US CPI – one hurdle to a rate cut jumped

USD: CPI good enough to firm up rate cut expectations

Since the turmoil in the financial markets at the start of last week there were only two key data points that could have complicated the ability of the FOMC to respond by easing its monetary stance – the CPI and jobs data for July. The CPI data yesterday was broadly in line with expectations and the lack of any nasty surprises will ensure that expectations of rate cuts remain steady for now. The key takeaway from a markets perspective that is important for FX is that the front-end of the US yield curve remains unchanged after a key risk event that will likely encourage further dollar selling if broader market conditions remain favourable.

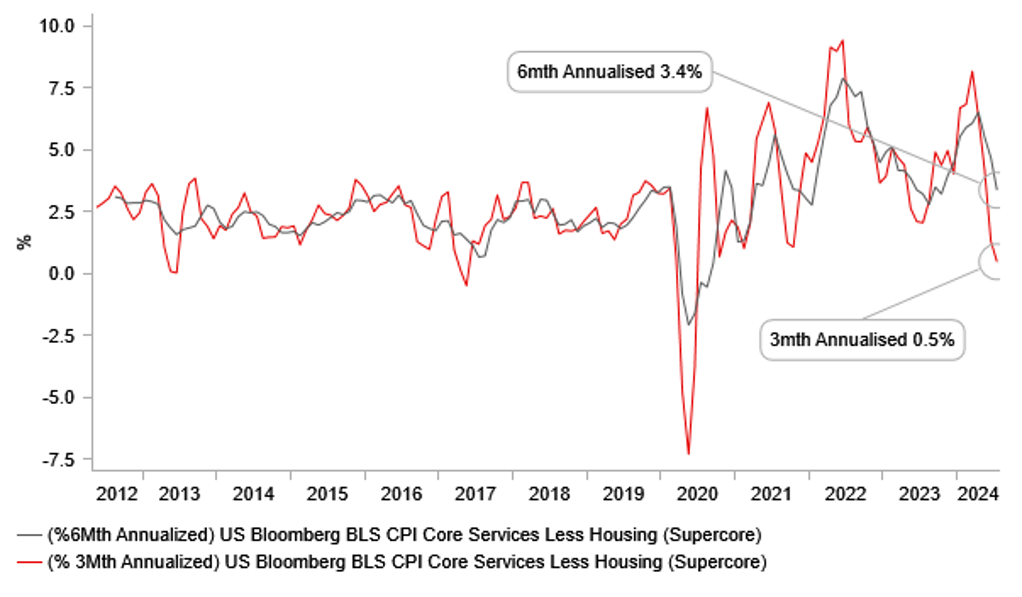

The data wasn’t universally favourable and the key component within the CPI data that is expected to slow further going forward – rents – actually picked up. Shelter increased 0.4% MoM, double the rate in June while OER increased 0.1ppt to 0.4% as well. Nonetheless, given the overall CPI was in line with expectations means that elements of CPI outside of rents were softer than expected. The supercore 3mth and 6mth annualised rates are now falling sharply and underline the continued softening trend in underlying “sticky” inflation that has concerned the Fed for much of the past year. This data is clearly the type of good news that was required in order to justify a rate cut in September.

There is currently 34bps of cuts priced for the September meeting which looks about right at this point. We are continuing to see a recovery in risk that points toward the prospect of the FOMC cutting just 25bps on 18th September but there is a long way to go yet and risks remain that we could see further equity market selling that could trigger another cycle of yen strength and further equity selling. Both US and Japanese equities have surpassed the 50% retracement of the sell-off from record highs in July to the low last week. Further gains in equities from here will likely be more difficult to realise which could in turn prompt renewed liquidation of risk positions.

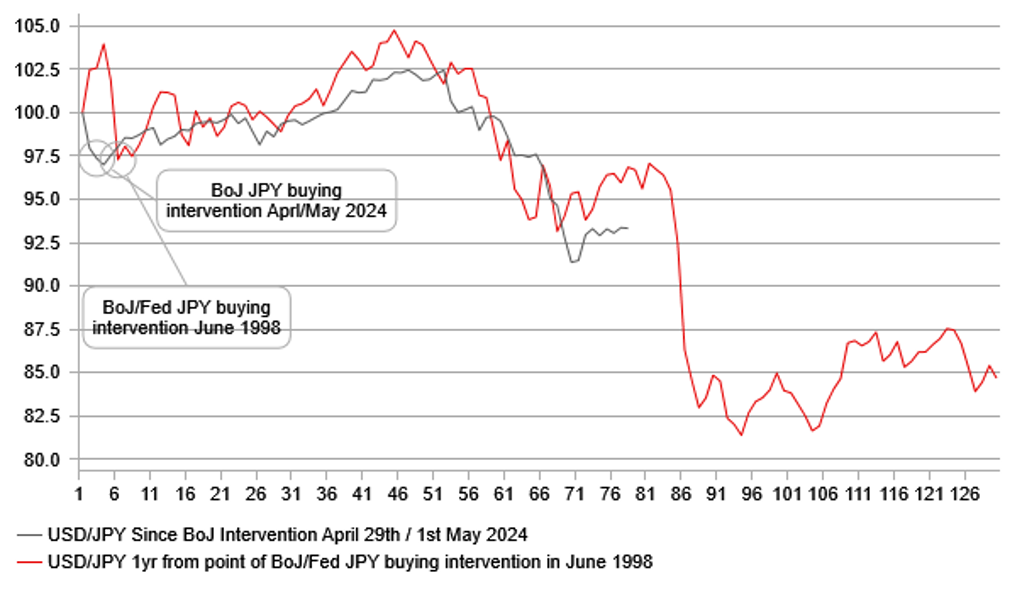

There are some similarities with 1998 in recent macro developments and the move in USD/JPY. The Fed and BoJ intervened to sell USD/JPY in June 1998 as the pair approached 150. The move lower faded, USD/JPY retraced higher but then Russia defaulted, contagion spread, a hedge fund (LTCM) collapsed, the Fed then cut inter-meeting and cut three times in total between September and November 1998. The increased risk aversion prompted a massive liquidation of yen shorts and USD/JPY plunged from 135 to close to 110 in three trading days! While we are not obviously suggesting a repeat of that, the point here is that after yen buying intervention again in April/May and then the big initial drop and the fall in US yields, USD/JPY is clearly more vulnerable to renewed volatility that would spark a further round of yen buying.

SUPER CORE INFLATION CONTINUES TO SLOW

Source: Bloomberg, Macrobond & MUFG GMR

AUD: Jobs data underlines prospects for RBA inaction

The Australian dollar is the biggest mover amongst G10 currencies this morning following the jobs data released earlier today. The data revealed a 58.2k increase in jobs, nearly three times more than the 20k consensus with all of the jobs (60.5k) increase in full-time employment. The good news from an inflation fighting perspective was the fact that the unemployment rate increased from 4.1% to 4.2%. This increase was obviously down to the fact that there was a bigger increase in the supply of labour. The participation rate jumped to a new record high of 67.1%.

The increased participation in the labour market will certainly ease concerns over wage-fuelled inflation and allow the RBA to justify not raising the key policy rate again but equally the strength of labour demand will curtail the appetite for cutting rates. In addition to the jobs data today, data on inflation expectations revealed an increase from 4.3% to 4.5%, the second increase in three months and to the highest level since April. The RBA is currently priced to cut for the first time in December.

The RBA sidelined while much of the rest of G10 is cutting rates over the coming months is certainly AUD supportive but the biggest downside risks for AUD lie abroad. Weaker global demand could well still drag AUD lower. News from China today was not good with steel production plunging 9% in MoM and YoY terms with the year-to-date annual drop at 2.2% with production dragged down by the ongoing real estate collapse. The top China steel producer today warned that the industry is facing a crisis worse than in 2008 (GFC) or 2015 (China shifting demand). The weakness in the steel sector is evident in iron ore prices down 10% since the beginning of August and at the lowest level since August last year. The sharp drop in iron ore prices could certainly result in renewed downside pressure on AUD. Finally, based on the yen upside risks highlighted above, the AUD would likely suffer if there was renewed upside pressure if yen carry positions are cut further – AUD/JPY has been a popular carry position in G10 FX.

USD/JPY SIMILARITIES – 1998 FROM THE POINT OF JPY BUYING INTERVENTION & 2024 FROM THE POINT OF JPY BUYING INTERVENTION

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.50% |

4.50% |

!!! |

|

UK |

09:30 |

Labour Productivity |

Q2 |

-0.3% |

-0.3% |

!! |

|

EC |

12:30 |

ECB Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

Jul |

-- |

0.6% |

!! |

|

US |

13:30 |

Export Price Index (MoM) |

Jul |

0.0% |

-0.5% |

!! |

|

US |

13:30 |

Import Price Index (MoM) |

Jul |

-0.1% |

0.0% |

!! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,880K |

1,875K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

236K |

233K |

!!! |

|

US |

13:30 |

Jobless Claims 4-Week Avg. |

-- |

-- |

240.75K |

!! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Aug |

-5.90 |

-6.60 |

!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Aug |

5.4 |

13.9 |

!!! |

|

US |

13:30 |

Core Retail Sales (MoM) |

Jul |

0.1% |

0.4% |

!!! |

|

US |

13:30 |

Retail Sales (MoM) |

Jul |

0.4% |

0.0% |

!!! |

|

US |

13:30 |

Retail Sales Ex Gas/Autos (MoM) |

Jul |

-- |

0.8% |

!!! |

|

CA |

13:30 |

New Motor Vehicle Sales (MoM) |

Jun |

-- |

184.7K |

! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

Jun |

-0.6% |

-0.8% |

!! |

|

US |

14:15 |

Capacity Utilization Rate |

Jul |

78.5% |

78.8% |

! |

|

US |

14:15 |

Industrial Production (YoY) |

Jul |

-- |

1.58% |

!! |

|

US |

14:15 |

Industrial Production (MoM) |

Jul |

-0.3% |

0.6% |

!!! |

|

US |

14:15 |

Manufacturing Production (MoM) |

Jul |

-0.2% |

0.4% |

!!! |

|

US |

15:00 |

Business Inventories (MoM) |

Jun |

0.3% |

0.5% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Aug |

43 |

42 |

! |

|

US |

18:10 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg