USD’s upward trend remains firmly in place after US CPI report

USD: US CPI report fails to derail the stronger US dollar trend

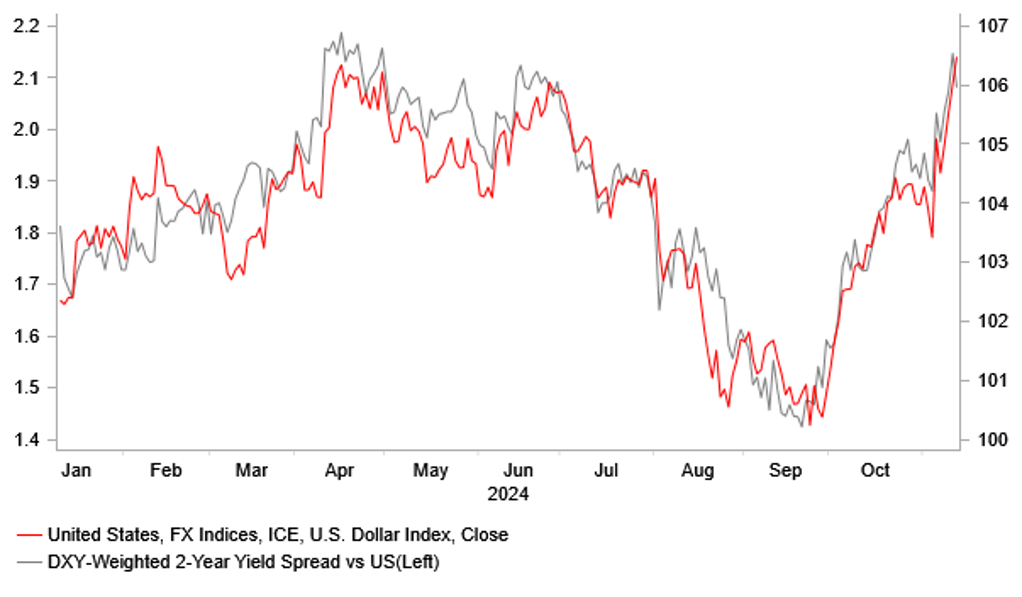

The US dollar has continued to trade at stronger levels during the Asian trading session after the sell-off following the release of yesterday’s latest US CPI report proved to be short-lived. Yesterday’s price action highlighted that there was strong demand to buy US dollars at weaker levels in anticipation that it will continue to strengthen encouraged by the incoming Trump administration’s policy agenda which is expected to lift US inflation and hurt economic growth outside of the US. The dollar index is currently on course for its fifth consecutive day of gains, and has just hit a fresh year to a date high of 106.78. It is the strongest level for the dollar index since the start of November 2023. The next important technical resistance levels are provided by the highs from October and November 2023 at 107.35 and 107.11 respectively. A decisive break above could open the door to a bigger adjustment higher back towards the highs from autumn 2022. At the current juncture, there is no obvious trigger to reverse the US dollar’s current strong upward momentum. While the release of the latest US CPI report for October has supported market expectations for the Fed to follow through with plans to deliver another 25bps rate cut in December, it could only trigger a temporary sell-off for the US dollar.

The US CPI revealed that core services ex-housing, a measure that the Fed is watching closely, decelerated in October when it increased by +0.3%M/M marking a slowdown from an increase of +0.4%M/M in September. It still points to the core PCE deflator coming in a little stronger on average in Q4 than the Fed’s forecast from the September FOMC meeting of 2.6% but it is unlikely on its own to stop the Fed from following through with plans to cut rates again in December. Market participants then expect the Fed to slow down the pace of easing further next year in anticipation that higher import tariffs will be implemented lifting US inflation and making the Fed more cautious over continuing to lower rates as we move through next year. There are currently just over 50bps of rate cuts priced in for 2025. Comments from Fed officials yesterday indicated that they would be cautious when cutting rates further. Kansas City Fed President Schmid stated that “while now is the time to begin dialling back the restrictiveness of monetary policy, it remains to be seen how much further rates will decline or where they might eventually settle”. A view shared by St Louis Fed President Musalem, and Dallas Fed President Logan who stated that widely consulted models put the neutral policy rate anywhere between 2.74% and 4.60%.

STRONGER USD IS BACKED UP BY MOVE IN YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

AUD/CNY: Bracing for the hit from escalating US-China trade tensions

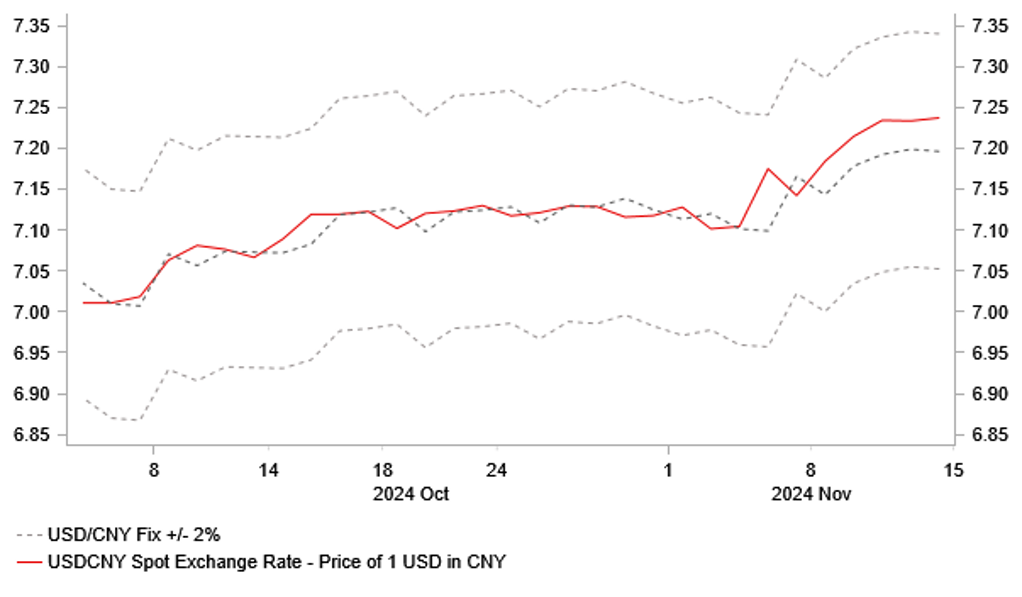

Asian currencies have continued to weaken overnight with the Malaysian ringgit and Indonesian rupiah hit the hardest as they continue to reverse strong gains recorded over the summer. In contrast, weakness in the renminbi has been dampened by the PBoC’s decision to set a stronger daily fixing rate which was lowered by marginally by 25pips to 7.1966 sending a signal to market participants that they will try to slow the adjustment higher in USD/CNY. The spot rate is currently trading just below the 7.2500-level and there is room for the pair to keep moving closer to the top of the +/-2% daily trading band that currently comes in at 7.3405. We expect the renminbi to weaker further in the year ahead as the incoming Trump administration moves to impose higher tariffs on imports from China. Our latest forecasts for USD/CNY show the pair moving up towards the 7.5000-level in the year ahead. In other developments overnight, Chinese policymakers have announced further policy steps to support the housing market including cutting taxes for homebuyers and developers. Home purchase deed taxes for first and second house buyers of flats of 140 square meters and below have been cut to 1% from as much as 3%. The threshold for land appreciation tax has been lowered by 0.5 percentage point.

The looming prospect of escalating trade tensions between the US and China is providing an offset to the potential boost to demand in China from recent stimulus measures. Bloomberg’s commodity price index has now almost fully reversed the adjustment higher in September that was driven by investor optimism over China stimulus announcements at the time. As we saw back between 2018 and 2019 Trump’s first trade shock resulted in weaker global growth and lower commodity prices. It poses downside risks for the G10 commodity-related currencies of the Australian and New Zealand dollars. The next important technical support level for AUD/USD is provided by the lows from earlier this year which comes in at around the 0.6400-level, and then the lows from back in autumn 2023 at around the 0.6300-level. The release overnight of the latest Australian labour market report has not altered the weakening trend for the Australian dollar. The report revealed that employment growth slowed in October but was not weak enough to bring forward market expectations for a RBA rate cut this year. The RBA’s relatively hawkish policy stance will not prevent the Australian dollar from weakening further.

CHINA PUSHES BACK AGAINST WEAKER CNY BY SETTING LOWER FIX

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

GDP SA QoQ |

3Q P |

0.4% |

0.4% |

!! |

|

EC |

10:00 |

Employment QoQ |

3Q P |

-- |

0.2% |

!! |

|

EC |

10:00 |

Industrial Production SA MoM |

Sep |

-1.4% |

1.8% |

!! |

|

US |

12:00 |

Fed's Kugler Speaks |

!! |

|||

|

EC |

12:30 |

ECB Releases Account of Oct Meeting |

!! |

|||

|

US |

13:30 |

PPI Final Demand MoM |

Oct |

0.2% |

0.0% |

!! |

|

US |

13:30 |

Initial Jobless Claims |

220k |

221k |

!! |

|

|

JN |

23:50 |

GDP Annualized SA QoQ |

3Q P |

0.7% |

2.9% |

!! |

Source: Bloomberg