Positive sentiment already fading

USD: Trade policy flux continues

The reprieve for the tech sector announced over the weekend did not have such a big impact on US equity markets (S&P +0.8%) but Asian equities are mostly higher today with the exception of China where markets are modestly lower. That in a way reflects the mixed news from Washington with President Trump stating that he was “looking at something to help car companies” with a possible temporary exemption for imported vehicles and parts. Big car companies have been lobbying for low-cost car components to be excluded. Tariffs are scheduled to go live on autos and auto parts no later than 3rd May. So once again, just like with the tech sector we may be about to get a carve-out given the negative impact for the US economy. The backtracking certainly highlights the fact that the US does not have all the leverage and the negative implications being borne out weakens the Trump administration’s negotiation strategy. That said, Trump doesn’t seem to see this and also announced trade investigations into semiconductor and pharmaceutical imports under Section 232 which by law must be completed within 270 days but likely would conclude more quickly than that.

While we are seeing carve-outs emerge from Trump’s trade policy there is unlikely to be any let-up over the coming weeks/months. The next dangerous stage for the financial markets will be getting confirmation of the damage being done to the real economy from the tariff hit and the uncertainty. Data released yesterday in China revealed a notable slowdown in cargo traffic through Chinese ports – China’s ports handled 244mn tons of cargo last week, 10% down from a weak earlier and down 4% from a year earlier. Global data indicates problems ahead in broken or damaged supply chains due to the tariff announcements. Data from Marine Traffic for the first week of April revealed there were 226 ships at Antwerp’s port, up from just 34 ships in the same week a year ago. Rotterdam had 99 ships vs 17 a year ago, and Hamburg 124 ships vs just 11 a year ago. The US is now possibly going to charge China cargo ships a USD 1mn docking fee up from between USD 20k-50k that is diverting vessels and leaving them in limbo. If this continues, the huge build-up in inventory will result in a sharp decline in production in China and elsewhere.

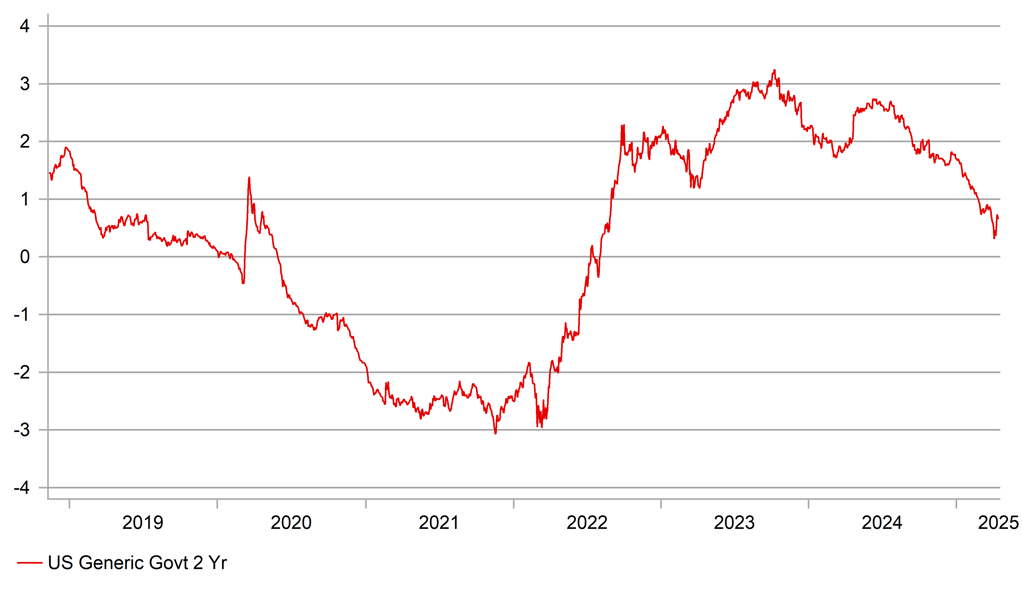

The potential hit to growth will be accompanied by a jump in inflation in the US of course and the NY Fed’s 1-year inflation expectation reading, reported yesterday, jumped from 3.13% to 3.58%, the biggest increase since February 2023. Fed Governor Waller yesterday argued that in either a “large tariff” or smaller tariff” scenario the inflation impact would be “temporary” and that there would be scope to ease monetary policy given the hit to growth would outweigh the rise in inflation. This kind of scenario points to a potential notable further decline in real yields, possibly into negative territory, at the front-end of the curve which is an unfavourable development for the dollar.

2-YEAR UST NOTE REAL YIELD HAS FALLEN SHARPLY AND IS AGAIN APPROACHING ZERO – A NEGATIVE SIGNAL FOR THE US DOLLAR

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Jobs data mixed but won’t deter the MPC from cutting

The pound was one of the top performing G10 currencies yesterday, gaining 0.8% versus the US dollar ahead of a busy week of data which started this morning with the release of the jobs and wage data for February and the more timely PAYE jobs data for March. The data once again underlined the continued backdrop for the UK economy of sticky wage growth that has forced the BoE into a more cautious approach to monetary easing than other G10 central banks. The average weekly earnings 3mth YoY rate came in unchanged at 5.6% (Jan revised from 5.8% to 5.6%). Private sector wages, excluding bonuses was also unchanged at 5.9% with the Jan reading revised down from 6.1% to 5.9%. So with the revisions to January, the data was slightly softer than expected but still indicating elevated and sticky wage growth. Wage growth at this rate is certainly inconsistent with the BoE’s 2.0% inflation target and makes the MPC’s decisions a little more complicated.

