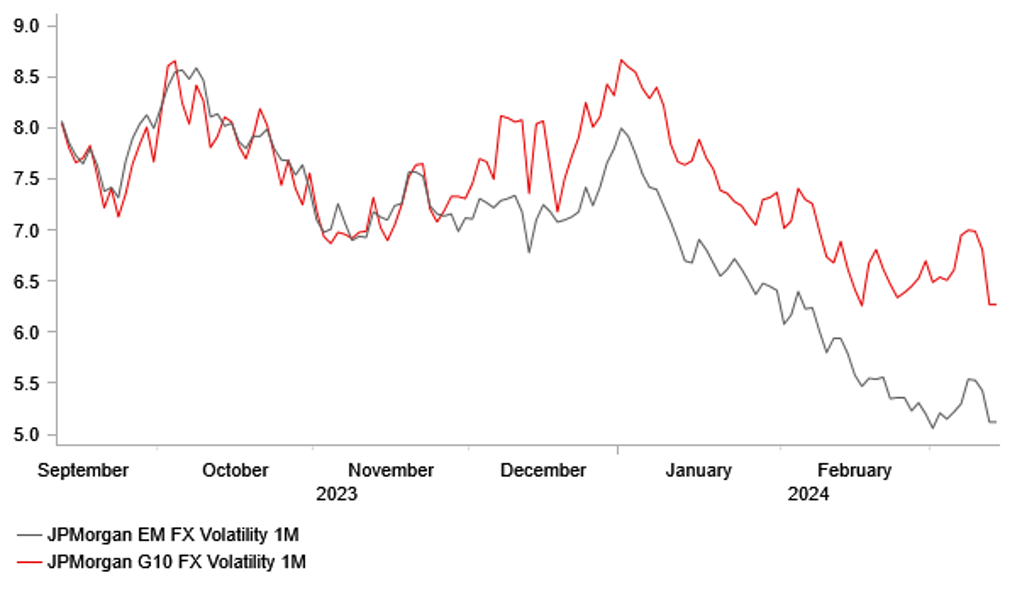

We expect the Fed to stick to those plans when they are updated at next week’s FOMC meeting although it is likely that they will express more caution over the pick-up in inflation at the start of this year. The Fed and market participants will receive further information today on inflation at the start of this year when the US PPI report for February is released this afternoon. The Bloomberg consensus is expecting producer price inflation to moderate in February after the upside surprise in January which if confirmed would provide further reassurance that the PCE deflator report for February that is released at the end of this month is likely to continue to reveal a more favourable inflation picture in comparison to the CPI report. The core PPI measure is expected to slow to a monthly increase of 0.2%M/M in February down from +0.5%M/M in January. Another upside surprise today would be US dollar supportive although price action so far this week continues to highlight that the foreign exchange market is struggling for direction. The ongoing drop in foreign exchange market volatility is reinforcing favourable conditions for FX carry trades which was highlighted yesterday by the adjustment lower in USD/MXN which fell back closer to its lowest level since the middle of last year at just above the 16.600-level.

The yen has been one G10 currency that has displayed more volatility recently encouraged by heightened speculation over a change in BoJ policy settings at next week’s meeting. Market speculation over an exit from negative rate policy next week has been supported by the announcements from large companies in Japan yesterday that have increased our confidence that stronger wage growth will continue in the upcoming fiscal year. The Nikkei reported that major Japanese companies including Honda Motor agreed to fully meet their labour unions’ wage demands in this year’s spring wage negotiations. According to the report, Honda will boost wages by a total of 5.6%. Similarly, Aeon agreed to raise wages for full-time workers at the core unit Aeon Retail by 6.4% above last year’s 5% while part-times will receive a previously promised 7% raise in hourly pay as they did in 2023. The developments give us more confidence that the release tomorrow of the preliminary results from the Rengo wage negotiations will provide a green light for the BoJ to tighten policy next week. However, the positive wage developments have not been sufficient to trigger further yen gains this week with USD/JPY attempting to rise back above the 148.00-level.

FX VOL CONTINUES TO FALL SUPPORTING FX CARRY TRADES

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Dovish repricing in UK rate market has weighed on the GBP this week

The pound has softened modestly so far this week after EUR/GBP again attempted and failed to break below support at the 0.8500-level at the end of last week. It has resulted in EUR/GBP rising back up to the 0.8550-level. The pound has been undermined this week by the dovish repricing of the UK rate curve which has meant that yield spreads have moved against the pound this week. The UK rate market has moved to price in a higher probability of the BoE beginning to cut rates sooner in June rather than waiting until August. There is now around a 50:50 probability of a 25bps cut priced in by the June MPC meeting while the August meeting is fully priced.

The main trigger for the dovish repricing was the release earlier this week of the latest UK labour market report that provided further reassurance that wage growth is continuing to moderate. There is now a good chance that private sector regular pay growth will come in below the BoE’s forecast for an average increase of 5.7% 3M/Y in Q1 although the data has been choppy recently. The BoE also received encouraging news yesterday when the latest monthly GDP report revealed that the UK economy returned to positive growth of +0.2%M/M in January. The report supports the BoE optimism that the technical recession is likely to be mild and short-lived. We would not be surprised to see it revised away over time given that the GDP contraction is not backed up by weakness in the labour market. The BoE’s upcoming policy meeting next week will provide more insight over the potential timing of the first rate cut.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

EC |

11:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

12:30 |

Core PPI (MoM) |

Feb |

0.2% |

0.5% |

!! |

|

US |

12:30 |

Initial Jobless Claims |

-- |

218K |

217K |

!!! |

|

US |

12:30 |

Retail Sales (MoM) |

Feb |

0.8% |

-0.8% |

!!! |

Source: Bloomberg