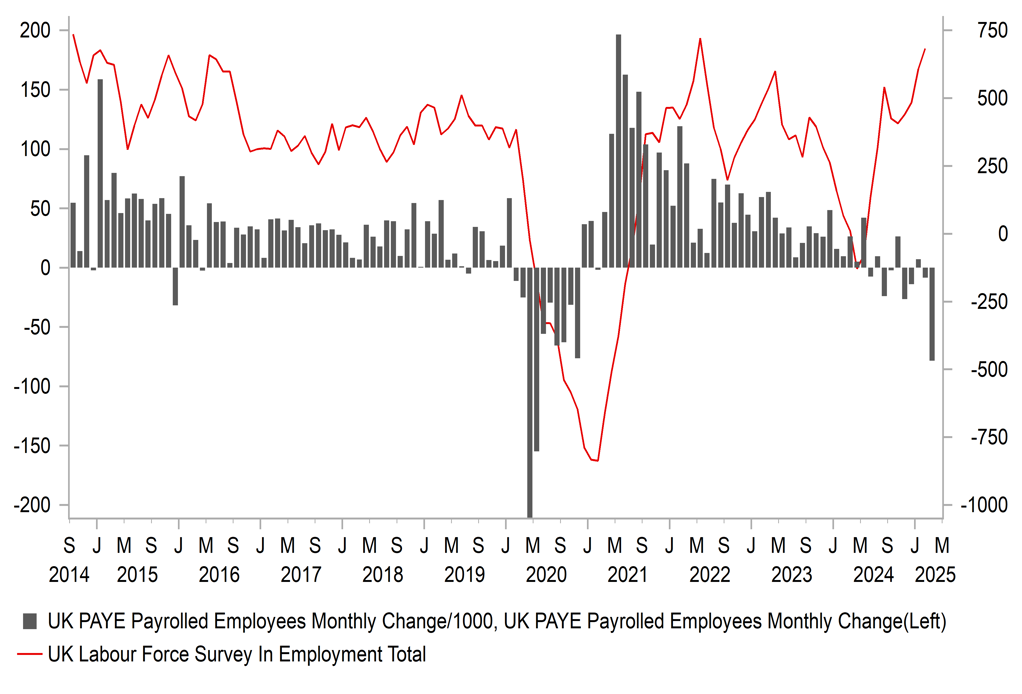

Still, there remains justification for a continued gradual approach to monetary easing and we see the data as still consistent with a quarterly pace of 25bp cuts to Bank Rate. The BoE has already indicated that it is placing more importance on labour market survey data given unreliability of the official data. The ILO unemployment rate remained at 4.4% with employment increasing 206k on a 3mth/3mth basis. Once again, the PAYE jobs data was much weaker with a drop of 78k in March after a decline of 8k in February (revised from +21k). The March drop was the largest since the covid turmoil in early 2020. In addition, the latest Recruitment & Employment Confederation survey data for March revealed the biggest increase in availability of workers since the pandemic in December 2020. The minimum wage increase this month, the NICs increase for employers and Trump trade policy uncertainties all contributed to the increased caution.

Survey data like this and the PAYE jobs data will help ease concerns within the MPC over the stickiness of wage growth and given the elevated levels of uncertainty created by Trump’s trade policy, will leave the MPC reasonably confident in continuing to cut rates in the current “careful and gradual” manner. A May rate cut of 25bps by the MPC is nearly fully priced and the softening demand for labour will ensure a cut is delivered. The scale of weakness in the PAYE jobs data could mean the pound continues to underperform the euro with investors more confident on the resilience of the euro-zone economy following the German fiscal spending announcement.

BIG DROP IN PAYE REPORTED EMPLOYMENT CONTRASTS WITH ILO DATA

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Bank Lending Survey |

-- |

-- |

-- |

!! |

|

UK |

10:00 |

10-Year Treasury Gilt Auction |

-- |

-- |

4.679% |

!!! |

|

GE |

10:00 |

German ZEW Current Conditions |

Apr |

-86.0 |

-87.6 |

!! |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Apr |

10.6 |

51.6 |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Feb |

0.1% |

0.8% |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Apr |

14.2 |

39.8 |

!! |

|

CA |

13:15 |

Housing Starts |

Mar |

238.0K |

229.0K |

! |

|

US |

13:30 |

Export Price Index (MoM) |

Mar |

-- |

0.1% |

! |

|

US |

13:30 |

Import Price Index (MoM) |

Mar |

0.1% |

0.4% |

! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Apr |

-14.80 |

-20.00 |

!! |

|

CA |

13:30 |

Common CPI (YoY) |

Mar |

2.4% |

2.5% |

!!! |

|

CA |

13:30 |

Core CPI (MoM) |

Mar |

-- |

0.7% |

!!! |

|

CA |

13:30 |

Core CPI (YoY) |

Mar |

-- |

2.7% |

!!! |

|

CA |

13:30 |

CPI (YoY) |

Mar |

2.6% |

2.6% |

! |

|

CA |

13:30 |

CPI (MoM) |

Mar |

0.7% |

1.1% |

!! |

|

CA |

13:30 |

Median CPI (YoY) |

Mar |

2.9% |

2.9% |

! |

|

CA |

13:30 |

Trimmed CPI (YoY) |

Mar |

2.9% |

2.9% |

! |

|

US |

16:35 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

EC |

17:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg